NVIDIA Corp (NVDA)

177.19

-7.70 (-4.16%)

NASDAQ · Last Trade: Feb 28th, 5:34 AM EST

An exchange-traded fund can save investors from picking winners and losers in complex industries like artificial intelligence.

Via The Motley Fool · February 28, 2026

Huang offers investors a glimpse of what's just ahead and farther down the road.

Via The Motley Fool · February 28, 2026

Most Wall Street analysts think Nvidia and Robinhood are deeply undervalued at current prices.

Via The Motley Fool · February 28, 2026

Gene Munster said Nvidia shares are sliding despite blowout earnings and record revenue as investors shift focus to 2027 growth concerns, even as AI infrastructure demand remains strong and Goldman Sachs reiterates its bullish stance.

Via Benzinga · February 28, 2026

The stock's sell-off looks more tied to spending fears than weakening demand.

Via The Motley Fool · February 27, 2026

2 Reasons Why Stocks Could Crash Under Trump in 2026fool.com

Macroeconomic uncertainty is rising, and it could have negative impacts on stock market performance.

Via The Motley Fool · February 27, 2026

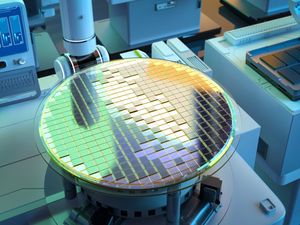

With data center fever gripping the world, which is the best single company to invest in to profit from it? Taiwan Semiconductor makes a compelling case for itself.

Via The Motley Fool · February 27, 2026

Artificial intelligence is supercharging DigitalOcean's business.

Via The Motley Fool · February 27, 2026

Via MarketBeat · February 27, 2026

Hotter-than-expected inflation data, continued AI jitters, and potential private credit contagion rattle markets, today, Feb. 27, 2026.

Via The Motley Fool · February 27, 2026

The final trading week of February 2026 has laid bare a striking fracture in the U.S. equity markets. While the technology sector continues to feast on a relentless AI-driven "execution" cycle, the broader market indices are increasingly weighed down by deep-seated structural issues in the healthcare and industrial sectors.

Via MarketMinute · February 27, 2026

It's hard to say HVAC is boring when the stock price has soared more than tenfold over the last three years.

Via The Motley Fool · February 27, 2026

Wall Street weighs surging AI demand against widening losses and massive data center spending plans, today, Feb. 27, 2026.

Via The Motley Fool · February 27, 2026

As of February 27, 2026, the U.S. Treasury market has entered a period of deceptive calm, with yields holding steady in a tight range as traders catch their breath following a month of volatile economic data. This "wait-and-see" approach reflects a broader strategic retreat by both bond and equity

Via MarketMinute · February 27, 2026

Dan Ives, managing director at Wedbush Securities, said on Friday in an interview with CNBC that the software stocks under pressure may be at a turning point.

Via Stocktwits · February 27, 2026

In a move that underscores the relentless momentum of the artificial intelligence infrastructure trade, major Wall Street analysts have issued a series of significant upgrades for Super Micro Computer (Nasdaq: SMCI), citing the company's pole position in the "industrialization" phase of AI. Following a robust second-quarter earnings beat for fiscal

Via MarketMinute · February 27, 2026

Following a week of intense market turbulence, BofA Securities (NASDAQ: NVDA) analyst Vivek Arya has issued a major price target upgrade for Nvidia Corp. (NASDAQ: NVDA) today, February 27, 2026. Raising the target from $275 to $300, Arya cited an "agentic AI inflection point" and overwhelming demand for the company’

Via MarketMinute · February 27, 2026

As the final reports of the fourth-quarter earnings season trickled in through late February 2026, the S&P 500 demonstrated a resilient performance that caught many analysts by surprise. The benchmark index recorded an 8.2% year-over-year increase in earnings per share (EPS), marking a significant milestone in a market

Via MarketMinute · February 27, 2026

The global economic landscape stands at a precipice following a year of unprecedented trade hostilities between the world’s two largest economies. As of late February 2026, the era of "super-tariffs"—which saw reciprocal duties between the United States and China soar to 145% and 125% respectively—has reached a

Via MarketMinute · February 27, 2026

In a move that has sent shockwaves through the global financial markets, OpenAI has finalized a historic $110 billion funding round, the largest venture capital injection in history. This massive infusion of capital values the artificial intelligence pioneer at a staggering $840 billion post-money, a figure that reflects the industry's

Via MarketMinute · February 27, 2026

NEW YORK — In a move that sent shockwaves through global trading floors on Friday, February 27, 2026, UBS (NYSE:UBS) officially downgraded its outlook on the U.S. stock market from “Overweight” to “Benchmark” (Neutral). The downgrade follows a staggering upside surprise in January’s Producer Price Index (PPI) data,

Via MarketMinute · February 27, 2026

The optimism that defined the start of 2026 evaporated on Friday as the S&P 500 and the Dow Jones Industrial Average suffered their steepest single-day declines in months. A surprise surge in the January Personal Consumption Expenditures (PCE) price index—the Federal Reserve’s preferred inflation gauge—shattered the

Via MarketMinute · February 27, 2026

Shares of regional banking institution Bank of Hawaii (NYSE:BOH) fell 5.1% in the afternoon session after a government report showed wholesale inflation was higher than expected, fueling concerns about credit risk and the potential for interest rates to remain elevated.

Via StockStory · February 27, 2026

Sometimes, instead of seeking needles in haystacks, it's best to just buy the haystack.

Via The Motley Fool · February 27, 2026

In an article on his website posted on Friday, Deepwater Management founder Gene Munster said that the drop in Nvidia shares is because accelerating revenue growth is no longer a catalyst for the company.

Via Stocktwits · February 27, 2026