Recent Articles from Talk Markets

TalkMarkets is a dynamic financial media company headquartered in Highland Park, New Jersey, dedicated to revolutionizing the way users engage with financial content. Founded in 2012, the company offers a unique, web-based platform that delivers personalized investment news, market analysis, and educational resources tailored to each user's interests and investment sophistication.

Website: https://www.talkmarkets.com

Stocks have been stuck in a compressing trading range for the past several months.

Via Talk Markets · January 31, 2026

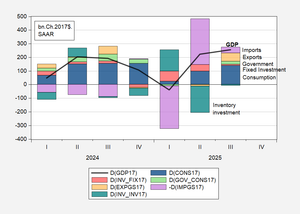

The slowing of the economy (as measured by domestic final sales) and the increase in the contemporaneous tariff rate have roughly equal coefficients.

Via Talk Markets · January 31, 2026

There has been much discussion, both here and around the world, of the possibility of a flight from the dollar. This has always been a serious risk since Donald Trump took office.

Via Talk Markets · January 31, 2026

An illustrated guide to things that should make you uneasy.

Via Talk Markets · January 31, 2026

We discuss why the modern discussion of the division of labor is distorted by bad theory and political incentives.

Via Talk Markets · January 31, 2026

Verizon issued strong Q4 results and strong guidance for 2026. We continue to recommend investment in the telecom giant for income.

Via Talk Markets · January 31, 2026

Some see “No Signs of Labor Market Weakness”. Others strongly disagree.

Via Talk Markets · January 31, 2026

Via Talk Markets · January 31, 2026

The action across a number of markets has started to get pretty wild recently.

Via Talk Markets · January 31, 2026

Via Talk Markets · January 31, 2026

For years, equity markets have leaned on the “Fed Put” – the belief that the central bank would reliably inject liquidity at the first sign of trouble. Warsh, however, is a vocal critic of the Fed’s tendency to “pamper” markets.

Via Talk Markets · January 31, 2026

2026 will be a bullish year, but not as rich as last one or the one before.

Via Talk Markets · January 31, 2026

With one exception, the trends in December continued in January. Headline business conditions continued to indicate contraction, but at a decelerating rate.

Via Talk Markets · January 31, 2026

The move underscores Beijing’s growing recognition that traditional stimulus tools are proving less effective in lifting consumer spending.

Via Talk Markets · January 31, 2026

Over the past year, Cenovus Energy has rallied 40.9%, significantly outperforming Enbridge’s 13.9% gain. But does stronger price performance automatically make Cenovus the better stock? Here's a look at the fundamentals of both companies to find out.

Via Talk Markets · January 31, 2026

Heavy put buying in GLD and SLV was a dead giveaway about the growing nervousness of the precious metals trade. Yesterday that nervousness turned into a fever. Selling fever.

Via Talk Markets · January 31, 2026

China is forecast to contribute 26.6% of global real GDP growth in 2026, by far the largest share of any country.

Via Talk Markets · January 31, 2026

The excitement over providing retail access to private equity seems to have turned sour with more skepticism. As the aforementioned excitement built, we talked frequently about not getting wrapped up with illiquid vehicles offering private equity.

Via Talk Markets · January 31, 2026

This past week, I raised my cash percentage to the highest level since last year's correction. I'm not ready to start pulling the trigger on short positions. But the market's conditions are becoming a lot frothier.

Via Talk Markets · January 31, 2026

I previously discussed companies that own land and water rights, which will be important to data center build-outs. But it all starts with energy. Without energy, data centers don’t run. The electricity generator to take note of is Black Hills.

Via Talk Markets · January 31, 2026

Hey, remember quantum computing? That was a sector that was getting a tremendous amount of hype, in spite of no products, no revenues, and certainly no profits. It’s heartening to see sanity return to the world, as these stocks get blown to pieces.

Via Talk Markets · January 31, 2026

Liquidity continues to be drained from the system, primarily through Treasury issuance and rising TGA balances, putting pressure on risk assets.

Via Talk Markets · January 31, 2026

Within hours of the Fed's announcement, gold surged 7% to a fresh all-time high of $5,500. This reaction was not on a rate cut. It was on a hold. The most boring possible outcome pressed gold to one of its biggest single day moves in years.

Via Talk Markets · January 31, 2026

In this video, Jordan argues that the recent

Via Talk Markets · January 31, 2026

Mag 7 earnings for Q4 2025 show a

Via Talk Markets · January 30, 2026

Unity Software stock tumbled roughly 20% to around $30 following Google’s announcement of Project Genie. The AI-powered game creation engine sent investors into selling mode, fearing new competition for Unity’s dominant market position.

Via Talk Markets · January 31, 2026

The market bloodbath has moved from silver to cryptocurrency. This weekend, Bitcoin is plunging, taking Ethereum, Solana, and XRP down with it.

Via Talk Markets · January 31, 2026

By 2019, the number of malls in the U.S. had declined to around 1,500. I was still bearish on the space back then. There was more consolidation that needed to happen. Little did I know how immediate and brutal that consolidation was about to become.

Via Talk Markets · January 31, 2026

Seagate Technology has been a wildly lucrative “picks and shovels” play on AI over the past year, as evidenced by its more-than-230% gain. However, investors should be prepared for volatility.

Via Talk Markets · January 31, 2026

Here is a short look at the 10 largest companies by market capitalization as of Saturday, Jan. 31, 2026. Additionally, I have included the percentages of their gains on a year-to-date basis. Let's dive into the numbers.

Via Talk Markets · January 31, 2026

Silver is getting crushed. At one point silver prices were down 37%.

Via Talk Markets · January 30, 2026

What has Wall Street been buzzing about this week? Here is a quick look at the top 5 Buy calls and the top 5 Sell calls made by Wall Street’s best analysts during the trading week of Jan. 26-30, 2026.

Via Talk Markets · January 31, 2026

The year has opened with cross-asset volatility, driven by geopolitical risk, monetary uncertainty, and uneven earnings visibility. Rather than triggering sell-offs, these forces are producing sector and asset-class rotations. Let's take a look.

Via Talk Markets · January 31, 2026

Inflation has been above target for five years. There are indications that a historic AI spending boom poses significant inflationary risk.

Via Talk Markets · January 31, 2026

Affordability is the intersection of “need” and “want”. Everyone has a certain level of purchasing power, based on their assets, income and credit limits.

Via Talk Markets · January 31, 2026

This week reinforced a key message for investors: markets are transitioning from broad AI enthusiasm to a more disciplined phase where earnings quality, capital efficiency, and macro resilience matter more than narratives.

Via Talk Markets · January 31, 2026

For many decades, the U.S. ran twin deficits, one at the Federal government level and the other on international trade.

Via Talk Markets · January 30, 2026

Cotton was a little higher after moving sharply lower the day before. Trends started to turn down on the daily reports.

Via Talk Markets · January 30, 2026

Chainlink shows short-term rebound from oversold levels near $10.83.

Via Talk Markets · January 31, 2026

The big sell-off in gold and silver on the news of the Warsh nomination is an overreaction and doesn’t reflect any real change in the economic or financial landscape.

Via Talk Markets · January 31, 2026

Joby Aviation is at the forefront of the eVTOL industry, aiming to revolutionize urban transport with its air taxis.

Via Talk Markets · January 31, 2026

Despite the nomination, doubts are growing over whether Warsh will secure Senate approval.

Via Talk Markets · January 31, 2026

ETH drops below $2,800 to $2,700 as charts point to potential 22% decline toward $2,100 target with key support at $2,500.

Via Talk Markets · January 31, 2026

The GBP/USD weekly forecast remains slightly subdued as the markets pared partial weekly gains amid dollar recovery and profit-taking.

Via Talk Markets · January 31, 2026

Transshipment is a real problem for someone like Trump trying to impose high tariffs, but the Chinese cars going to Canada are not going to be the issue.

Via Talk Markets · January 31, 2026

Central banks from Washington to Frankfurt are telling us they're in a good place. And they have a point, even if that seems wildly at odds with gestures at everything going on in the world.

Via Talk Markets · January 31, 2026

In January 2026, economists find that tariffs contributed ~1.1–1.4% to annual inflation. While median households face $1,400 in extra annual costs, the impact is less than feared due to implementation lags and exceptions.

Via Talk Markets · January 31, 2026

Today’s silver crash is a reminder that the market can remain irrational longer than you can remain solvent. Whether this is a temporary shock or the start of a deeper correction remains to be seen.

Via Talk Markets · January 30, 2026

In this video, we dive into stock market trends, dissect key sector moves, and share actionable insights to help individual investors navigate volatile markets with confidence.

Via Talk Markets · January 30, 2026

The week's video is in Q & A format with a focus on issues weighing on the minds of investors in late January 2026

Via Talk Markets · January 30, 2026

EUR/USD drops during the North American session, down by 0.75% amid a session characterized by overall US Dollar strength, sponsored by Trump’s mild-hawkish pick to lead the Fed and an inflation report that warrants steady rates by the Fed.

Via Talk Markets · January 30, 2026

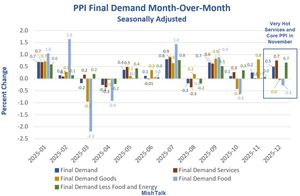

The Producer Price Index (PPI) surged past expectations, signaling persistent inflationary pressure in the manufacturing sector. This unexpected spike complicates the Fed's

Via Talk Markets · January 30, 2026

In this video lesson, I review all the data that suggests this market is on some very thin foundation. When price confirms (if it confirms), the sell-off has the potential to be very ugly.

Via Talk Markets · January 30, 2026

Precious metals saw

Via Talk Markets · January 30, 2026

Have the silver fundamentals changed? Likely not. But they were likely overpriced. If so, how much were they overpriced?

Via Talk Markets · January 30, 2026

After hitting record highs, gold and silver faced massive, record-breaking declines, illustrating the dangers of over-allocation and the psychological pitfalls of

Via Talk Markets · January 30, 2026

Theory has to guide your trading. Yesterday's options flow gave us the framework to avoid today's massacre. When your edge disappears, you step aside.

Via Talk Markets · January 30, 2026

Stocks retreated on Friday as Big Tech remained under pressure, with the Dow and Nasdaq shedding triple digits and marking a third-straight weekly loss.

Via Talk Markets · January 30, 2026

Cricut designs and sells consumer cutting machines, accessories, and digital content that enable craft, design, and small-scale production projects.

Via Talk Markets · January 30, 2026

The dip in MSFT stock appears to be overdone. This is why value investors can look into various strategy plays.

Via Talk Markets · January 30, 2026

GameStop shares moved higher after CEO Ryan Cohen outlined plans for a major acquisition, with investor Michael Burry adding to his stake and backing the strategy.

Via Talk Markets · January 30, 2026

Monero is under renewed pressure as bearish sentiment tightens its grip across the broader crypto market.

Via Talk Markets · January 30, 2026

Zcash has experienced a sharp decline over the past 24 hours, dropping more than 9% to a low of $329 amid a broader cryptocurrency market downturn.

Via Talk Markets · January 30, 2026

The gold and silver prices are in the midst of one of their largest (at least by dollar amount) moves downward, which the Wall Street media is attributing to the nomination of Trump’s new Fed chair candidate.

Via Talk Markets · January 30, 2026

Markets may look strong on the surface, but underneath, deep fractures are forming.

Via Talk Markets · January 30, 2026

Silver plunged in a clear way, and this doesn’t look like a correction. It looks like the beginning of the slide.

Via Talk Markets · January 30, 2026

People tend to overrate the importance of Fed chairs, as the Fed has a great deal of institutional inertia.

Via Talk Markets · January 30, 2026

25Q4Y/Y earnings are expected to be 10.9%. Excluding the energy sector, the Y/Y earnings estimate is 11.3%.

Via Talk Markets · January 30, 2026

This isn't just a correction—it’s a massive liquidity washout driven by extreme leverage and

Via Talk Markets · January 30, 2026

Yesterday, Jerome Powell prematurely praised a decline in services inflation.

Via Talk Markets · January 30, 2026

Joby Aviation has been burning cash in the past few years as it worked on its aircraft, which it expects to enter service later this year or early next year.

Via Talk Markets · January 30, 2026

Bitcoin faces a continued downtrend, with analysts predicting struggles against the stock market and a delayed recovery until 2026.

Via Talk Markets · January 30, 2026