Medical tech company Masimo (NASDAQ:MASI) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 7.9% year on year to $370.9 million. The company expects the full year’s revenue to be around $1.52 billion, close to analysts’ estimates. Its non-GAAP profit of $1.33 per share was 8.8% above analysts’ consensus estimates.

Is now the time to buy Masimo? Find out by accessing our full research report, it’s free.

Masimo (MASI) Q2 CY2025 Highlights:

- Revenue: $370.9 million vs analyst estimates of $368.7 million (7.9% year-on-year growth, 0.6% beat)

- Adjusted EPS: $1.33 vs analyst estimates of $1.22 (8.8% beat)

- The company slightly lifted its revenue guidance for the full year to $1.52 billion at the midpoint from $1.52 billion

- Management raised its full-year Adjusted EPS guidance to $5.33 at the midpoint, a 7% increase

- Operating Margin: 17.4%, up from 8.2% in the same quarter last year

- Free Cash Flow Margin: 17.7%, down from 22.6% in the same quarter last year

- Constant Currency Revenue rose 7% year on year (10.1% in the same quarter last year)

- Market Capitalization: $8.74 billion

Katie Szyman, Chief Executive Officer of Masimo, said, “We once again delivered strong results in the second quarter as our core health care business continued to demonstrate strong growth and earnings. We are intensely focused on building our leading position in pulse oximetry to increase our market share in key global markets and advanced monitoring categories, and on driving commercial excellence throughout the organization. We have also expanded our leadership team to ensure that we have the right people and pillars in place to execute our growth strategy. Notably, our team has been highly effective in the implementation of tariff mitigation measures, allowing us to guide to a tariff impact that is 50% less than our original estimate. Each of these factors is contributing to our positive momentum and we are investing in our core healthcare business to achieve our goals and potentially accelerate our long-range revenue growth.”

Company Overview

Founded in 1989 to solve the "unsolvable problem" of accurate pulse oximetry during patient movement, Masimo (NASDAQ:MASI) develops and manufactures noninvasive patient monitoring technologies, including its breakthrough pulse oximetry systems that accurately measure blood oxygen levels even during patient movement.

Revenue Growth

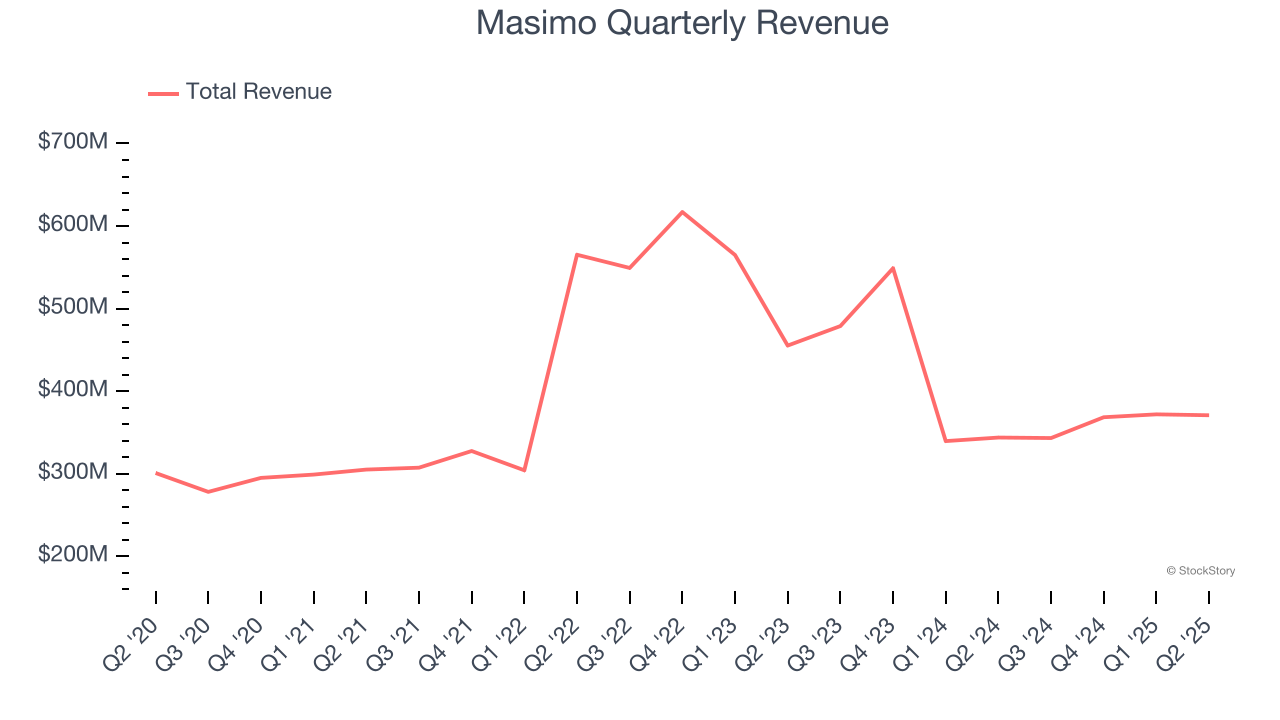

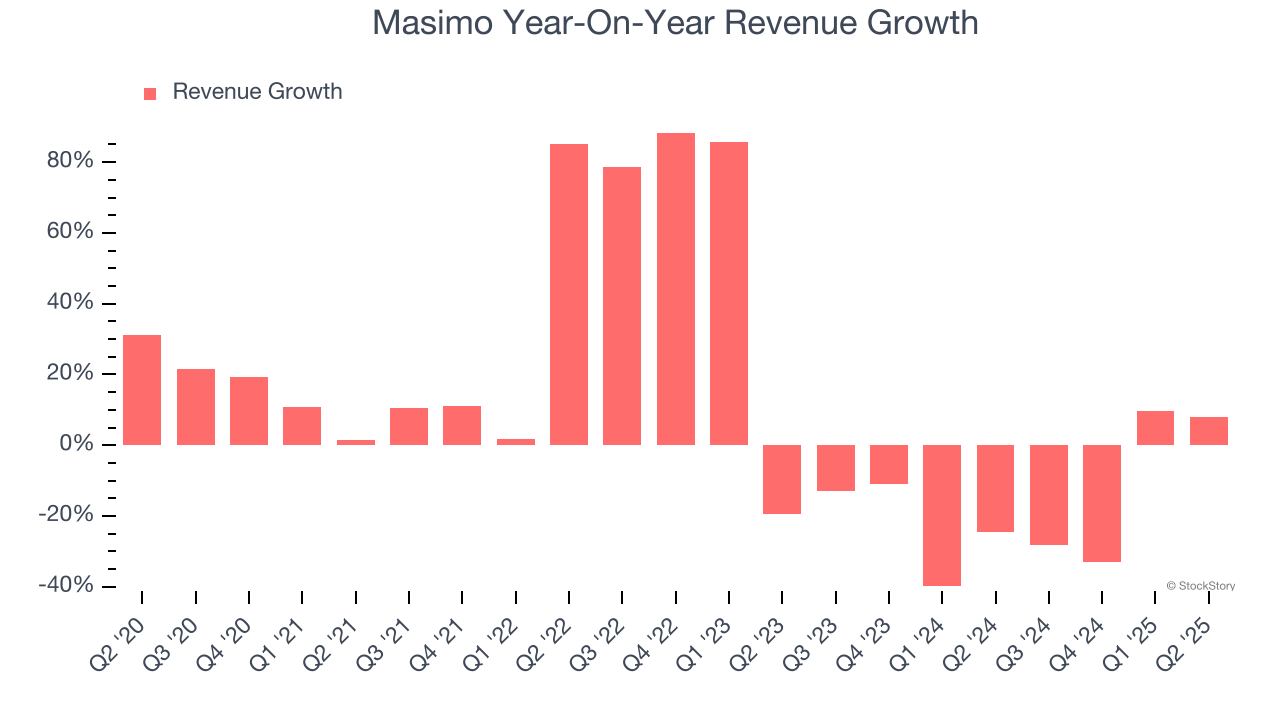

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Masimo’s sales grew at a mediocre 6.8% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Masimo’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 18.4% annually.

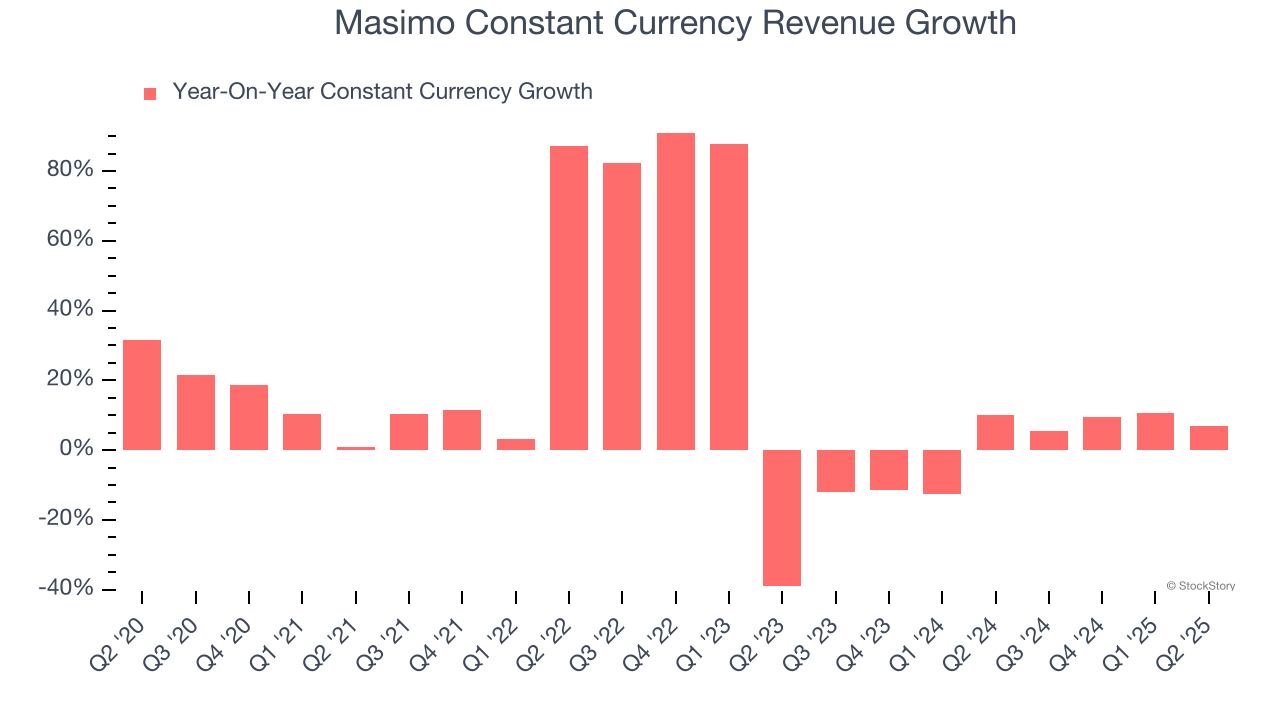

Masimo also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales were flat. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Masimo.

This quarter, Masimo reported year-on-year revenue growth of 7.9%, and its $370.9 million of revenue exceeded Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 8.4% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

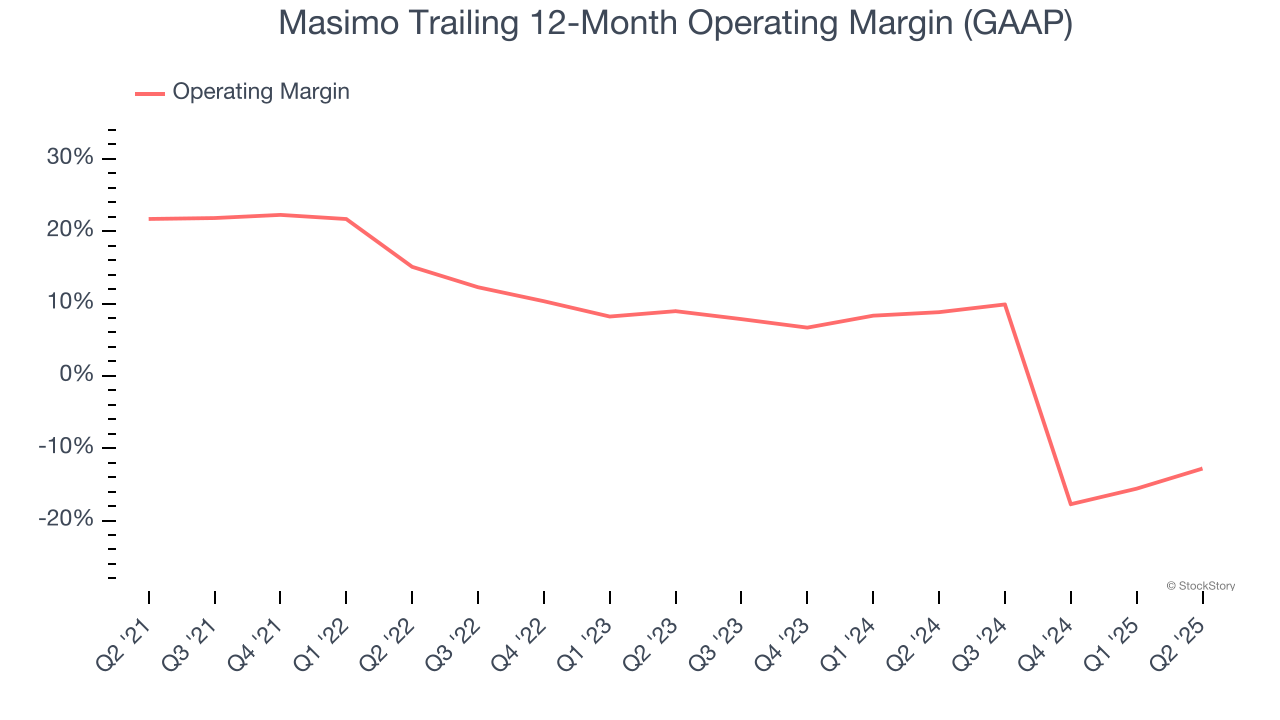

Masimo was profitable over the last five years but held back by its large cost base. Its average operating margin of 8% was weak for a healthcare business.

Looking at the trend in its profitability, Masimo’s operating margin decreased by 34.5 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 21.8 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Masimo generated an operating margin profit margin of 17.4%, up 9.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

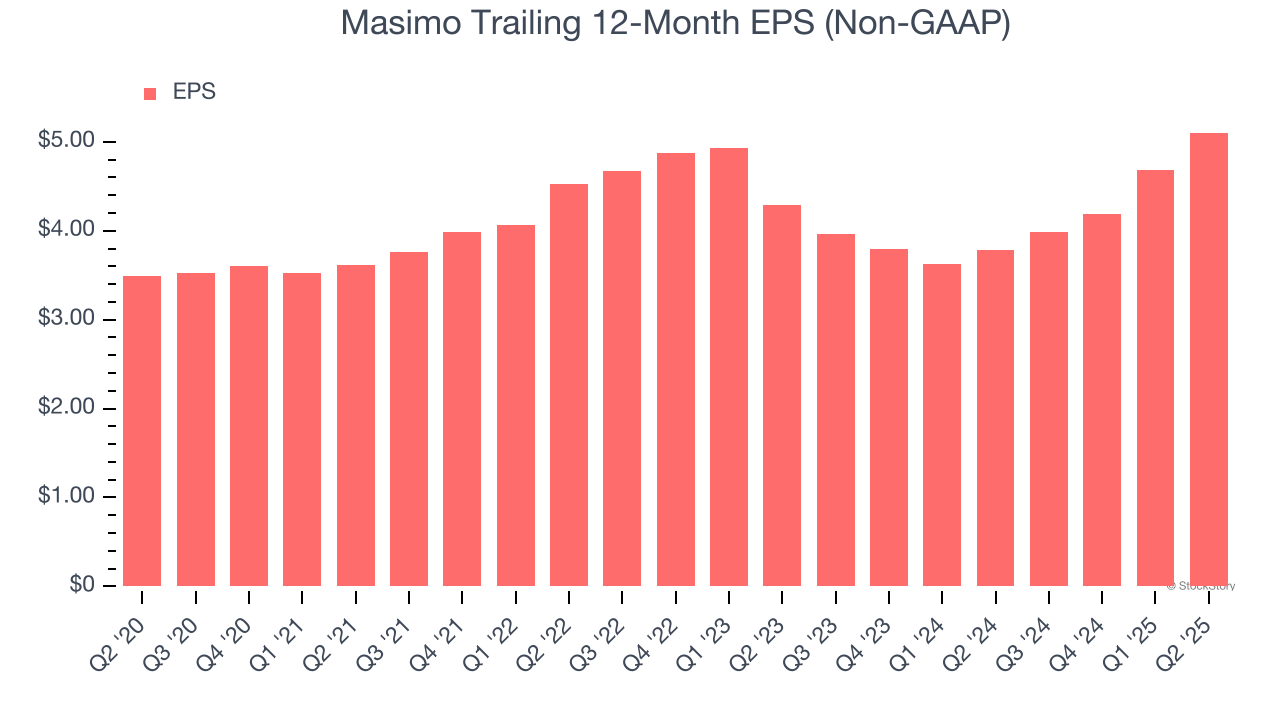

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Masimo’s solid 7.9% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q2, Masimo reported adjusted EPS at $1.33, up from $0.91 in the same quarter last year. This print beat analysts’ estimates by 8.8%. Over the next 12 months, Wall Street expects Masimo’s full-year EPS of $5.10 to shrink by 2.3%.

Key Takeaways from Masimo’s Q2 Results

We were impressed by how significantly Masimo blew past analysts’ constant currency revenue expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. Overall, we think this was a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 6.1% to $154.35 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.