H&R Block has been treading water for the past six months, recording a small return of 1% while holding steady at $55.

Does this present a buying opportunity for HRB? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does HRB Stock Spark Debate?

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE:HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

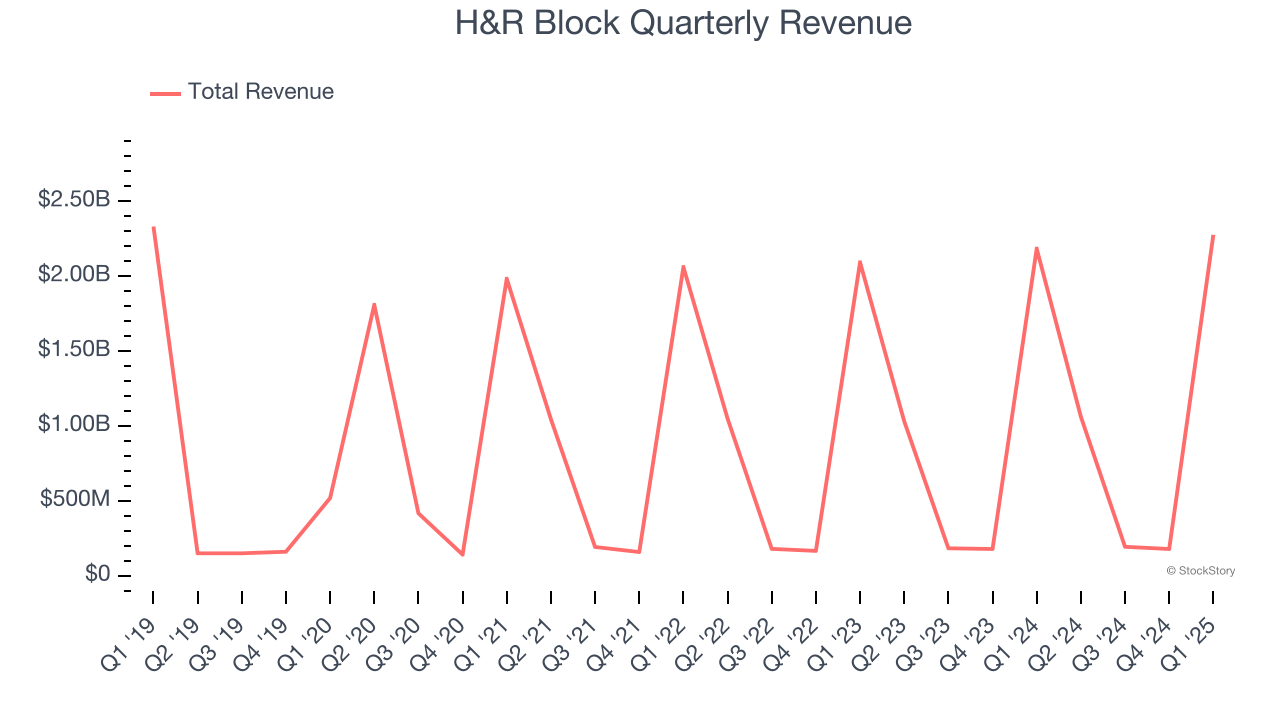

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, H&R Block grew its sales at an incredible 30.5% compounded annual growth rate. Its growth surpassed the average consumer discretionary company and shows its offerings resonate with customers. We note H&R Block is a seasonal business because it generates most of its revenue during tax season, so the charts in our report will look a bit lumpy.

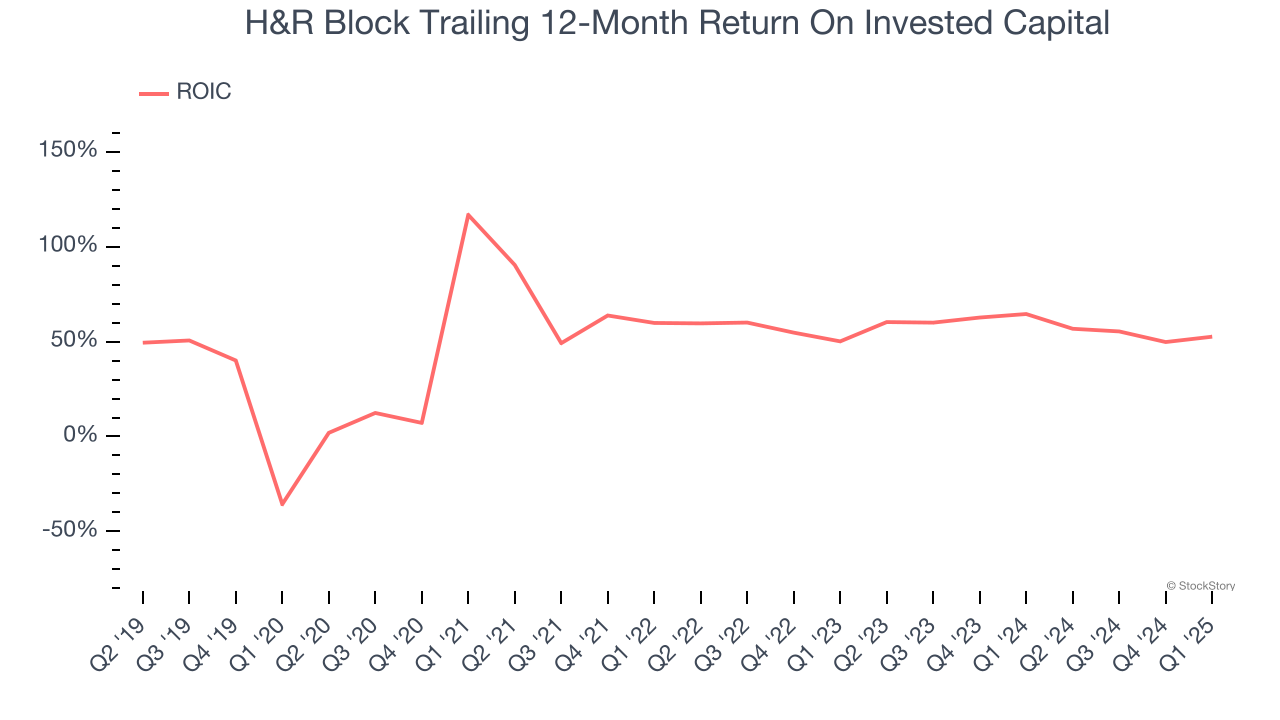

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

H&R Block’s five-year average ROIC was 56.7%, placing it among the best consumer discretionary companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect H&R Block’s revenue to rise by 1.8%, close to its 30.5% annualized growth for the past five years. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet. At least the company is tracking well in other measures of financial health.

Final Judgment

H&R Block’s positive characteristics outweigh the negatives, but at $55 per share (or 16× forward EV-to-EBITDA), is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2024 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.