Uniform rental provider Vestis Corporation (NYSE:VSTS) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 5.7% year on year to $665.2 million. Next quarter’s revenue guidance of $678 million underwhelmed, coming in 4.8% below analysts’ estimates. Its non-GAAP loss of $0.05 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Vestis? Find out by accessing our full research report, it’s free.

Vestis (VSTS) Q1 CY2025 Highlights:

- Revenue: $665.2 million vs analyst estimates of $693 million (5.7% year-on-year decline, 4% miss)

- Adjusted EPS: -$0.05 vs analyst estimates of $0.15 (significant miss)

- Adjusted EBITDA: $47.62 million vs analyst estimates of $83.07 million (7.2% margin, 42.7% miss)

- Revenue Guidance for Q2 CY2025 is $678 million at the midpoint, below analyst estimates of $711.8 million

- EBITDA guidance for Q2 CY2025 is $63 million at the midpoint, below analyst estimates of $89.75 million

- Operating Margin: -1.3%, down from 6.1% in the same quarter last year

- Free Cash Flow was -$6.85 million, down from $63.16 million in the same quarter last year

- Market Capitalization: $1.17 billion

“We are disappointed with our second quarter results, which do not reflect the true potential of our business. As Interim CEO, I’ve been engaging with our teammates and focusing on our operations to drive immediate action,” said Phillip Holloman, Interim Executive Chairman, President and CEO.

Company Overview

Operating a network of more than 350 facilities with 3,300 delivery routes serving customers weekly, Vestis (NYSE:VSTS) provides uniform rentals, workplace supplies, and facility services to over 300,000 business locations across the United States and Canada.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $2.73 billion in revenue over the past 12 months, Vestis is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

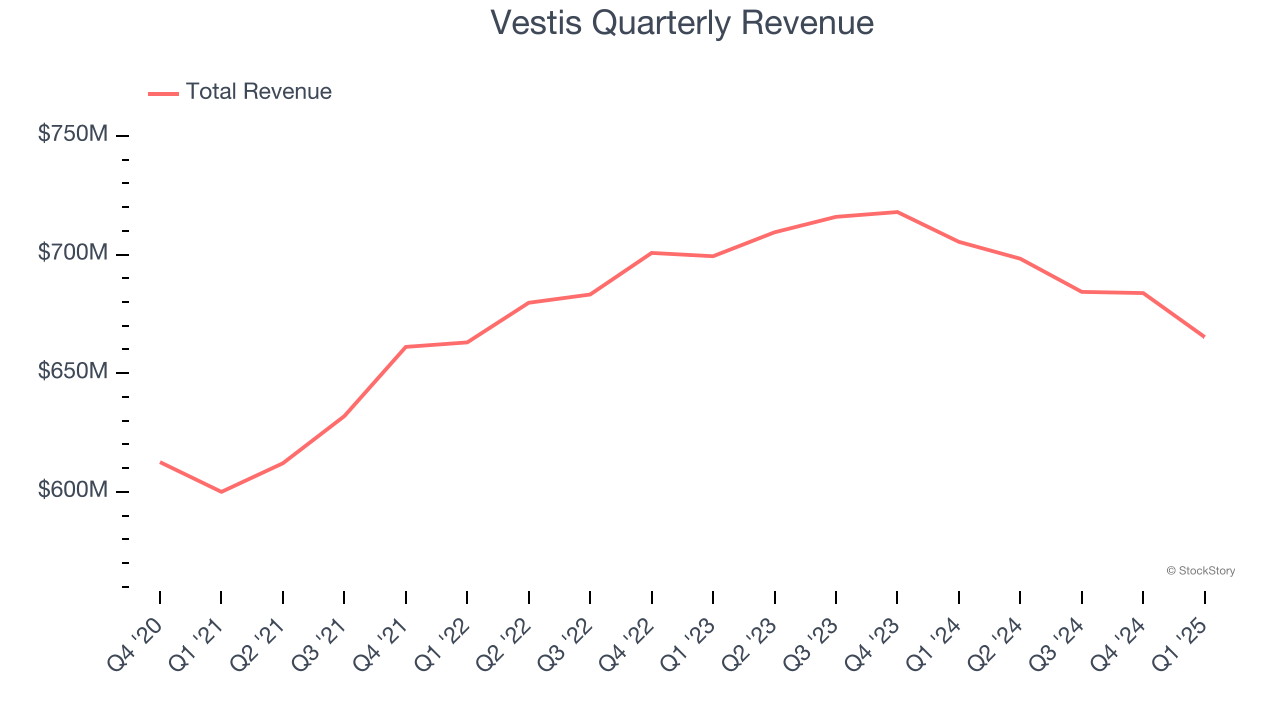

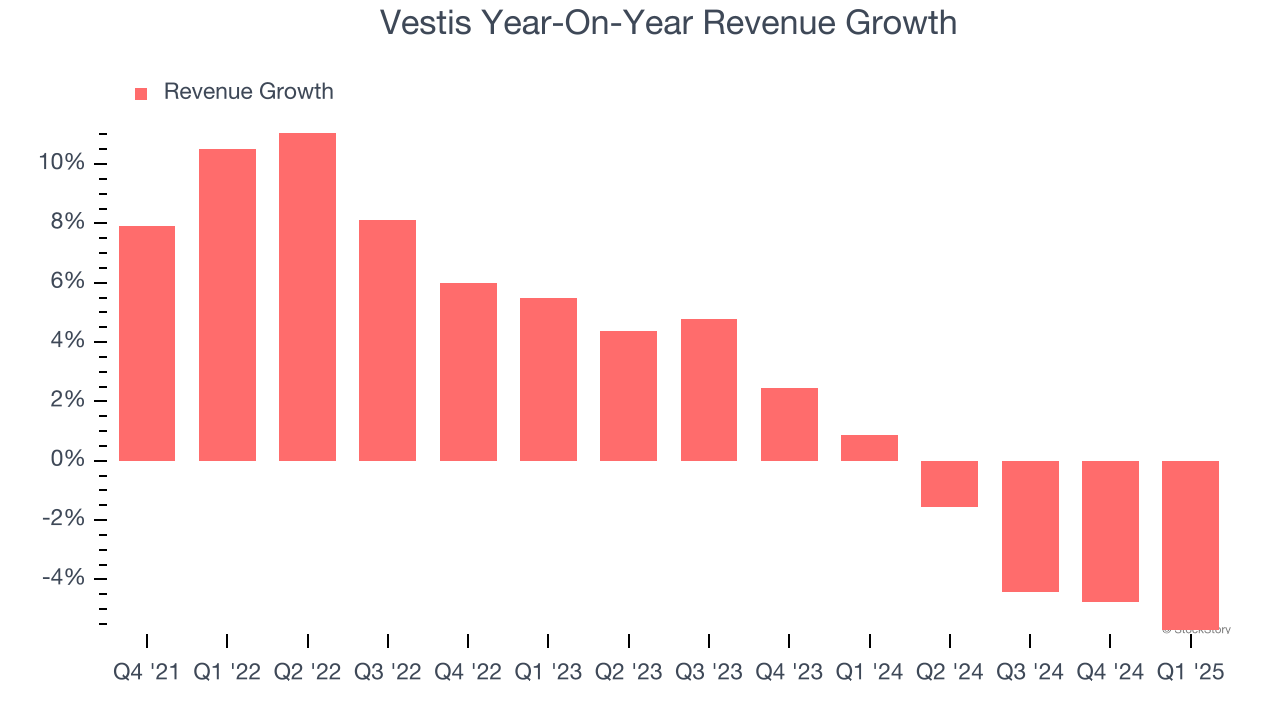

As you can see below, Vestis grew its sales at a sluggish 2.7% compounded annual growth rate over the last four years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Vestis’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Vestis missed Wall Street’s estimates and reported a rather uninspiring 5.7% year-on-year revenue decline, generating $665.2 million of revenue. Company management is currently guiding for a 2.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.9% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

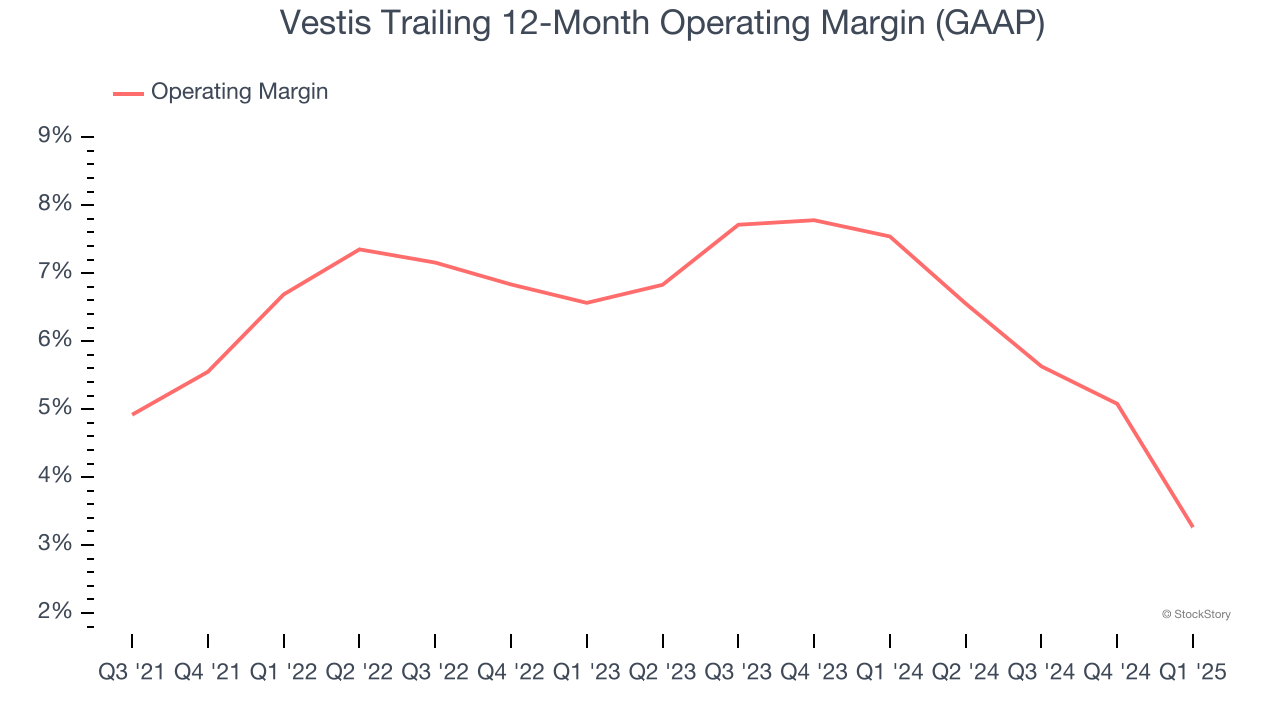

Operating Margin

Vestis was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.9% was weak for a business services business.

Analyzing the trend in its profitability, Vestis’s operating margin decreased by 2.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Vestis’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q1, Vestis generated an operating profit margin of negative 1.3%, down 7.4 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

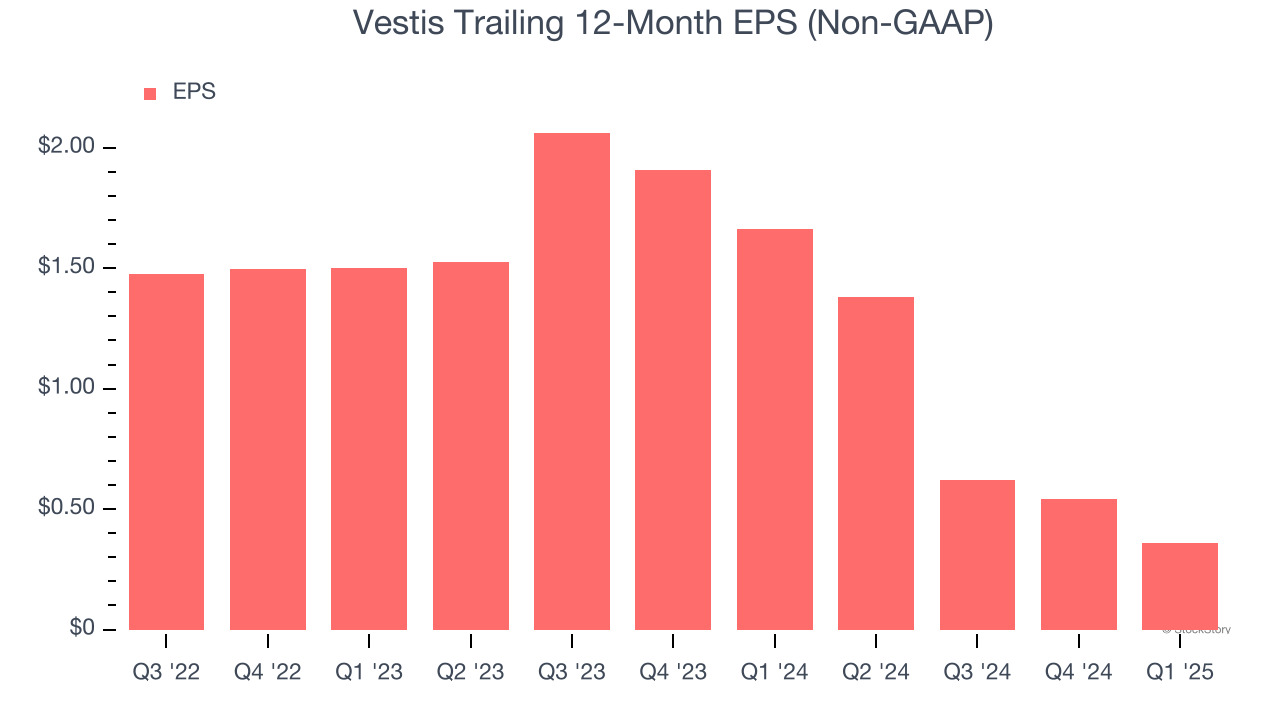

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Vestis’s full-year EPS dropped significantly over the last three years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Vestis’s low margin of safety could leave its stock price susceptible to large downswings.

In Q1, Vestis reported EPS at negative $0.05, down from $0.13 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Vestis’s full-year EPS of $0.36 to grow 120%.

Key Takeaways from Vestis’s Q1 Results

This was a terrible quarter, with large misses across the board and guidance also falling well short of expectations. There were no redeeming qualities here. The stock traded down 25.9% to $6.45 immediately following the results.

Vestis underperformed this quarter, but does that create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.