Safety certification company UL Solutions (NYSE:ULS) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 5.2% year on year to $705 million. Its non-GAAP profit of $0.37 per share was 18.1% above analysts’ consensus estimates.

Is now the time to buy UL Solutions? Find out by accessing our full research report, it’s free.

UL Solutions (ULS) Q1 CY2025 Highlights:

- Revenue: $705 million vs analyst estimates of $704.8 million (5.2% year-on-year growth, in line)

- Adjusted EPS: $0.37 vs analyst estimates of $0.31 (18.1% beat)

- Adjusted EBITDA: $161 million vs analyst estimates of $149.2 million (22.8% margin, 7.9% beat)

- Operating Margin: 15.5%, up from 13.6% in the same quarter last year

- Free Cash Flow Margin: 14.6%, up from 12.5% in the same quarter last year

- Market Capitalization: $12 billion

Company Overview

Founded in 1894 as a response to the growing dangers of electricity in American homes and businesses, UL Solutions (NYSE:ULS) provides testing, inspection, and certification services that help companies ensure their products meet safety, security, and sustainability standards.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.91 billion in revenue over the past 12 months, UL Solutions is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

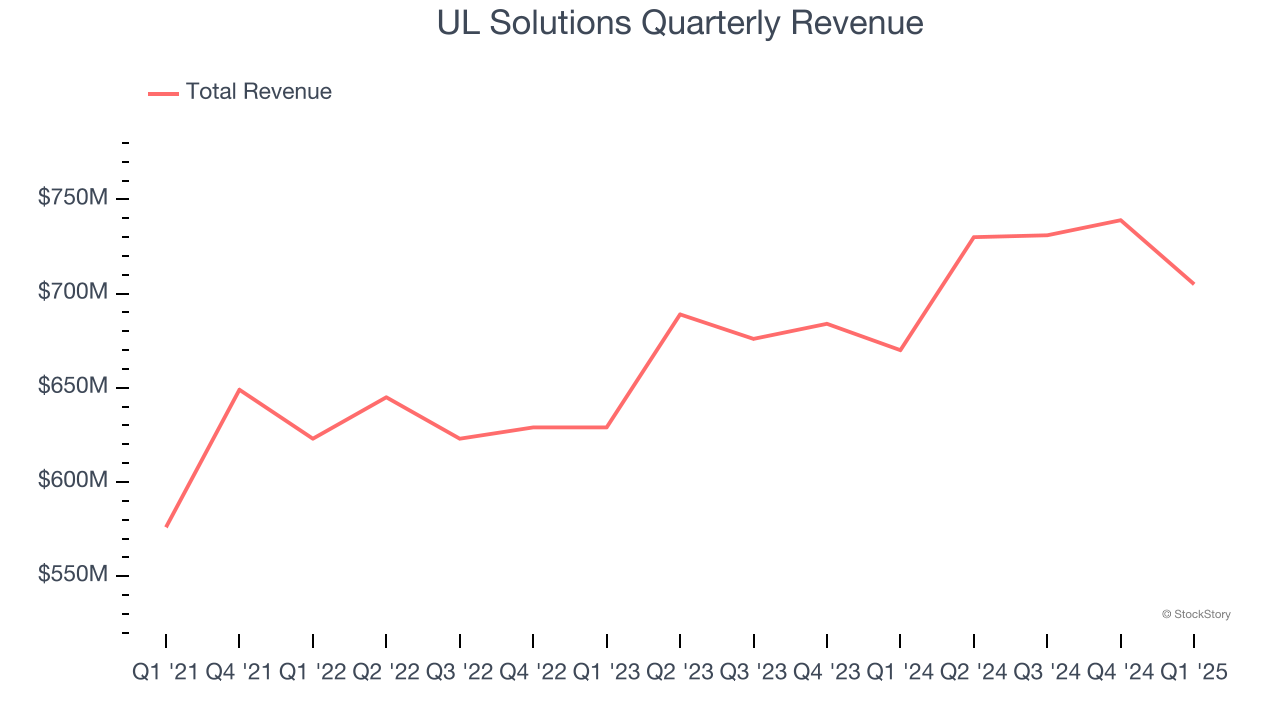

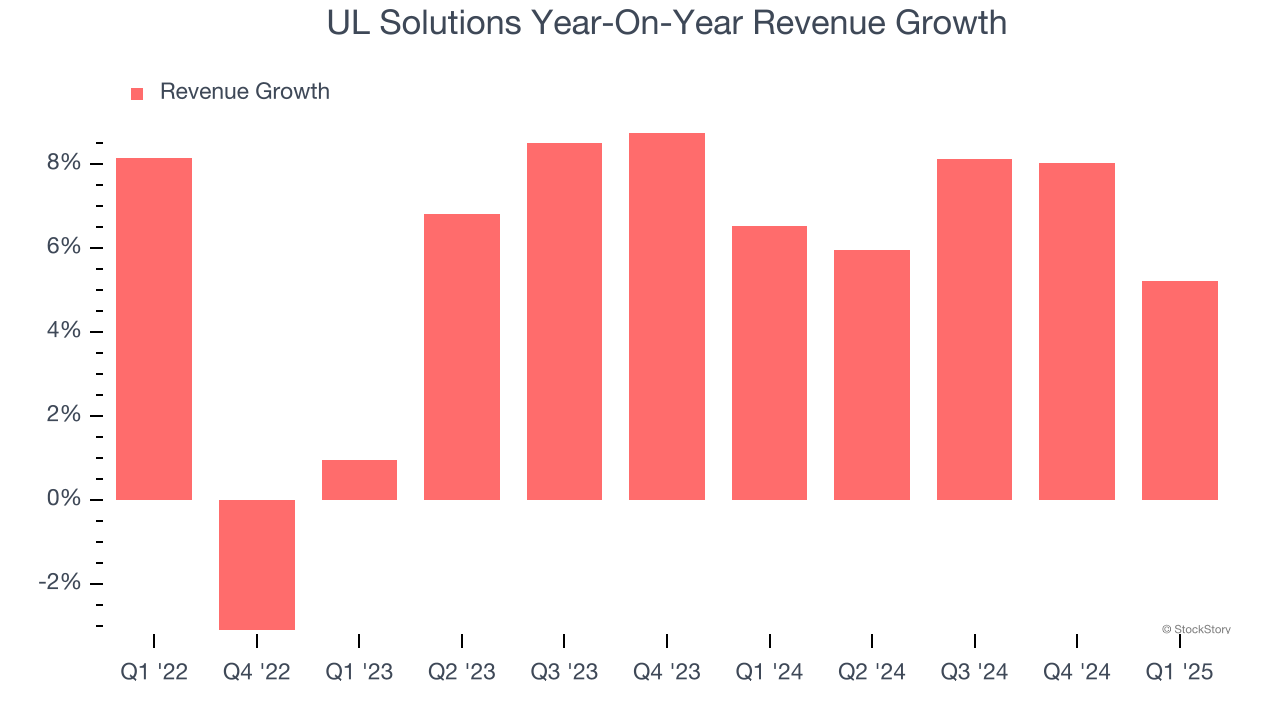

As you can see below, UL Solutions grew its sales at a mediocre 4.3% compounded annual growth rate over the last three years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. UL Solutions’s annualized revenue growth of 7.2% over the last two years is above its three-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Industrial and Consumer, which are 0% and 0% of revenue. Over the last two years, UL Solutions’s Industrial revenue averaged 3.1% year-on-year declines while its Consumer revenue averaged 7.7% declines.

This quarter, UL Solutions grew its revenue by 5.2% year on year, and its $705 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and suggests the market sees some success for its newer products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

UL Solutions has been an efficient company over the last four years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 15%.

Analyzing the trend in its profitability, UL Solutions’s operating margin might fluctuated slightly but has generally stayed the same over the last four years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, UL Solutions generated an operating profit margin of 15.5%, up 1.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

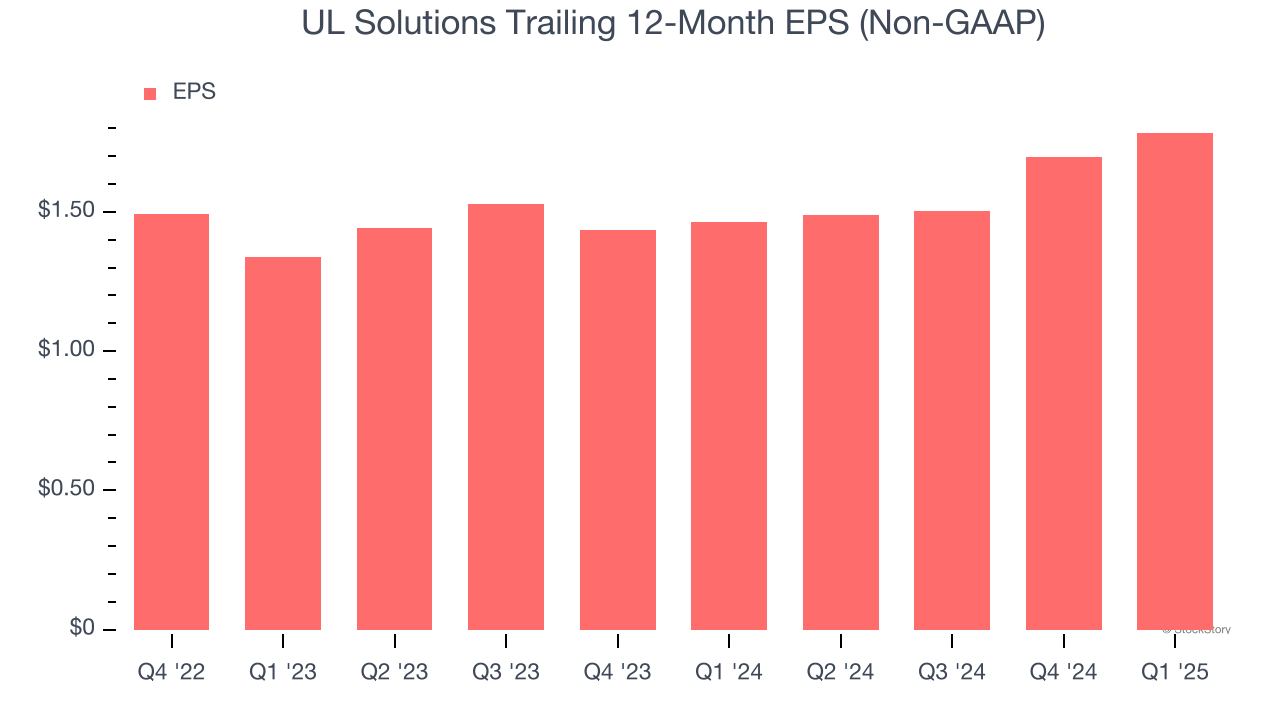

UL Solutions’s full-year EPS grew at an astounding 15.4% compounded annual growth rate over the last two years, better than the broader business services sector.

In Q1, UL Solutions reported EPS at $0.37, up from $0.29 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects UL Solutions’s full-year EPS of $1.78 to shrink by 1.9%.

Key Takeaways from UL Solutions’s Q1 Results

We were impressed by how significantly UL Solutions blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue was in line. Zooming out, we think this was a good print with some key areas of upside, but shares traded down 4.8% to $56.99 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.