Specialty pharmaceutical company Supernus Pharmaceuticals (NASDAQ:SUPN) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 4.3% year on year to $149.8 million. On the other hand, the company’s full-year revenue guidance of $615 million at the midpoint came in 1.6% below analysts’ estimates. Its GAAP loss of $0.21 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Supernus Pharmaceuticals? Find out by accessing our full research report, it’s free.

Supernus Pharmaceuticals (SUPN) Q1 CY2025 Highlights:

- Revenue: $149.8 million vs analyst estimates of $147.9 million (4.3% year-on-year growth, 1.3% beat)

- EPS (GAAP): -$0.21 vs analyst estimates of -$0.01 (significant miss)

- Adjusted EBITDA: -$10.23 million vs analyst estimates of $49.3 million (-6.8% margin, significant miss)

- The company reconfirmed its revenue guidance for the full year of $615 million at the midpoint

- Operating Margin: -6.8%, down from -2.2% in the same quarter last year

- Market Capitalization: $1.81 billion

“Our first quarter results reflect, once again, double-digit revenue growth from our core products, as well as strong growth in adjusted operating earnings,” said Jack Khattar, President and CEO of Supernus.

Company Overview

With a diverse portfolio of eight FDA-approved medications targeting neurological conditions, Supernus Pharmaceuticals (NASDAQ:SUPN) develops and markets treatments for central nervous system disorders including epilepsy, ADHD, Parkinson's disease, and migraine.

Sales Growth

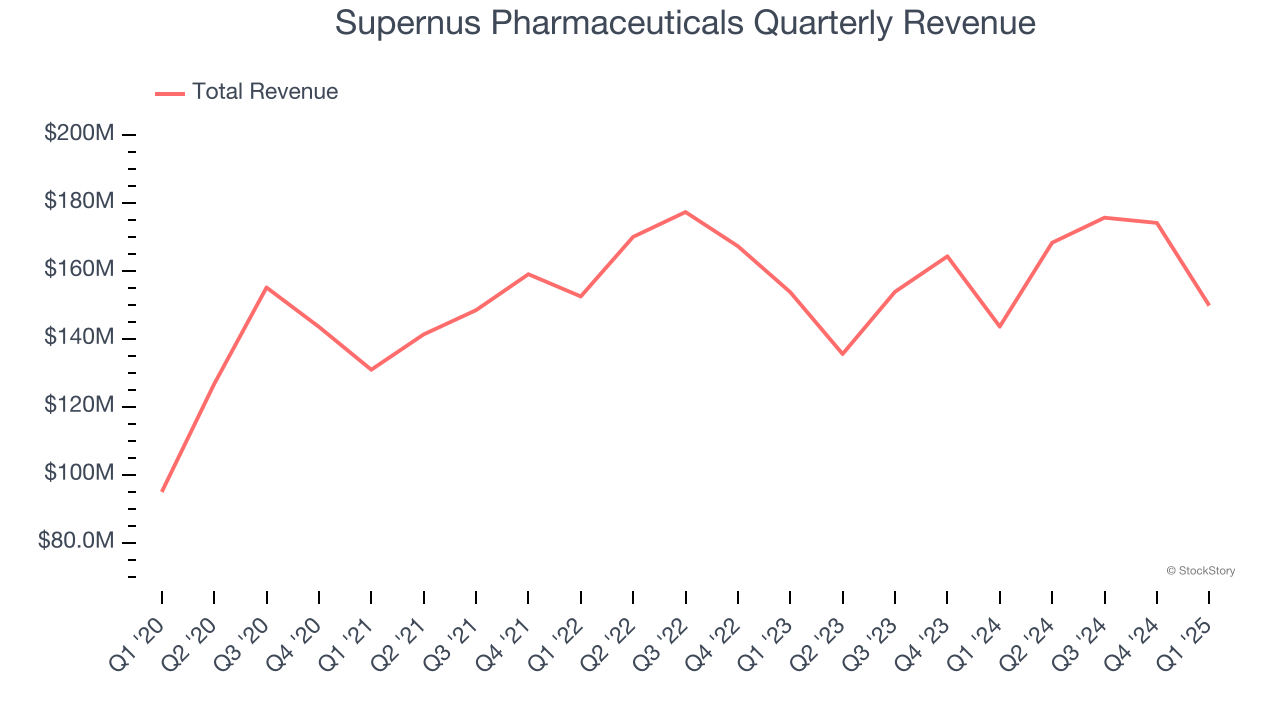

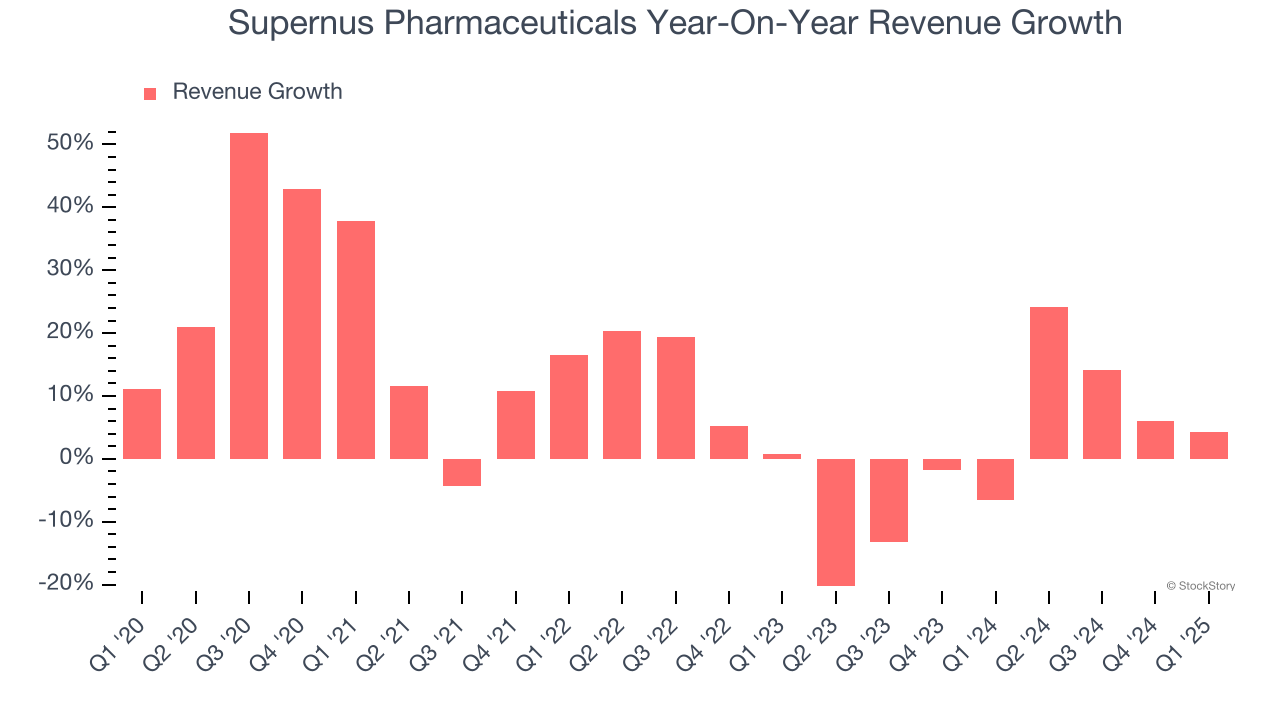

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Supernus Pharmaceuticals’s sales grew at a decent 10.7% compounded annual growth rate over the last five years. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Supernus Pharmaceuticals’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

Supernus Pharmaceuticals also breaks out the revenue for its most important segment, . Over the last two years, Supernus Pharmaceuticals’s revenue was flat. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Supernus Pharmaceuticals reported modest year-on-year revenue growth of 4.3% but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to decline by 5.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

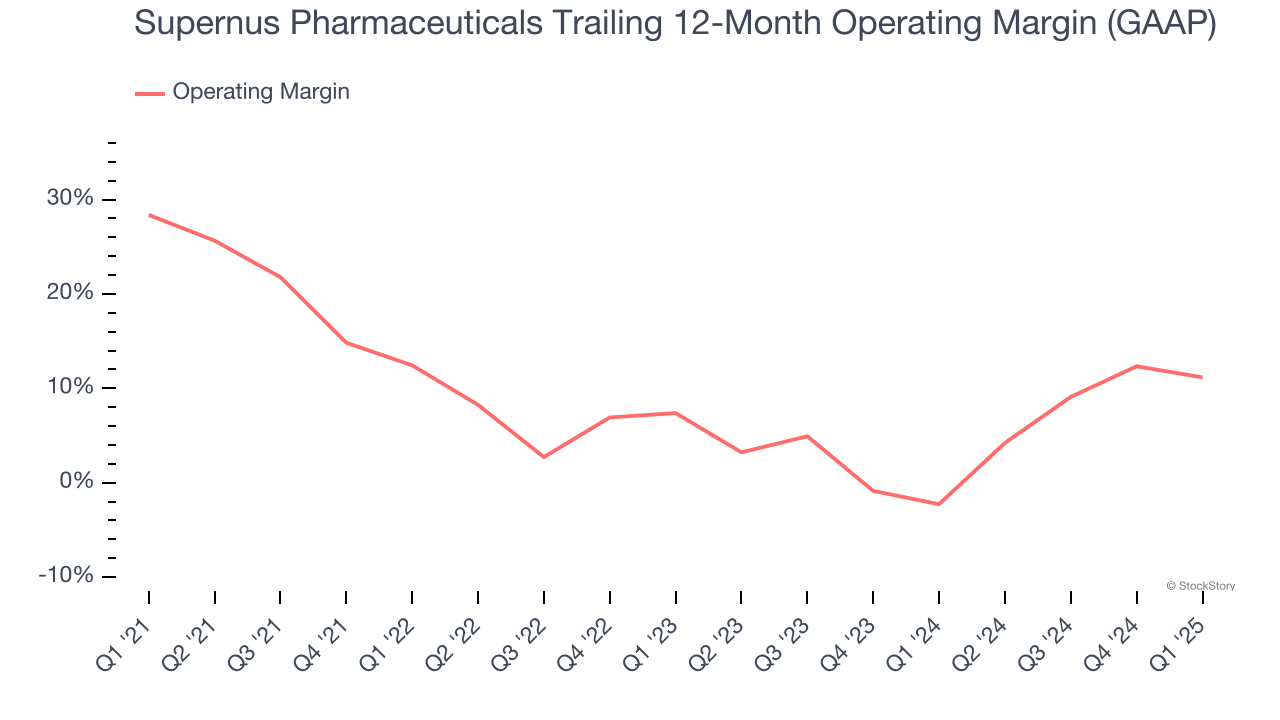

Supernus Pharmaceuticals has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.1%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Supernus Pharmaceuticals’s operating margin decreased by 17.2 percentage points over the last five years, but it rose by 3.8 percentage points on a two-year basis. Still, shareholders will want to see Supernus Pharmaceuticals become more profitable in the future.

This quarter, Supernus Pharmaceuticals generated an operating profit margin of negative 6.8%, down 4.7 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

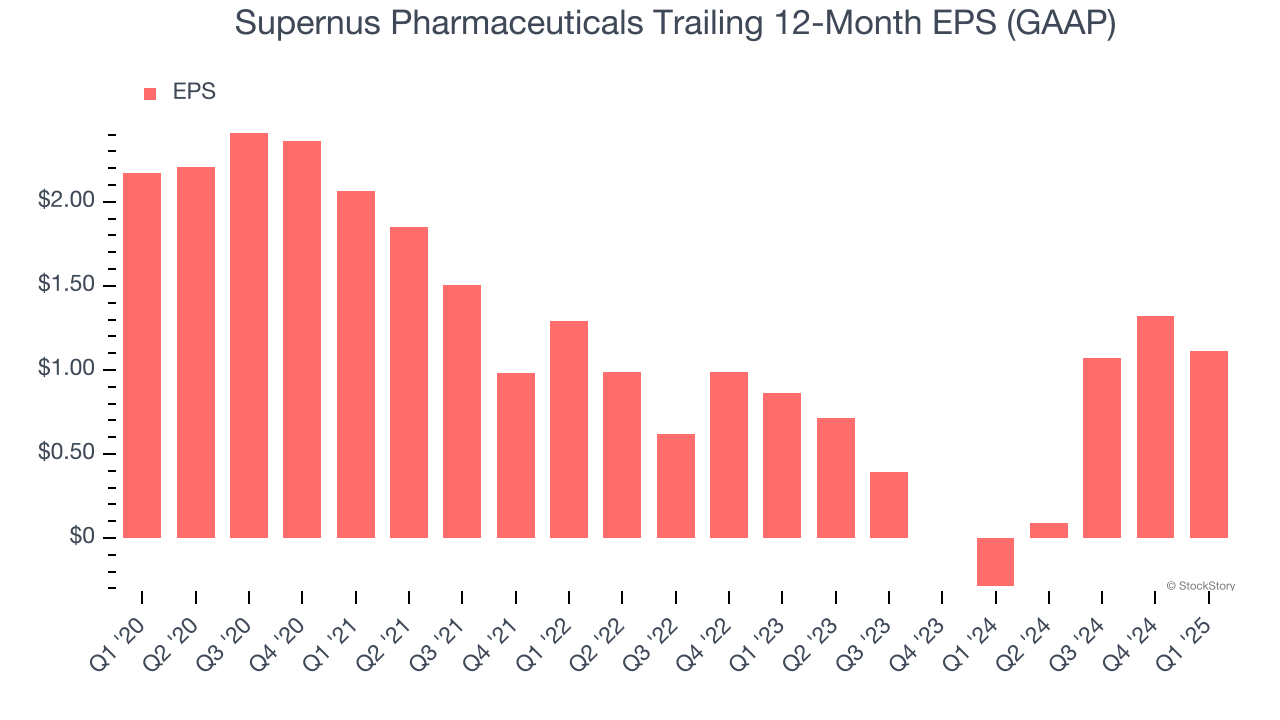

Sadly for Supernus Pharmaceuticals, its EPS declined by 12.6% annually over the last five years while its revenue grew by 10.7%. This tells us the company became less profitable on a per-share basis as it expanded.

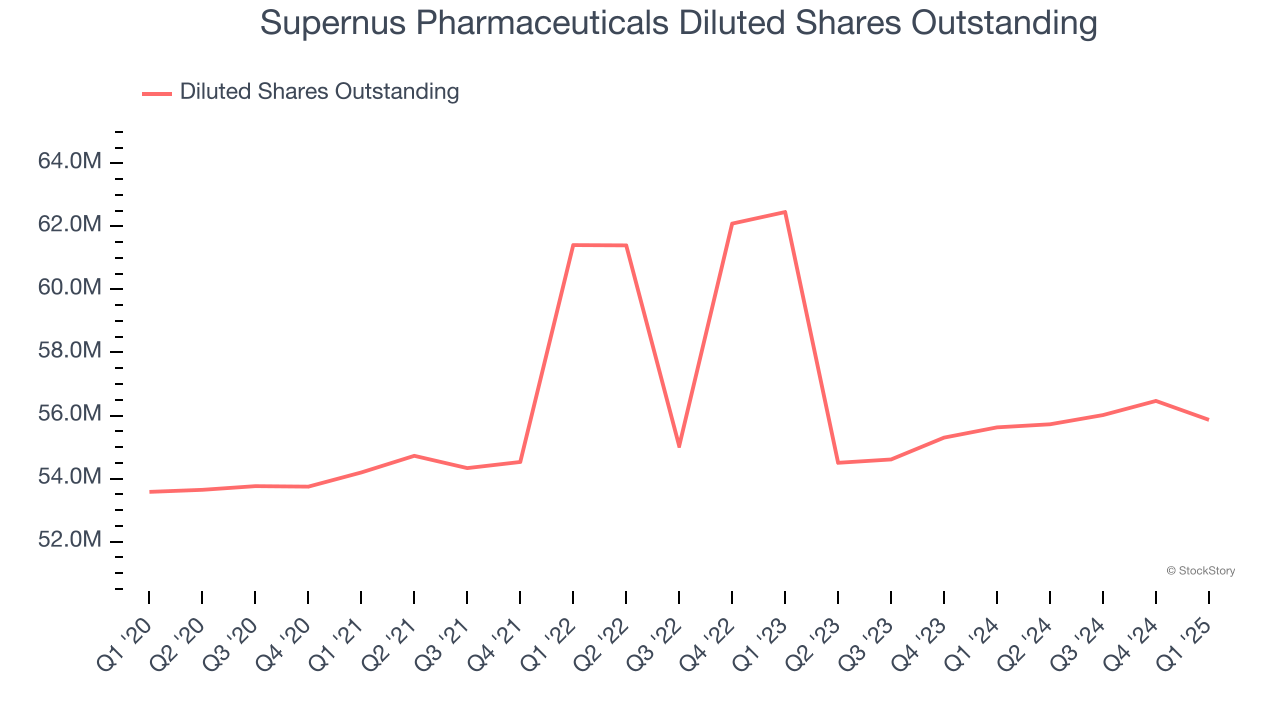

Diving into the nuances of Supernus Pharmaceuticals’s earnings can give us a better understanding of its performance. As we mentioned earlier, Supernus Pharmaceuticals’s operating margin declined by 17.2 percentage points over the last five years. Its share count also grew by 4.3%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, Supernus Pharmaceuticals reported EPS at negative $0.21, down from $0 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Supernus Pharmaceuticals’s Q1 Results

It was good to see Supernus Pharmaceuticals narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed significantly and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $32.20 immediately following the results.

Supernus Pharmaceuticals didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.