Biotech company Sarepta Therapeutics (NASDAQ:SRPT) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 80.2% year on year to $744.9 million. Its non-GAAP loss of $3.42 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Sarepta Therapeutics? Find out by accessing our full research report, it’s free.

Sarepta Therapeutics (SRPT) Q1 CY2025 Highlights:

- Revenue: $744.9 million vs analyst estimates of $693.5 million (80.2% year-on-year growth, 7.4% beat)

- Adjusted EPS: -$3.42 vs analyst estimates of -$0.65 (significant miss)

- Adjusted EBITDA: -$249.6 million vs analyst estimates of -$371 million (-33.5% margin, 32.7% beat)

- 2025 guidance: total product revenue lowered to $2.45 billion (from ($3.0 billion prior) while combined R&D and SG&A expense raised to $2.0 billion (from $1.25 billion prior)

- Operating Margin: -40.3%, down from 8.4% in the same quarter last year

- Market Capitalization: $6.26 billion

“In the first quarter, we achieved net product revenue of $611.5 million, a 70% increase over the same quarter prior year; our PMO franchise performed well at $236.5 million; and ELEVIDYS achieved $375.0 million, growing at 180% over the same quarter prior year. However, we also faced headwinds in the quarter. While we are taking a variety of actions to address and resolve these challenges, we have adjusted our guidance for 2025 to $2.3 billion to $2.6 billion,” said Doug Ingram, president and chief executive officer, Sarepta Therapeutics.

Company Overview

Pioneering treatments for a devastating childhood muscle-wasting disease that primarily affects boys, Sarepta Therapeutics (NASDAQ:SRPT) develops and commercializes RNA-targeted therapies and gene therapies for rare genetic disorders, primarily Duchenne muscular dystrophy.

Sales Growth

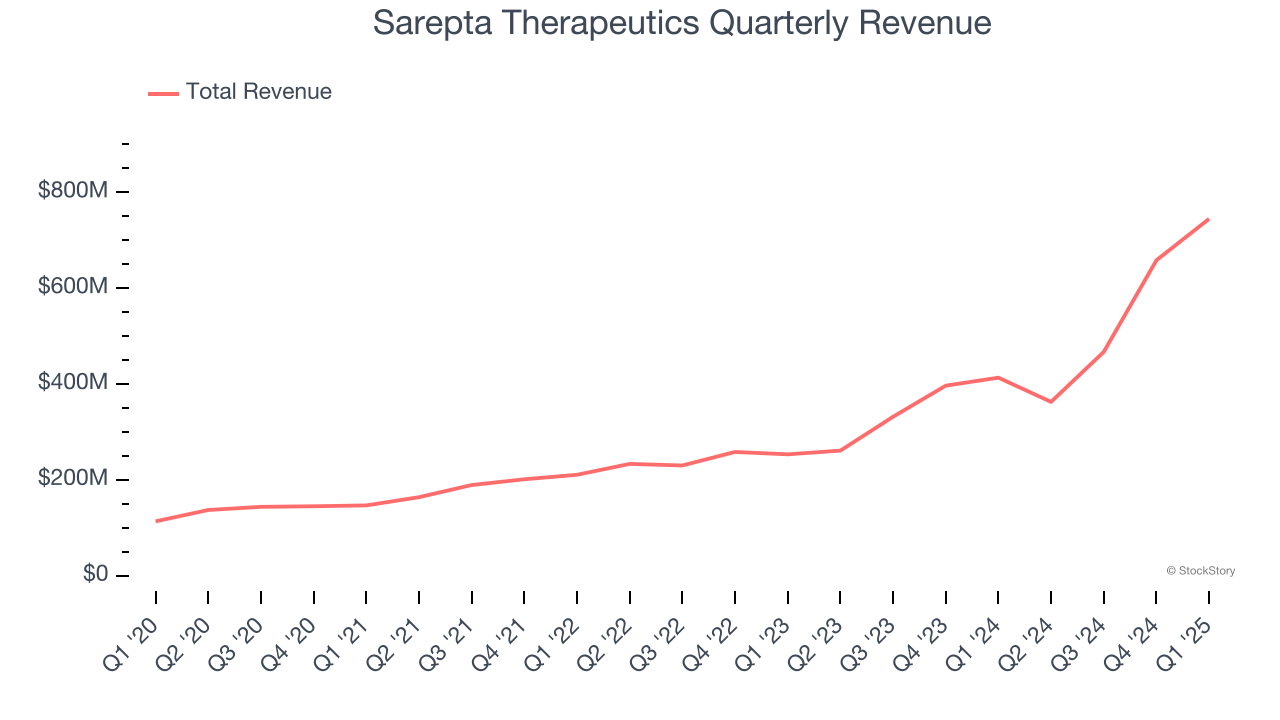

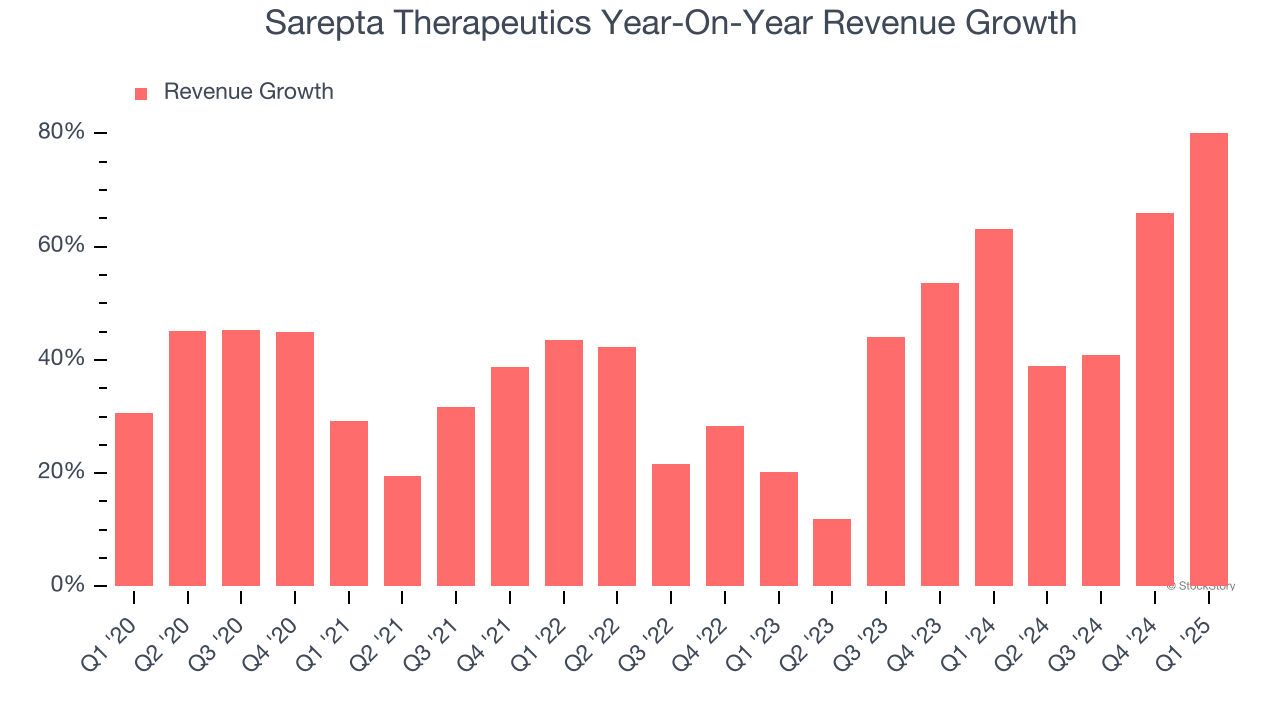

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Sarepta Therapeutics’s sales grew at an incredible 40.5% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Sarepta Therapeutics’s annualized revenue growth of 51.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its most important segment, . Over the last two years, Sarepta Therapeutics’s revenue averaged 50.8% year-on-year growth.

This quarter, Sarepta Therapeutics reported magnificent year-on-year revenue growth of 80.2%, and its $744.9 million of revenue beat Wall Street’s estimates by 7.4%.

Looking ahead, sell-side analysts expect revenue to grow 45.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and suggests the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

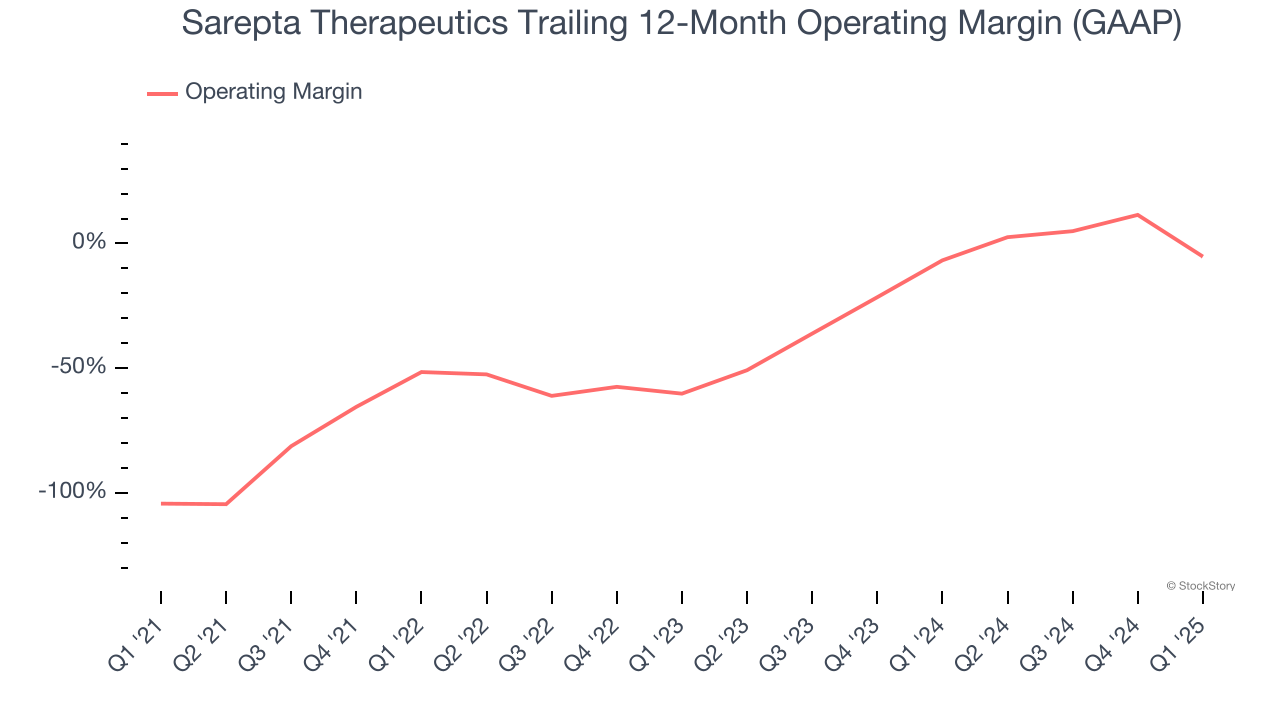

Sarepta Therapeutics’s high expenses have contributed to an average operating margin of negative 30.1% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Sarepta Therapeutics’s operating margin rose by 99.1 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 55 percentage points on a two-year basis. These data points are very encouraging and shows momentum is on its side.

This quarter, Sarepta Therapeutics generated a negative 40.3% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

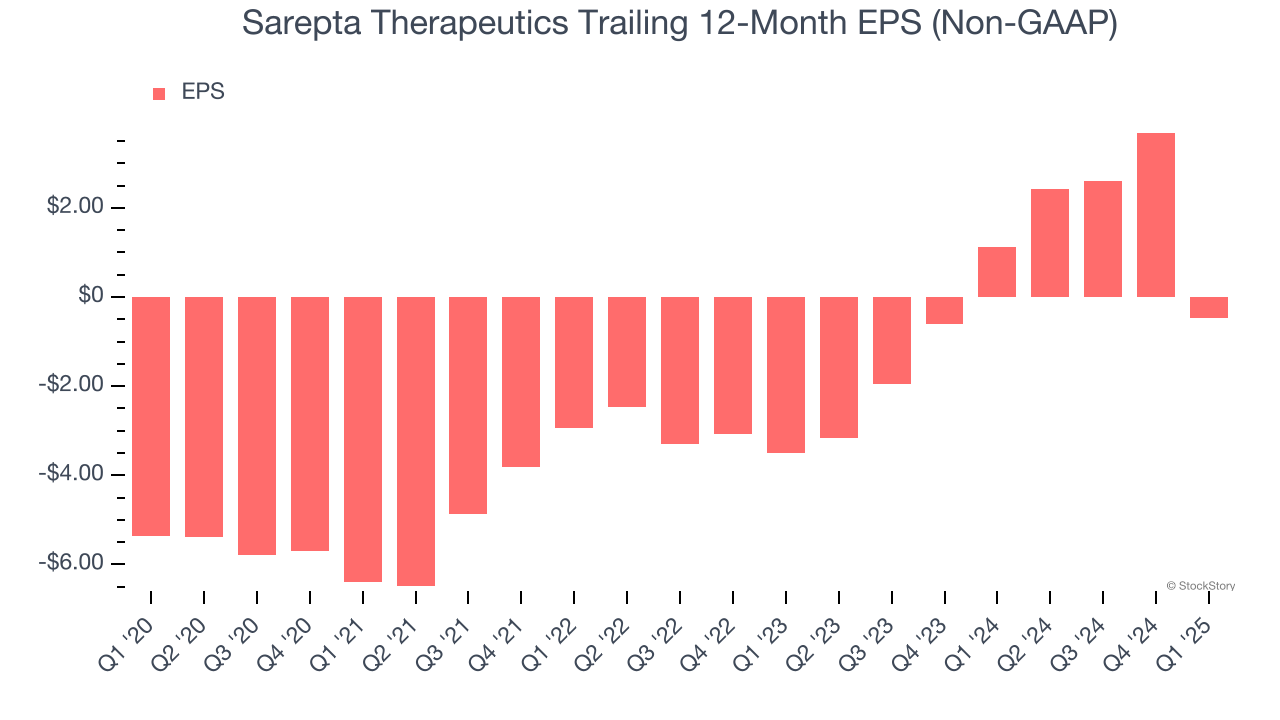

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Sarepta Therapeutics’s full-year earnings are still negative, it reduced its losses and improved its EPS by 38.8% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q1, Sarepta Therapeutics reported EPS at negative $3.42, down from $0.73 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Sarepta Therapeutics’s full-year EPS of negative $0.46 will flip to positive $10.20.

Key Takeaways from Sarepta Therapeutics’s Q1 Results

The big driver of the stock is the company's updated full-year 2025 guidance, which drastically lowered product revenue while drastically raising operating expenses. This means that profit estimates need to come down massively. The stock traded down 22.8% to $36.02 immediately following the results.

Is Sarepta Therapeutics an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.