Pediatric healthcare provider Pediatrix Medical Group (NYSE:MD) reported Q1 CY2025 results topping the market’s revenue expectations, but sales fell by 7.4% year on year to $458.4 million. Its non-GAAP profit of $0.33 per share was 36.7% above analysts’ consensus estimates.

Is now the time to buy Pediatrix Medical Group? Find out by accessing our full research report, it’s free.

Pediatrix Medical Group (MD) Q1 CY2025 Highlights:

- Revenue: $458.4 million vs analyst estimates of $451.1 million (7.4% year-on-year decline, 1.6% beat)

- Adjusted EPS: $0.33 vs analyst estimates of $0.24 (36.7% beat)

- Adjusted EBITDA: $49.18 million vs analyst estimates of $39.5 million (10.7% margin, 24.5% beat)

- EBITDA guidance for the full year is $230 million at the midpoint, above analyst estimates of $226.9 million

- Operating Margin: 7%, up from 3.2% in the same quarter last year

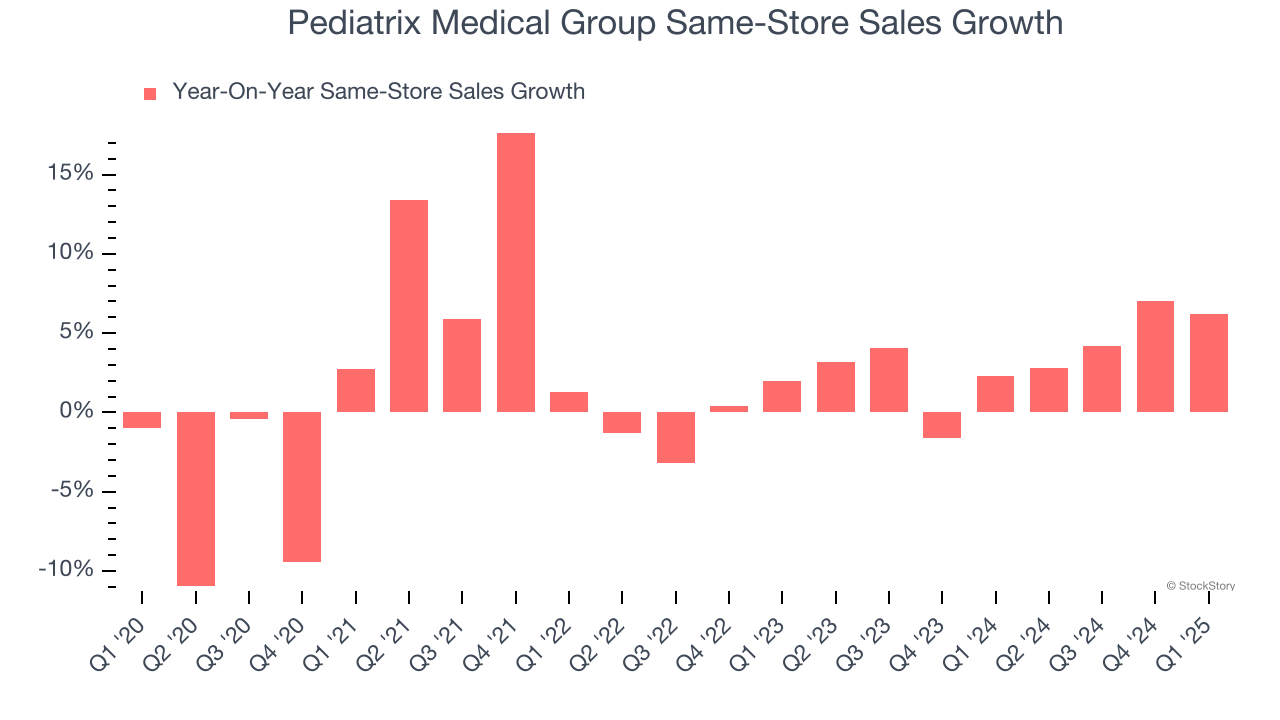

- Same-Store Sales rose 6.2% year on year (2.3% in the same quarter last year)

- Market Capitalization: $1.09 billion

“Our strong first quarter results reflect same-unit top-line outperformance versus our expectations, continued steady cost management and the successful results of the portfolio restructuring we completed last year. As a result of our strong first quarter performance, we are raising our full year 2025 Adjusted EBITDA outlook from a range of $215 million to $235 million to a range of $220 million to $240 million, demonstrating our commitment to delivering value for our stakeholders,” said Mark S. Ordan, Chief Executive Officer of Pediatrix Medical Group.

Company Overview

With a network of approximately 2,620 affiliated physicians caring for some of the most vulnerable patients, Pediatrix Medical Group (NYSE:MD) provides specialized physician services focused on neonatal, maternal-fetal, pediatric cardiology and other pediatric subspecialty care across 37 states.

Sales Growth

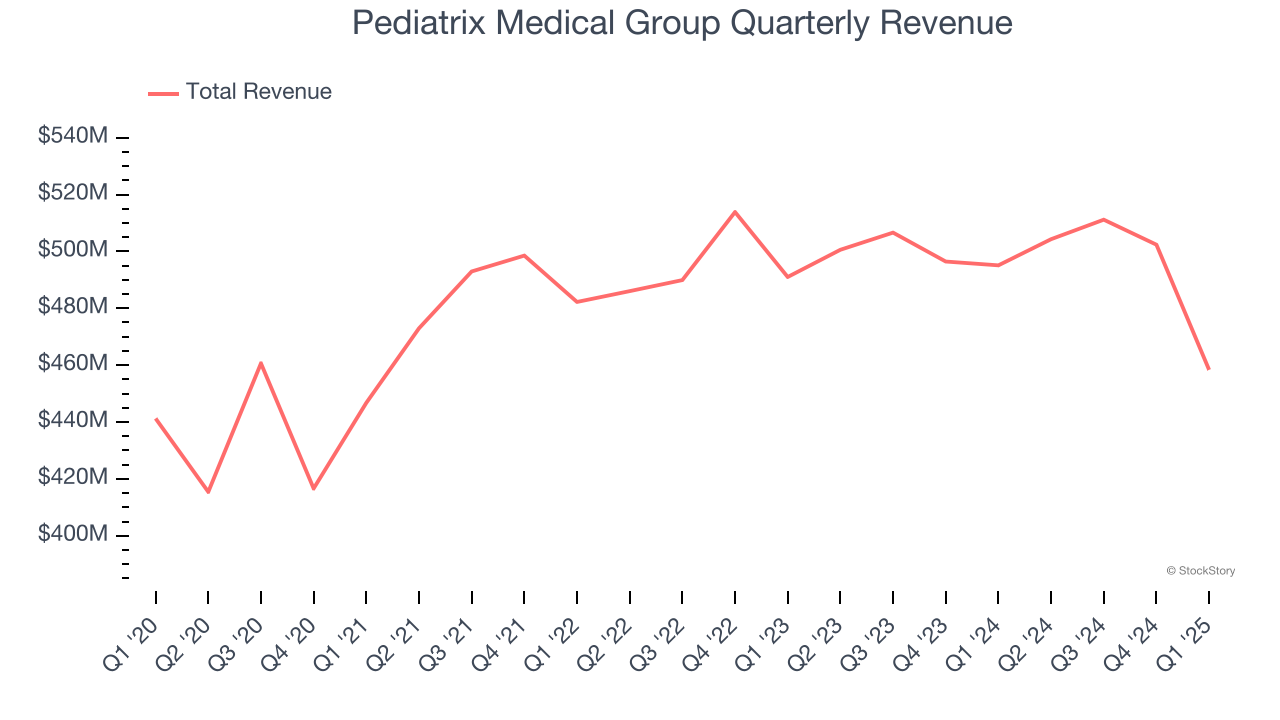

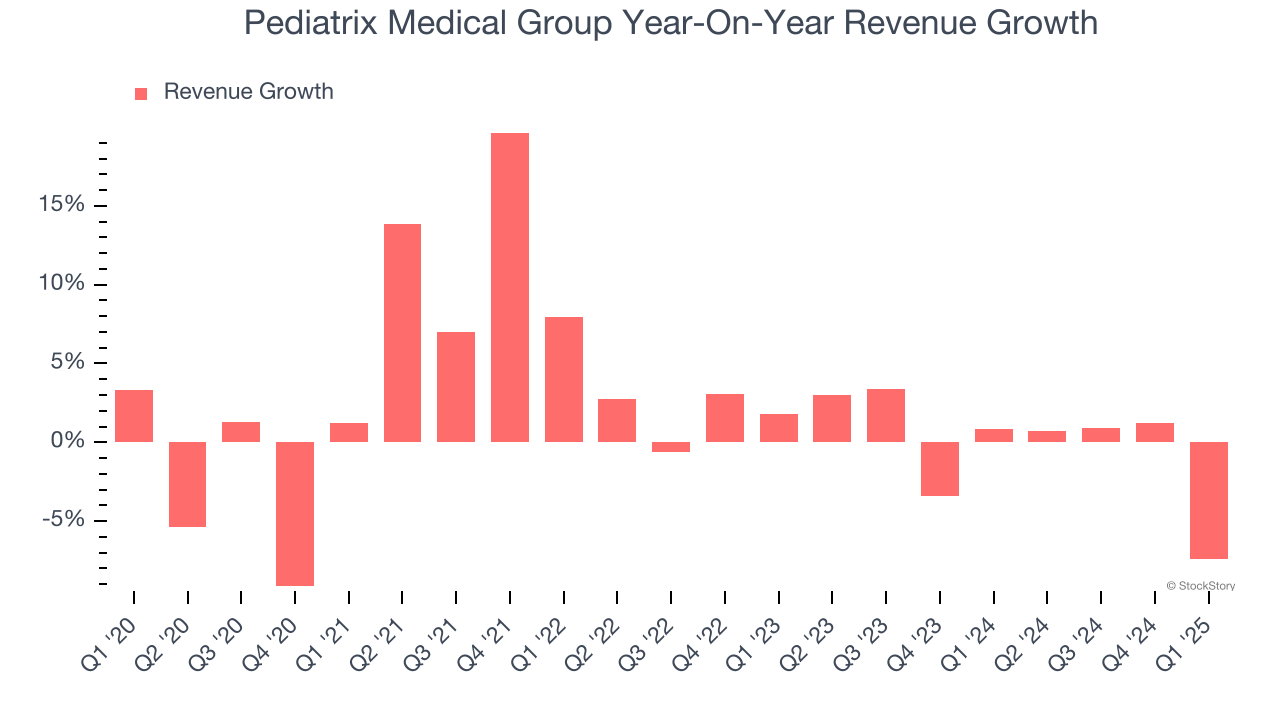

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Pediatrix Medical Group grew its sales at a tepid 2% compounded annual growth rate. This was below our standards and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Pediatrix Medical Group’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Pediatrix Medical Group’s same-store sales averaged 3.5% year-on-year growth. Because this number is better than its revenue growth, we can see its sales from existing locations are performing better than its sales from new locations.

This quarter, Pediatrix Medical Group’s revenue fell by 7.4% year on year to $458.4 million but beat Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to decline by 5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

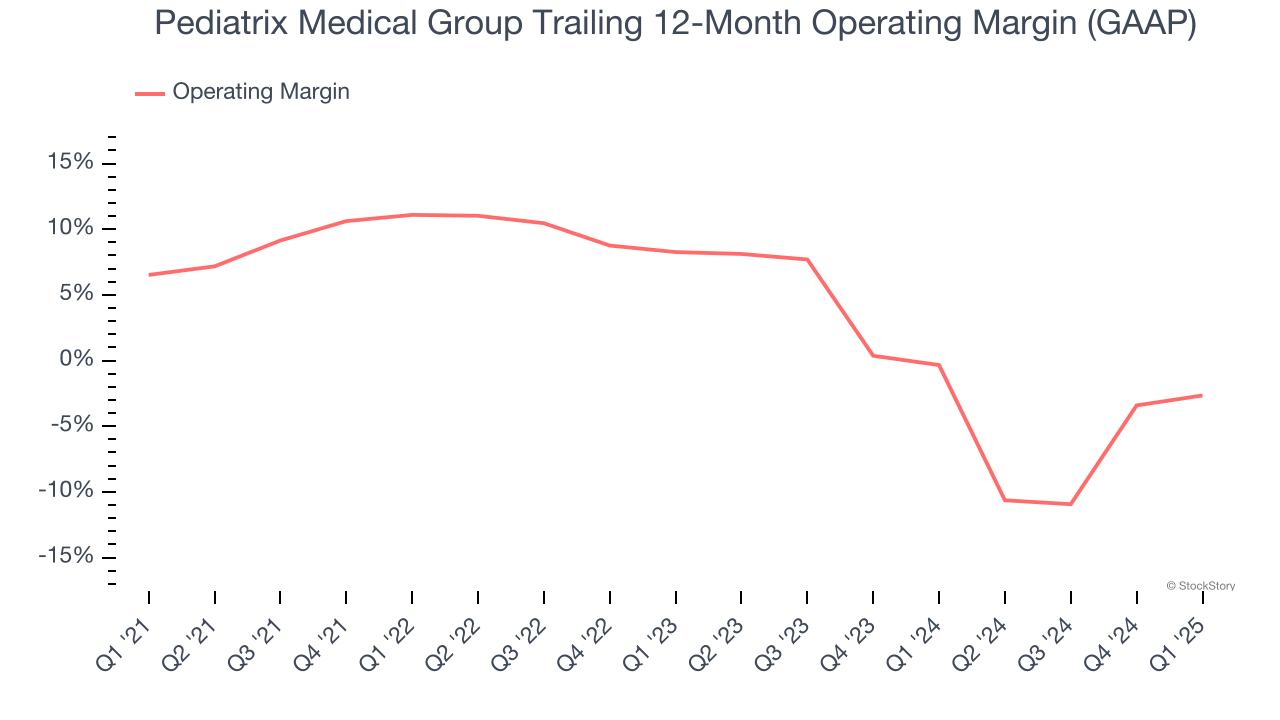

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Pediatrix Medical Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.5% was weak for a healthcare business.

Analyzing the trend in its profitability, Pediatrix Medical Group’s operating margin decreased by 9.2 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 10.9 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q1, Pediatrix Medical Group generated an operating profit margin of 7%, up 3.8 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

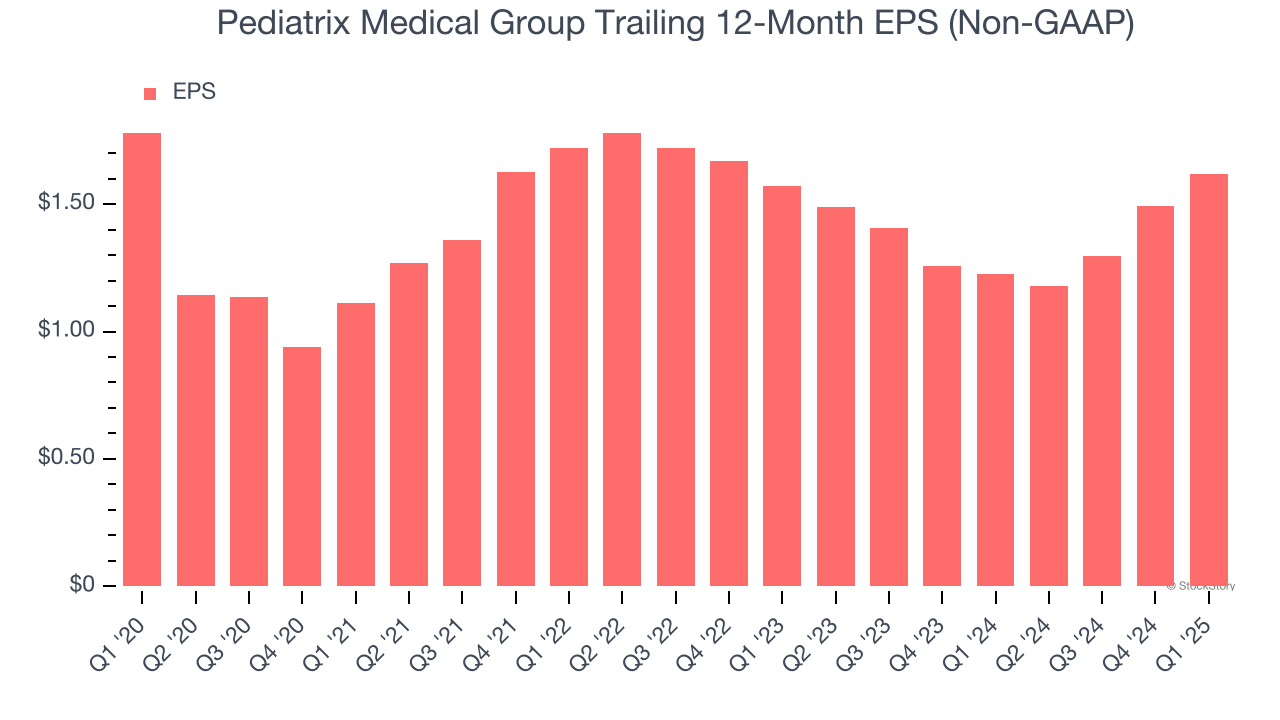

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

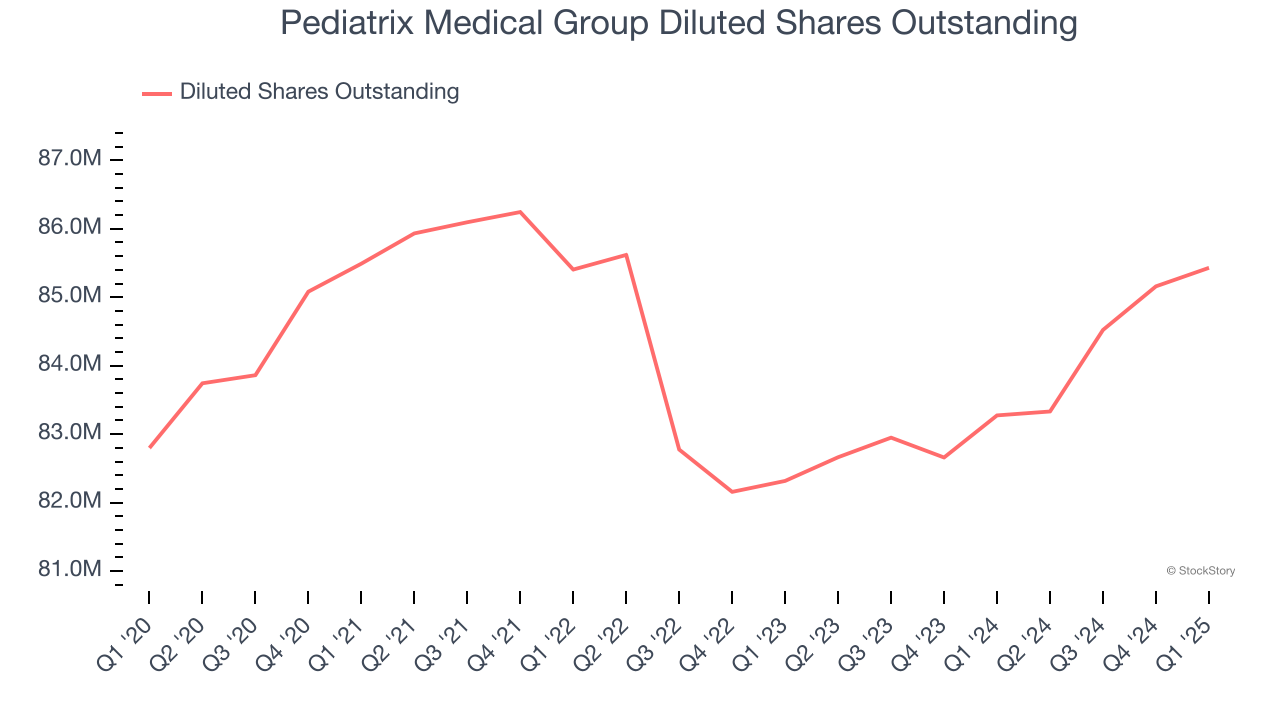

Sadly for Pediatrix Medical Group, its EPS declined by 1.9% annually over the last five years while its revenue grew by 2%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into Pediatrix Medical Group’s earnings to better understand the drivers of its performance. As we mentioned earlier, Pediatrix Medical Group’s operating margin improved this quarter but declined by 9.2 percentage points over the last five years. Its share count also grew by 3.2%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, Pediatrix Medical Group reported EPS at $0.33, up from $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Pediatrix Medical Group’s full-year EPS of $1.62 to shrink by 4%.

Key Takeaways from Pediatrix Medical Group’s Q1 Results

We were impressed by how Pediatrix Medical Group blew past analysts’ same-store sales, revenue, EPS, and EBITDA expectations this quarter. We were also excited it lifted its full-year EBITDA guidance, topping Wall Street’s estimates. Zooming out, we think this was a solid print, but shares traded down 6.3% to $12.11 immediately following the results.

So do we think Pediatrix Medical Group is an attractive buy at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.