Railway infrastructure company L.B. Foster (NASDAQ:FSTR) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 21.3% year on year to $97.79 million. On the other hand, the company’s full-year revenue guidance of $560 million at the midpoint came in 3% above analysts’ estimates. Its GAAP loss of $0.20 per share was significantly below analysts’ consensus estimates.

Is now the time to buy L.B. Foster? Find out by accessing our full research report, it’s free.

L.B. Foster (FSTR) Q1 CY2025 Highlights:

- Revenue: $97.79 million vs analyst estimates of $114.4 million (21.3% year-on-year decline, 14.5% miss)

- EPS (GAAP): -$0.20 vs analyst estimates of $0.01 (significant miss)

- Adjusted EBITDA: $1.82 million vs analyst estimates of $4.55 million (1.9% margin, 59.9% miss)

- The company reconfirmed its revenue guidance for the full year of $560 million at the midpoint

- EBITDA guidance for the full year is $45 million at the midpoint, above analyst estimates of $41.88 million

- Operating Margin: -2%, down from 1.7% in the same quarter last year

- Backlog: $237.2 million at quarter end

- Market Capitalization: $219.1 million

John Kasel, President and Chief Executive Officer, commented, "As mentioned in our 2024 year end earnings announcement back in March, we started 2025 with first quarter sales and profitability down versus last year. This was due to an exceptionally-strong first quarter last year for our Rail segment. Within the segment, Rail Products sales declined $23.7 million, or 44.7%, due to lower Rail Distribution volumes. Infrastructure sales grew 5.0% over last year and expanded operating results in the quarter driven by a 33.7% increase in Precast Concrete sales. Focusing on what we can influence in the short term, we drove cost controls which resulted in an 8.4% reduction in operating expenses versus last year, partially mitigating the impact of lower gross profit from the Rail Distribution sales decline. We also stepped up our stock buybacks to 168,911 shares in the first quarter, or 1.5% of outstanding common stock."

Company Overview

Founded with a $2,500 loan, L.B. Foster (NASDAQ:FSTR) is a provider of products and services for the transportation and energy infrastructure sectors, including rail products, construction materials, and coating solutions.

Sales Growth

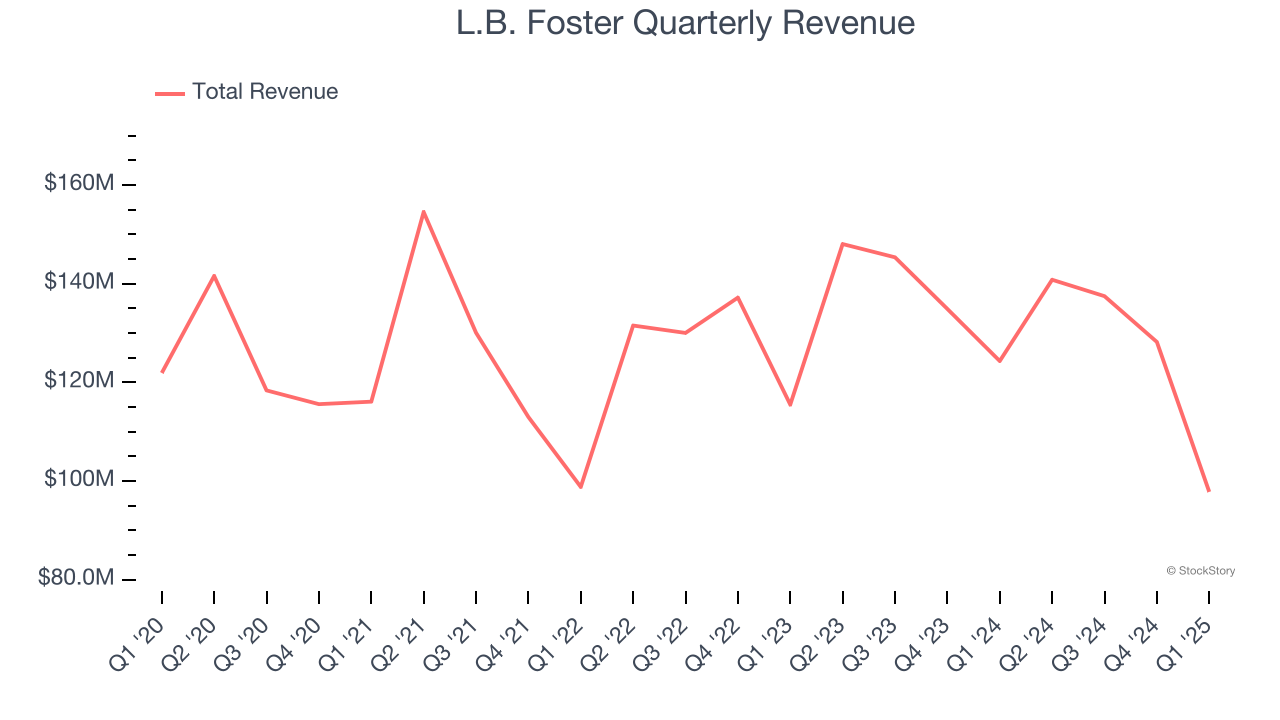

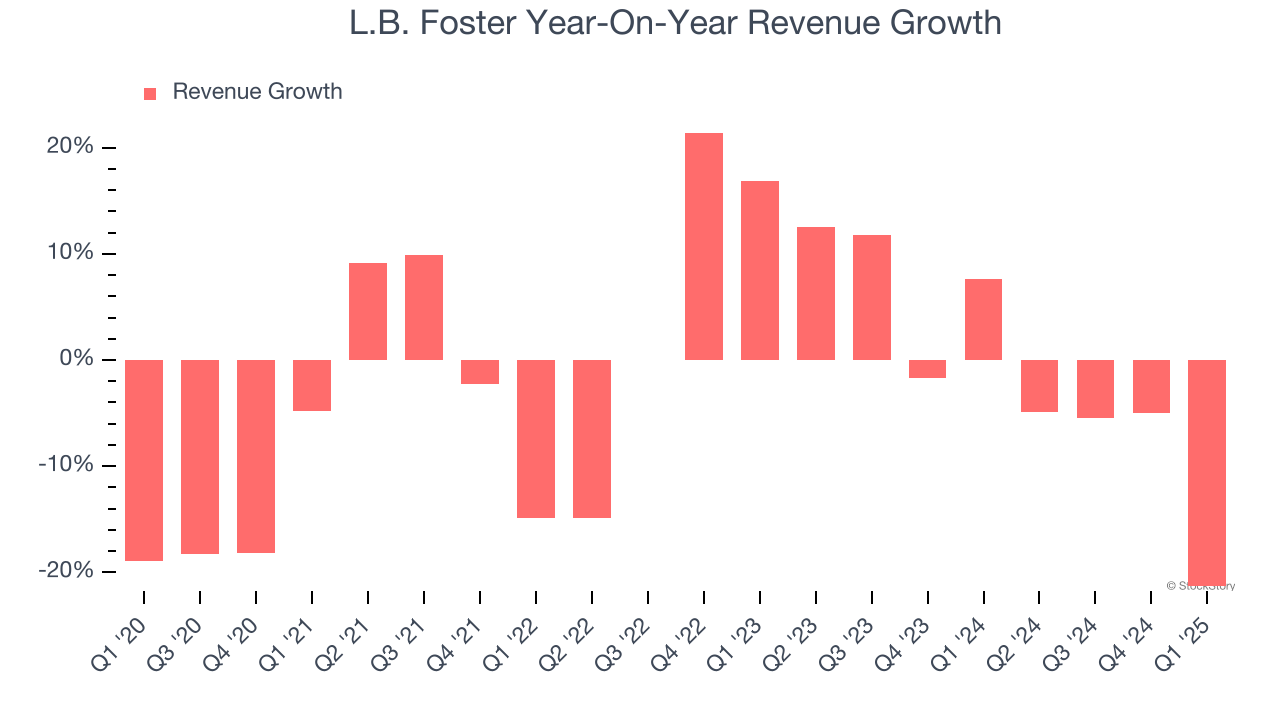

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. L.B. Foster struggled to consistently generate demand over the last five years as its sales dropped at a 2.3% annual rate. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. L.B. Foster’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop in sales.

This quarter, L.B. Foster missed Wall Street’s estimates and reported a rather uninspiring 21.3% year-on-year revenue decline, generating $97.79 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.9% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

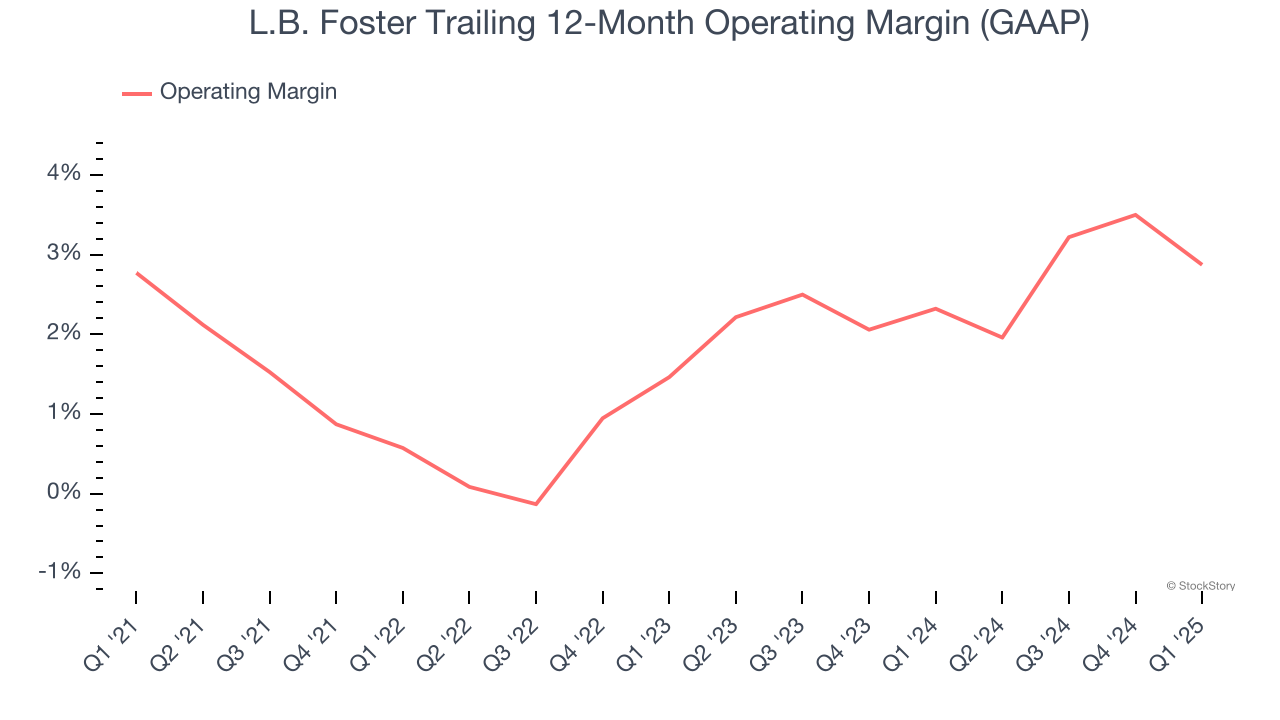

Operating Margin

L.B. Foster was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, L.B. Foster’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

In Q1, L.B. Foster generated an operating profit margin of negative 2%, down 3.7 percentage points year on year. Since L.B. Foster’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

Earnings Per Share

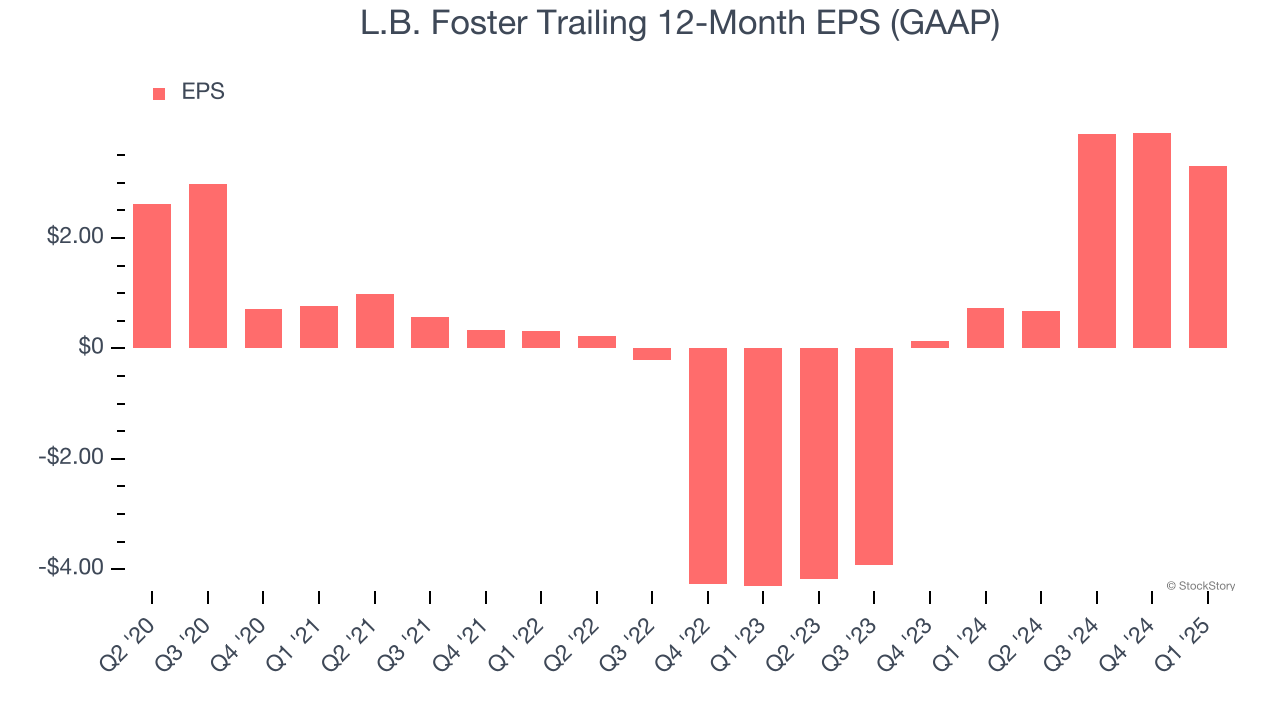

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

L.B. Foster’s EPS grew at a weak 3.5% compounded annual growth rate over the last five years. This performance was better than its 2.3% annualized revenue declines, but we take it with a grain of salt because its operating margin didn’t expand and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For L.B. Foster, its two-year annual EPS growth of 66.4% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q1, L.B. Foster reported EPS at negative $0.20, down from $0.40 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects L.B. Foster’s full-year EPS of $3.31 to shrink by 42.1%.

Key Takeaways from L.B. Foster’s Q1 Results

We were impressed by L.B. Foster’s full-year revenue and EBITDA guidance, which exceeded analysts’ expectations. On the other hand, its revenue, EPS, and EBITDA missed significantly. Overall, this was a softer quarter. The stock traded down 1.1% to $20.20 immediately after reporting.

Is L.B. Foster an attractive investment opportunity right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.