B2B travel services company Global Business Travel (NYSE:GBTG) fell short of the market’s revenue expectations in Q1 CY2025 as sales only rose 1.8% year on year to $621 million. Next quarter’s revenue guidance of $625 million underwhelmed, coming in 4.2% below analysts’ estimates. Its GAAP profit of $0.16 per share was 78.5% above analysts’ consensus estimates.

Is now the time to buy Global Business Travel? Find out by accessing our full research report, it’s free.

Global Business Travel (GBTG) Q1 CY2025 Highlights:

- Revenue: $621 million vs analyst estimates of $633.3 million (1.8% year-on-year growth, 1.9% miss)

- EPS (GAAP): $0.16 vs analyst estimates of $0.09 (78.5% beat)

- Adjusted EBITDA: $141 million vs analyst estimates of $139.8 million (22.7% margin, 0.9% beat)

- The company dropped its revenue guidance for the full year to $2.43 billion at the midpoint from $2.53 billion, a 3.8% decrease

- EBITDA guidance for the full year is $510 million at the midpoint, below analyst estimates of $549.5 million

- Operating Margin: 8.9%, up from 2.6% in the same quarter last year

- Free Cash Flow Margin: 4.2%, down from 5.6% in the previous quarter

- Transaction Value: 8.35 billion, up 244 million year on year

- Market Capitalization: $3.24 billion

Paul Abbott, Amex GBT’s Chief Executive Officer, stated: "In the first quarter, we delivered on our commitments, with strong profit growth, margin expansion and cash generation. Investments in our software and services are driving share gains and productivity improvements. Our strong and flexible operating model positions us well to navigate through a more uncertain environment.”

Company Overview

Holding close ties to American Express, Global Business Travel (NYSE:GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

Sales Growth

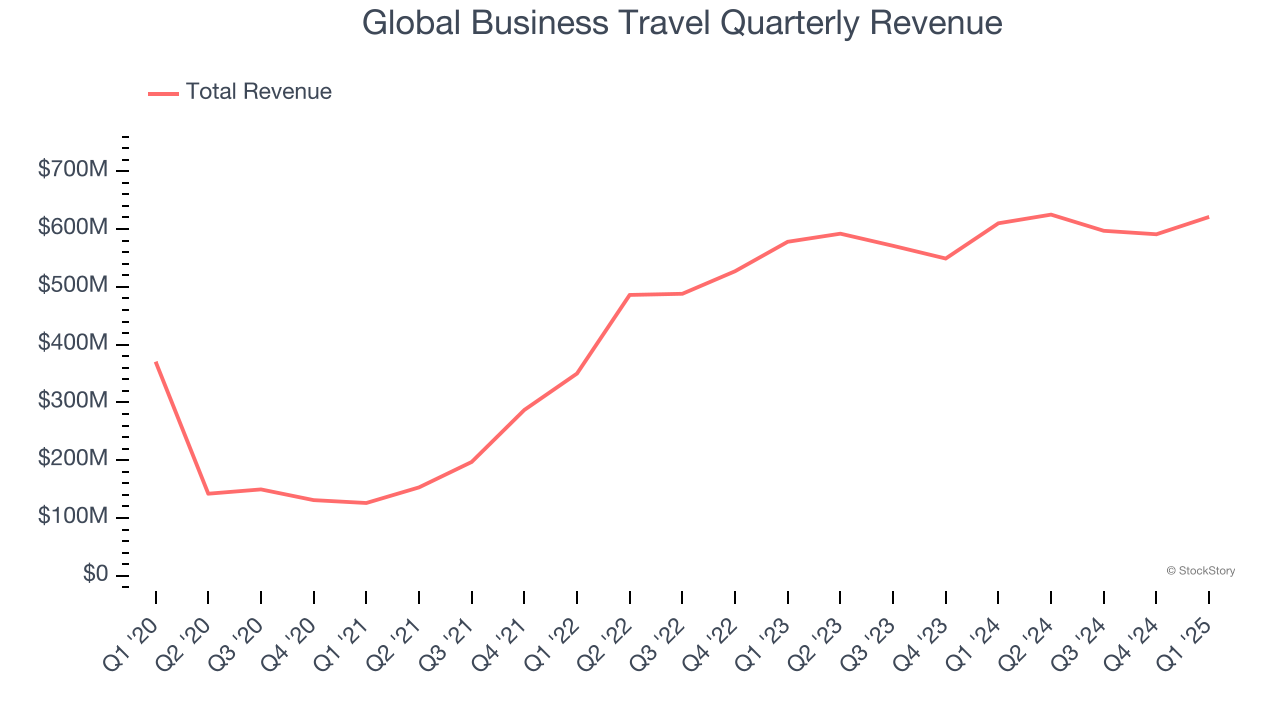

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Global Business Travel grew its sales at an excellent 35.1% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Global Business Travel’s revenue grew by 1.8% year on year to $621 million, falling short of Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

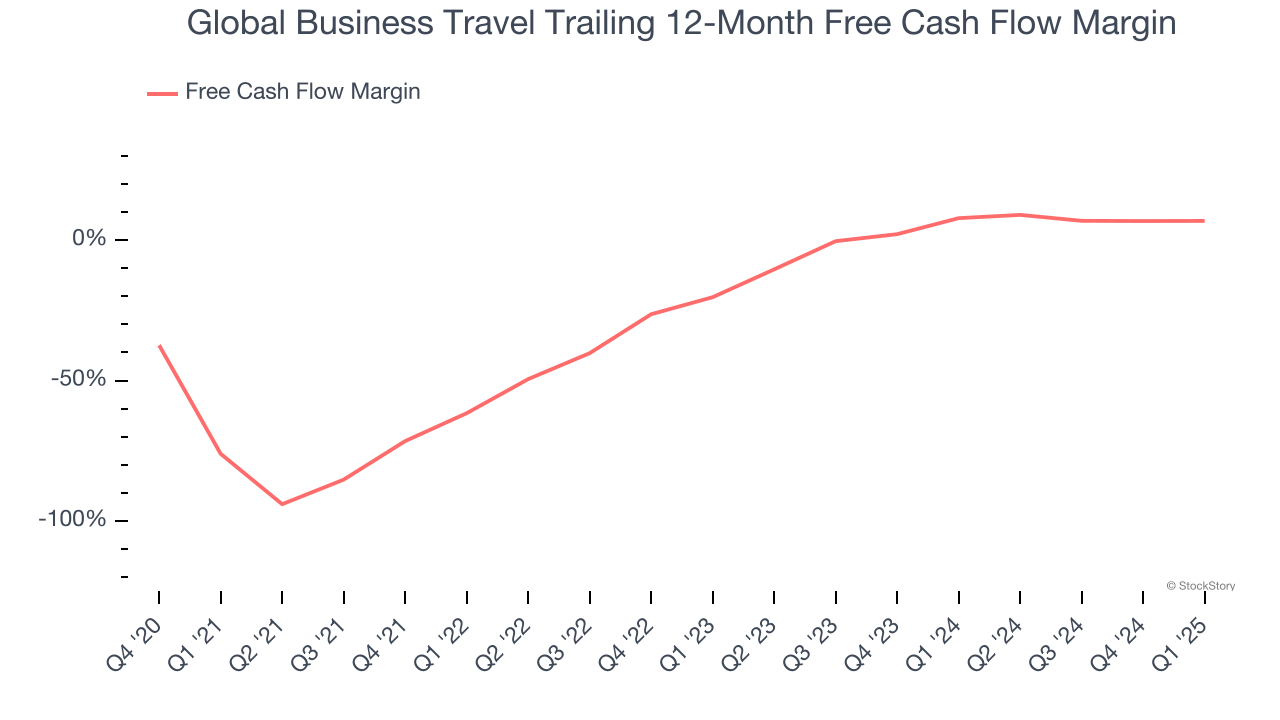

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Global Business Travel has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.9%, subpar for a software business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Global Business Travel to make large cash investments in working capital (i.e., stocking inventories) and capital expenditures (i.e., building new facilities).

Global Business Travel’s free cash flow clocked in at $26 million in Q1, equivalent to a 4.2% margin. This cash profitability was in line with the comparable period last year but below its one-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Global Business Travel’s Q1 Results

It was good to see Global Business Travel top analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue missed and its full-year revenue and EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better, but the stock traded up 4% to $7.16 immediately after reporting.

Is Global Business Travel an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.