Health insurance company Clover Health (NASDAQ:CLOV) fell short of the market’s revenue expectations in Q1 CY2025, but sales rose 33.3% year on year to $462.3 million. Its GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Clover Health? Find out by accessing our full research report, it’s free.

Clover Health (CLOV) Q1 CY2025 Highlights:

- Revenue: $462.3 million vs analyst estimates of $469.1 million (33.3% year-on-year growth, 1.4% miss)

- EPS (GAAP): $0 vs analyst estimates of -$0.04 (significant beat)

- Adjusted EBITDA: $25.78 million vs analyst estimates of $9.27 million (5.6% margin, significant beat)

- EBITDA guidance for the full year is $60 million at the midpoint, above analyst estimates of $45.66 million

- Operating Margin: -0.3%, up from -6.5% in the same quarter last year

- Free Cash Flow was -$16.48 million, down from $25.49 million in the same quarter last year

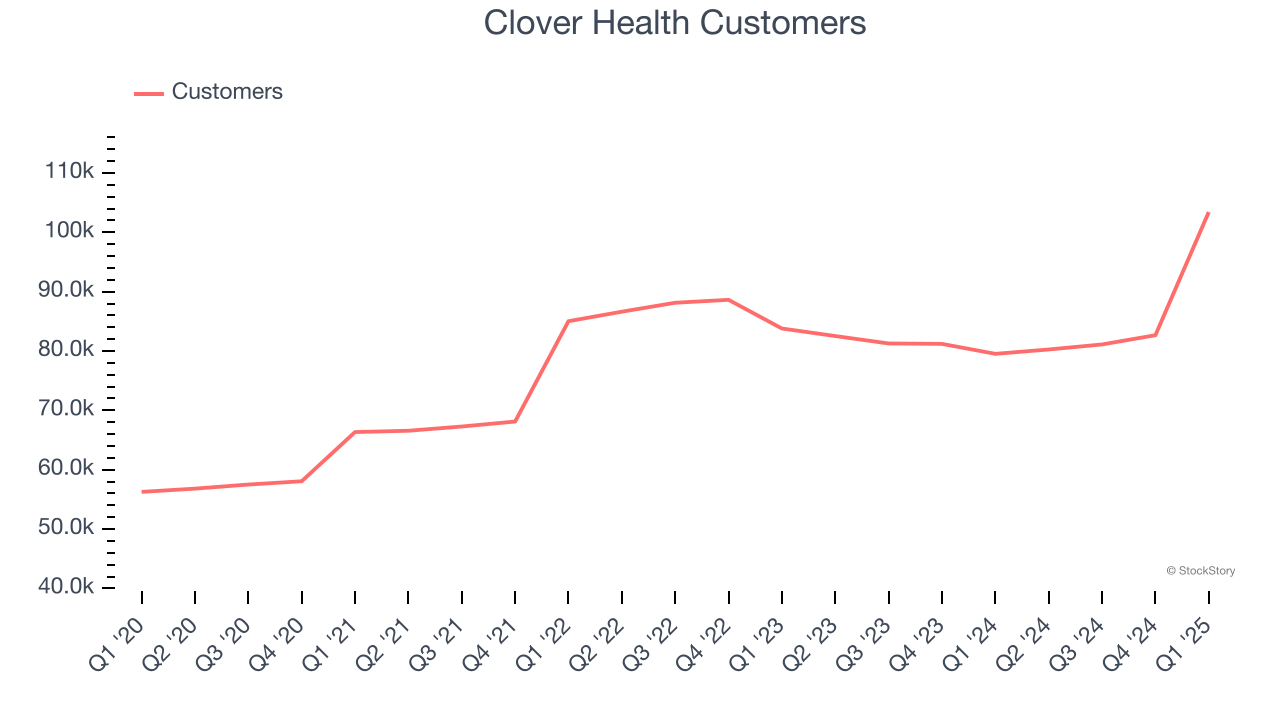

- Customers: 103,418, up from 82,664 in the previous quarter

- Market Capitalization: $1.71 billion

"I am very pleased with our strong start to the year, demonstrating our ability to meaningfully grow membership and expand profitability," said Clover Health CEO Andrew Toy.

Company Overview

Founded in 2014 to improve healthcare for America's seniors through technology, Clover Health (NASDAQ:CLOV) provides Medicare Advantage plans for seniors with a focus on affordable care and uses its proprietary Clover Assistant software to help physicians manage patient care.

Sales Growth

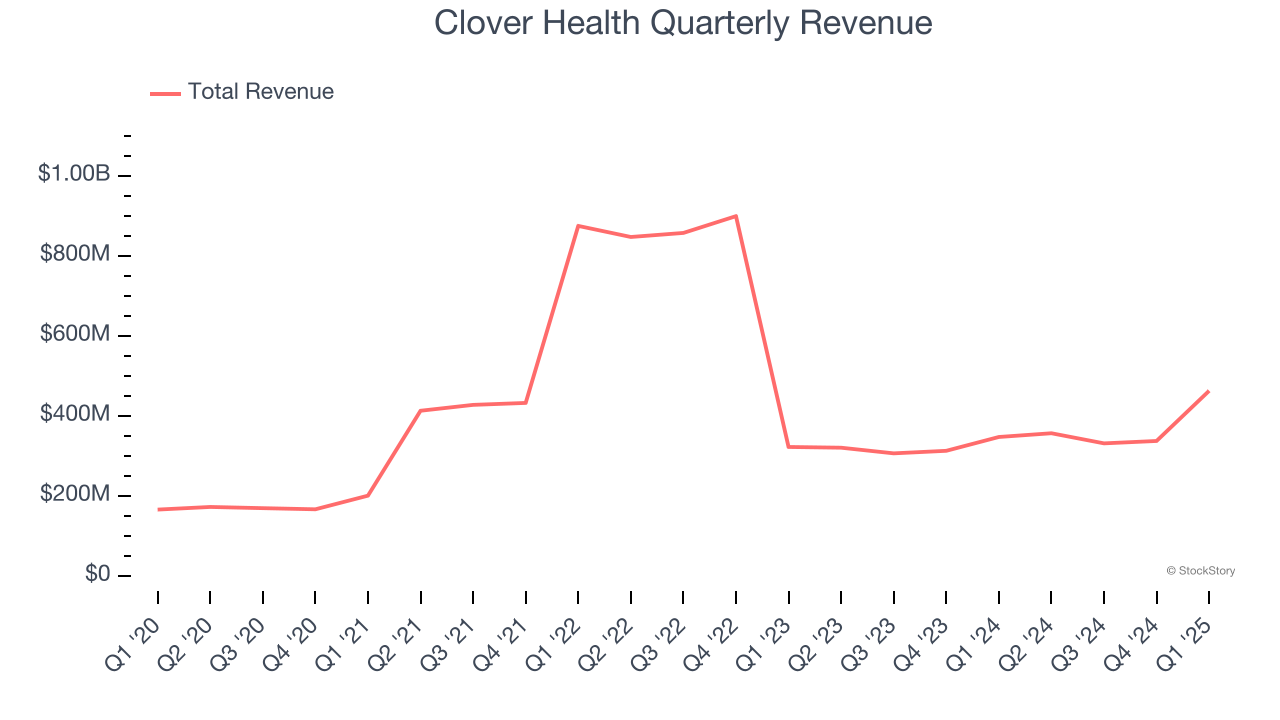

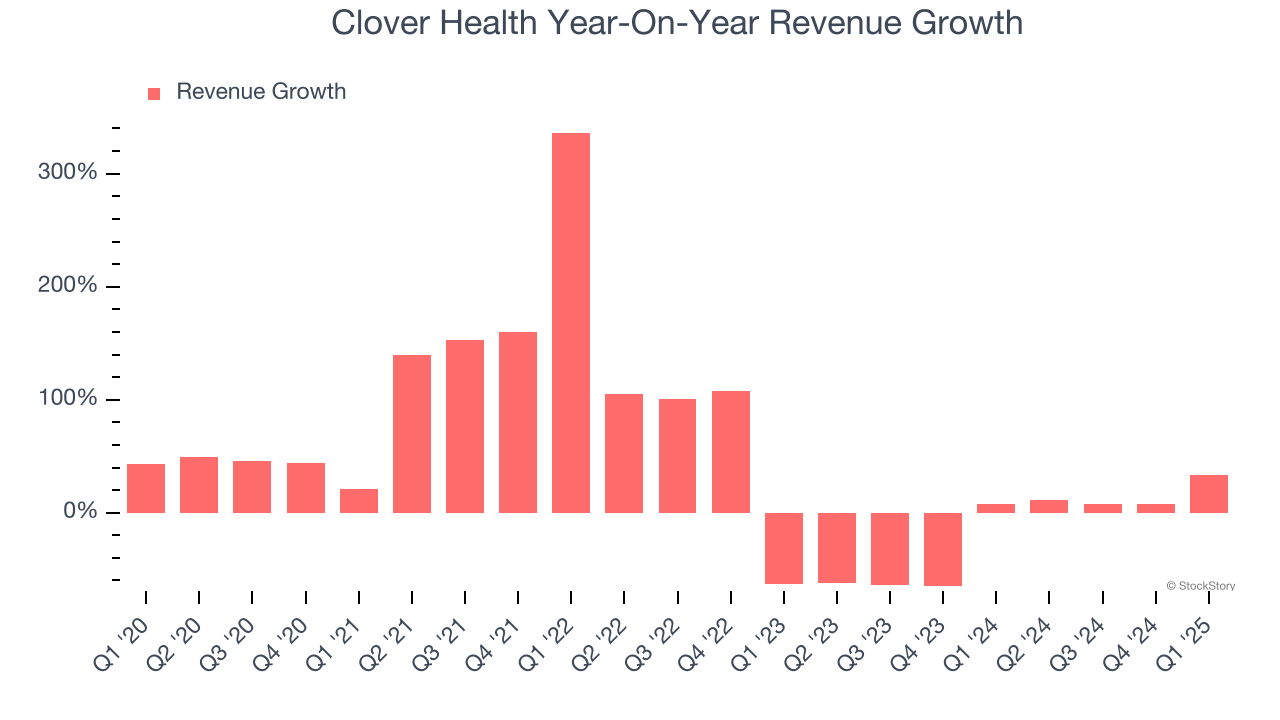

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Clover Health’s sales grew at an excellent 23.8% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Clover Health’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 28.7% over the last two years.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 103,418 in the latest quarter. Over the last two years, Clover Health neither added nor lost customers. Because this number is better than its revenue growth, we can see the average customer spent less money each year on the company’s products and services.

This quarter, Clover Health pulled off a wonderful 33.3% year-on-year revenue growth rate, but its $462.3 million of revenue fell short of Wall Street’s rosy estimates.

Looking ahead, sell-side analysts expect revenue to grow 32.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

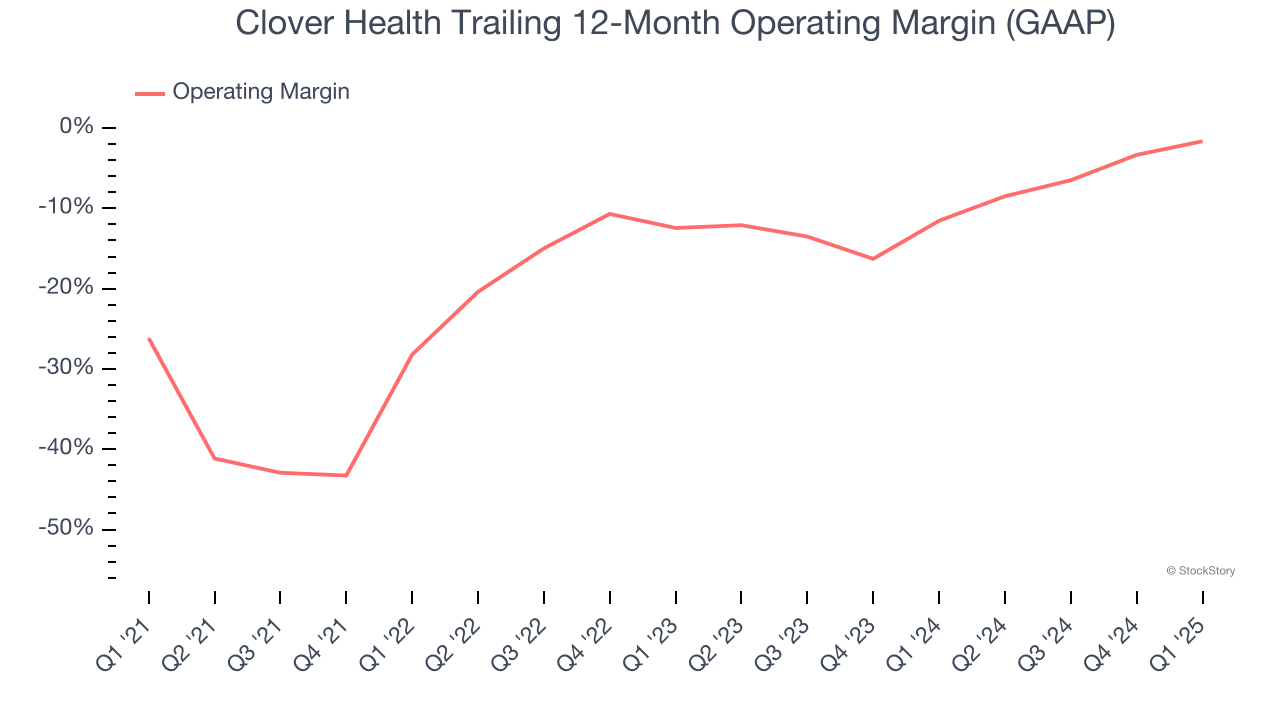

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Although Clover Health broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 15.5% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Clover Health’s operating margin rose by 24.5 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 10.8 percentage points on a two-year basis.

This quarter, Clover Health generated a negative 0.3% operating margin. The company's consistent lack of profits raise a flag.

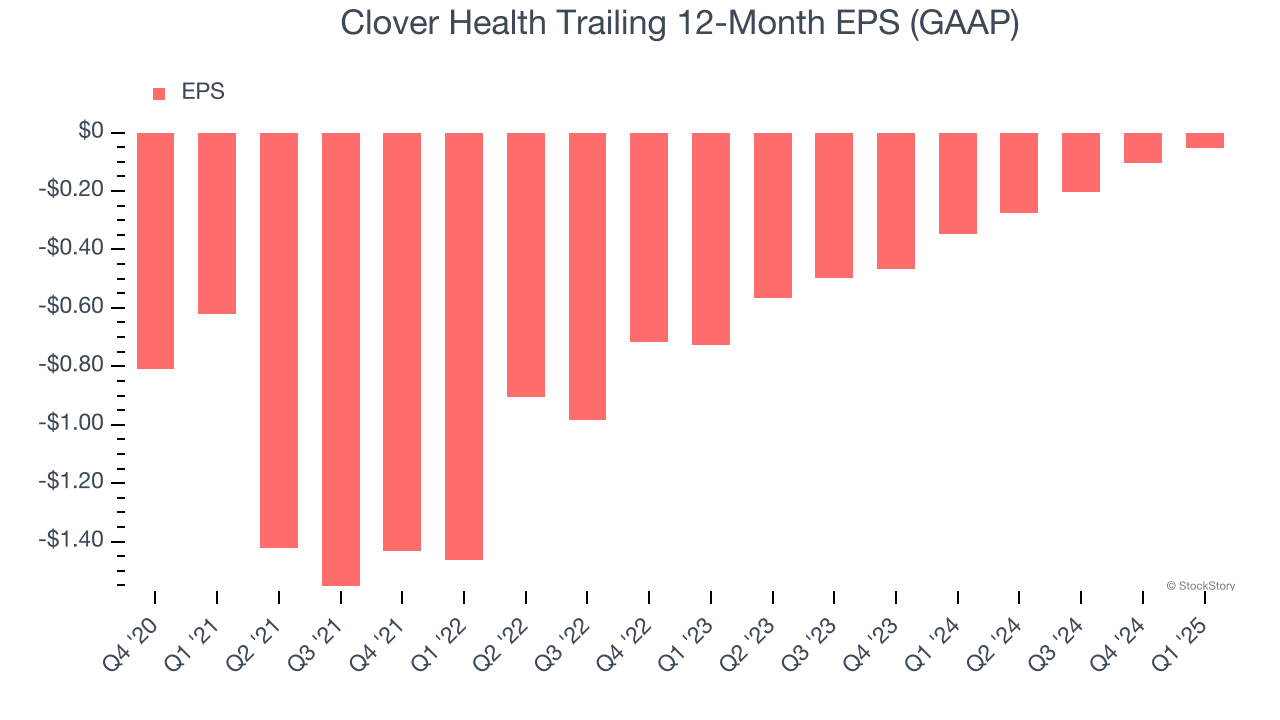

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Clover Health’s full-year earnings are still negative, it reduced its losses and improved its EPS by 45.8% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability.

In Q1, Clover Health reported EPS at $0, up from negative $0.05 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street is optimistic. Analysts forecast Clover Health’s full-year EPS of negative $0.05 will reach break even.

Key Takeaways from Clover Health’s Q1 Results

We were impressed by how significantly Clover Health blew past analysts’ EPS expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $3.37 immediately following the results.

Indeed, Clover Health had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.