Packaging manufacturer Ball (NYSE:BLL) announced better-than-expected revenue in Q1 CY2025, with sales up 7.8% year on year to $3.10 billion. Its non-GAAP profit of $0.76 per share was 8.7% above analysts’ consensus estimates.

Is now the time to buy Ball? Find out by accessing our full research report, it’s free.

Ball (BALL) Q1 CY2025 Highlights:

- Revenue: $3.10 billion vs analyst estimates of $2.90 billion (7.8% year-on-year growth, 6.7% beat)

- Adjusted EPS: $0.76 vs analyst estimates of $0.70 (8.7% beat)

- Adjusted EBITDA: $1.94 billion vs analyst estimates of $436.6 million (62.8% margin, significant beat)

- Operating Margin: 24.3%, up from 6.8% in the same quarter last year

- Free Cash Flow was -$746 million compared to -$1.40 billion in the same quarter last year

- Market Capitalization: $14.64 billion

"We delivered strong first quarter results, returning $612 million to shareholders. Our solid financial foundation, leaner operating model and focused growth strategy enabled us to drive meaningful volume and comparable diluted earnings per share growth. While we remain mindful of heightened geopolitical uncertainty in select markets, we are confident in our ability to meet our 2025 objectives. Our commitment to operational excellence remains central to our strategy. We continue to unlock manufacturing efficiencies, invest in innovation and sustainability, and tightly manage our cost structure. These actions position us well to navigate near-term challenges and consistently deliver long-term value for our shareholders," said Daniel W. Fisher, chairman and chief executive officer.

Company Overview

Started with a $200 loan in 1880, Ball (NYSE:BLL) manufactures aluminum packaging for beverages, personal care, and household products as well as aerospace systems and other technologies.

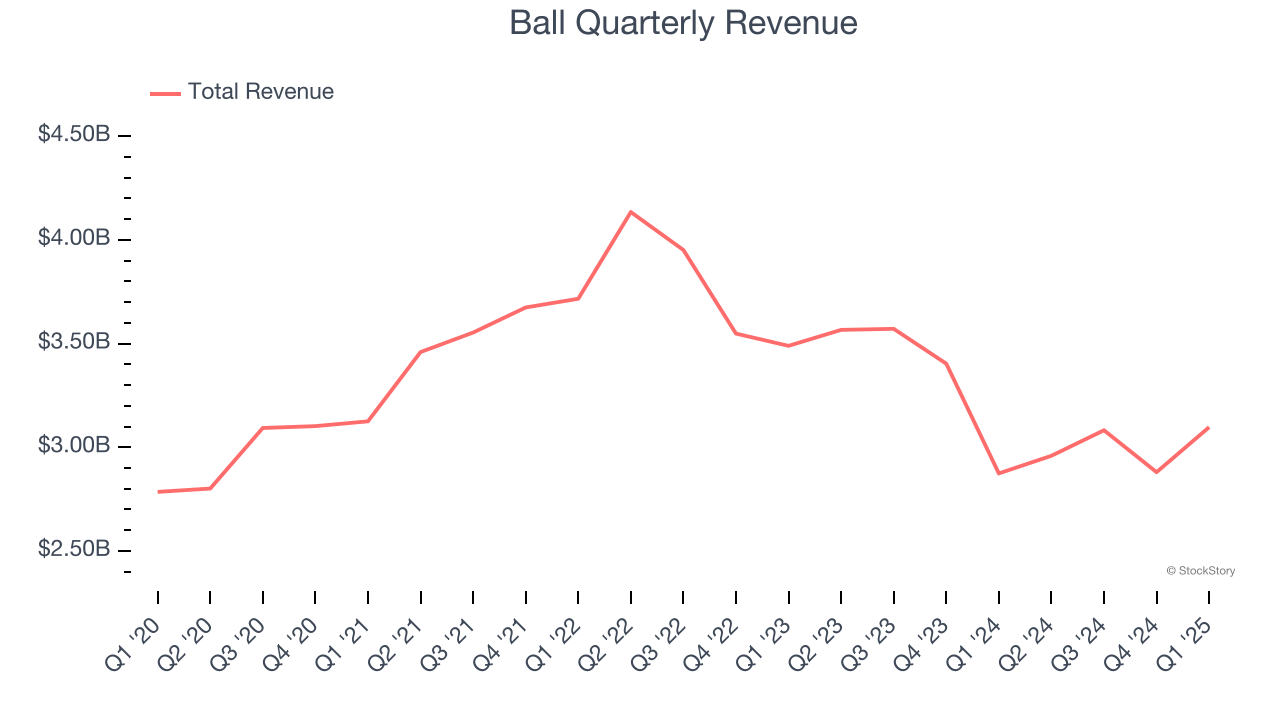

Sales Growth

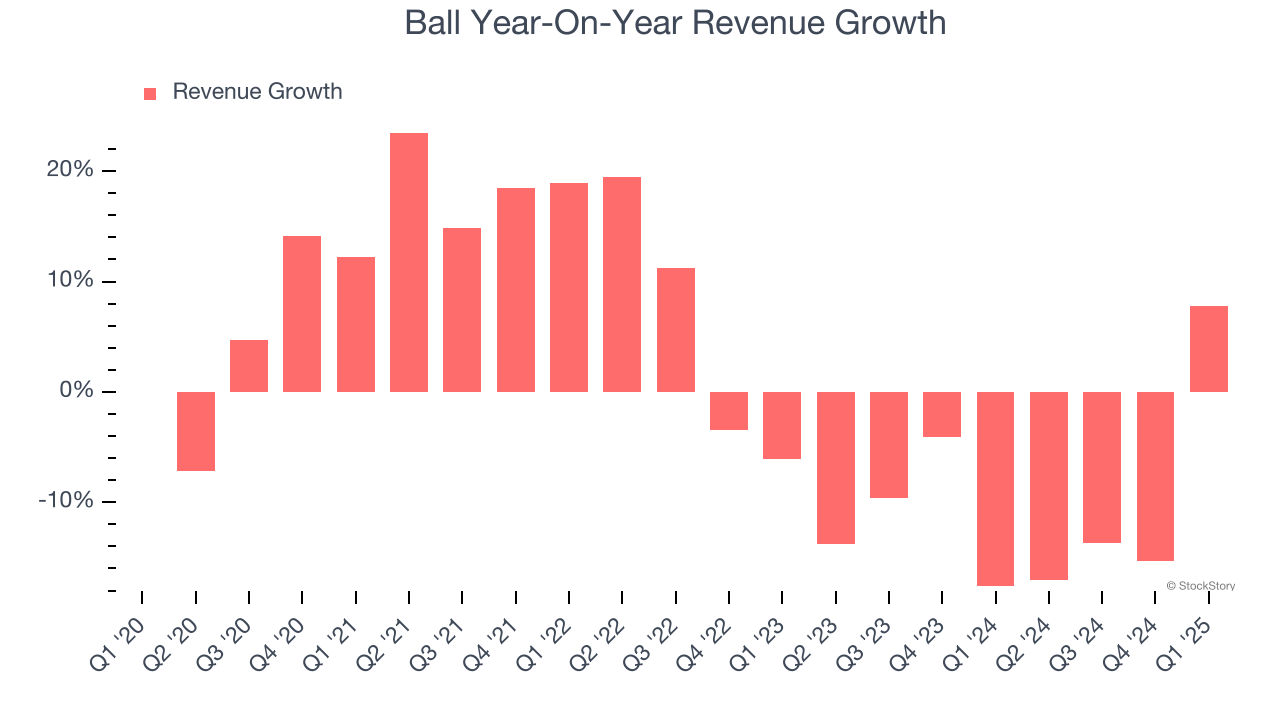

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Ball struggled to consistently increase demand as its $12.02 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Ball’s recent performance shows its demand remained suppressed as its revenue has declined by 10.9% annually over the last two years. Ball isn’t alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Ball reported year-on-year revenue growth of 7.8%, and its $3.10 billion of revenue exceeded Wall Street’s estimates by 6.7%.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

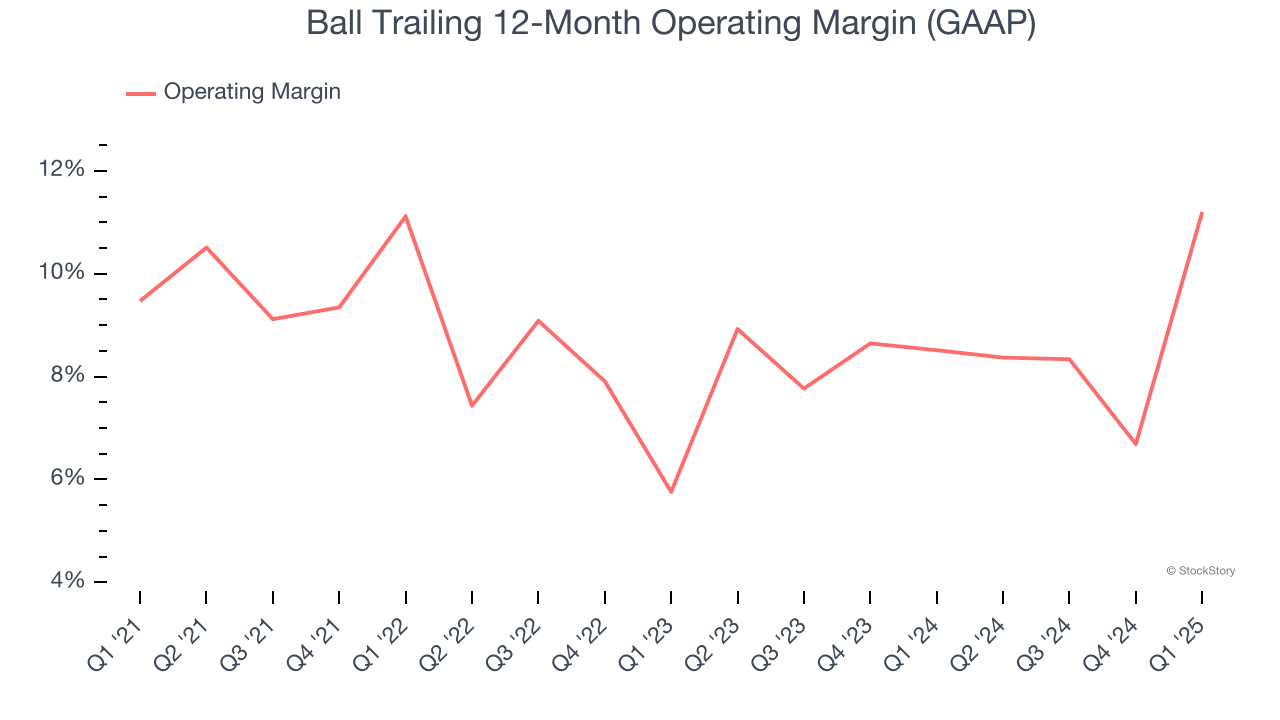

Operating Margin

Ball has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 9.1%, higher than the broader industrials sector.

Looking at the trend in its profitability, Ball’s operating margin rose by 1.7 percentage points over the last five years, showing its efficiency has improved.

This quarter, Ball generated an operating profit margin of 24.3%, up 17.5 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

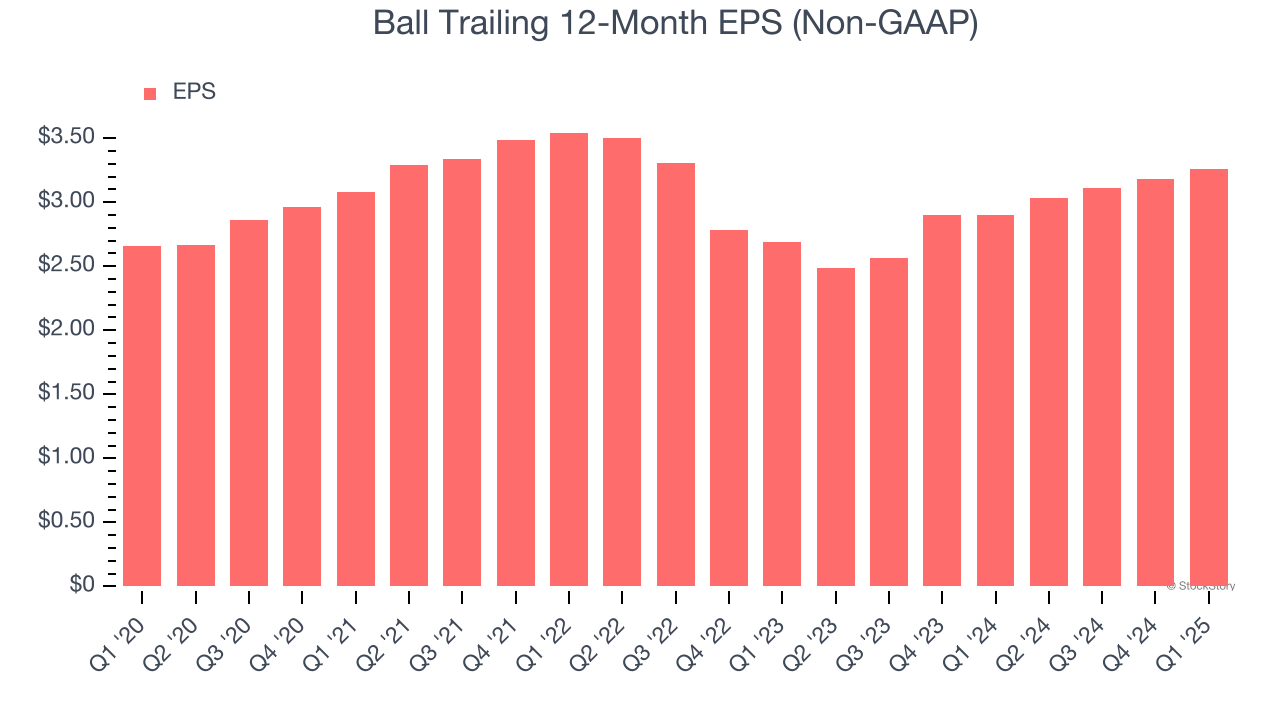

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Ball’s EPS grew at an unimpressive 4.2% compounded annual growth rate over the last five years. On the bright side, this performance was better than its flat revenue and tells us management responded to softer demand by adapting its cost structure.

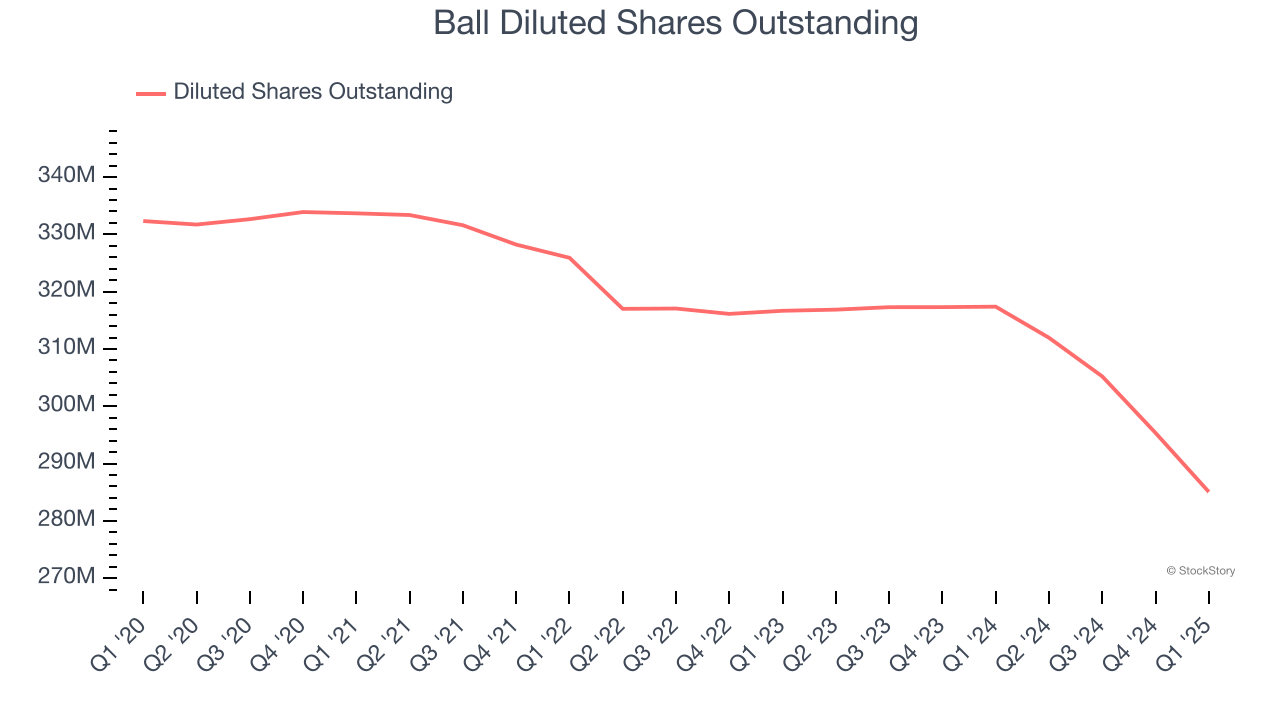

We can take a deeper look into Ball’s earnings to better understand the drivers of its performance. As we mentioned earlier, Ball’s operating margin expanded by 1.7 percentage points over the last five years. On top of that, its share count shrank by 14.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Ball, its two-year annual EPS growth of 10% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q1, Ball reported EPS at $0.76, up from $0.68 in the same quarter last year. This print beat analysts’ estimates by 8.7%. Over the next 12 months, Wall Street expects Ball’s full-year EPS of $3.26 to grow 11.2%.

Key Takeaways from Ball’s Q1 Results

We were impressed by how significantly Ball blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 1.1% to $52.40 immediately following the results.

Ball had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.