Water handling and recycling company Aris Water (NYSE:ARIS) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 16.5% year on year to $120.5 million. Its non-GAAP profit of $0.35 per share was 24% above analysts’ consensus estimates.

Is now the time to buy Aris Water? Find out by accessing our full research report, it’s free.

Aris Water (ARIS) Q1 CY2025 Highlights:

- Revenue: $120.5 million vs analyst estimates of $113.1 million (16.5% year-on-year growth, 6.5% beat)

- Adjusted EPS: $0.35 vs analyst estimates of $0.28 (24% beat)

- Adjusted EBITDA: $56.54 million vs analyst estimates of $52.54 million (46.9% margin, 7.6% beat)

- EBITDA guidance for Q2 CY2025 is $52.5 million at the midpoint, below analyst estimates of $56.49 million

- Operating Margin: 23.1%, down from 26.9% in the same quarter last year

- Free Cash Flow was -$27.23 million, down from $24.23 million in the same quarter last year

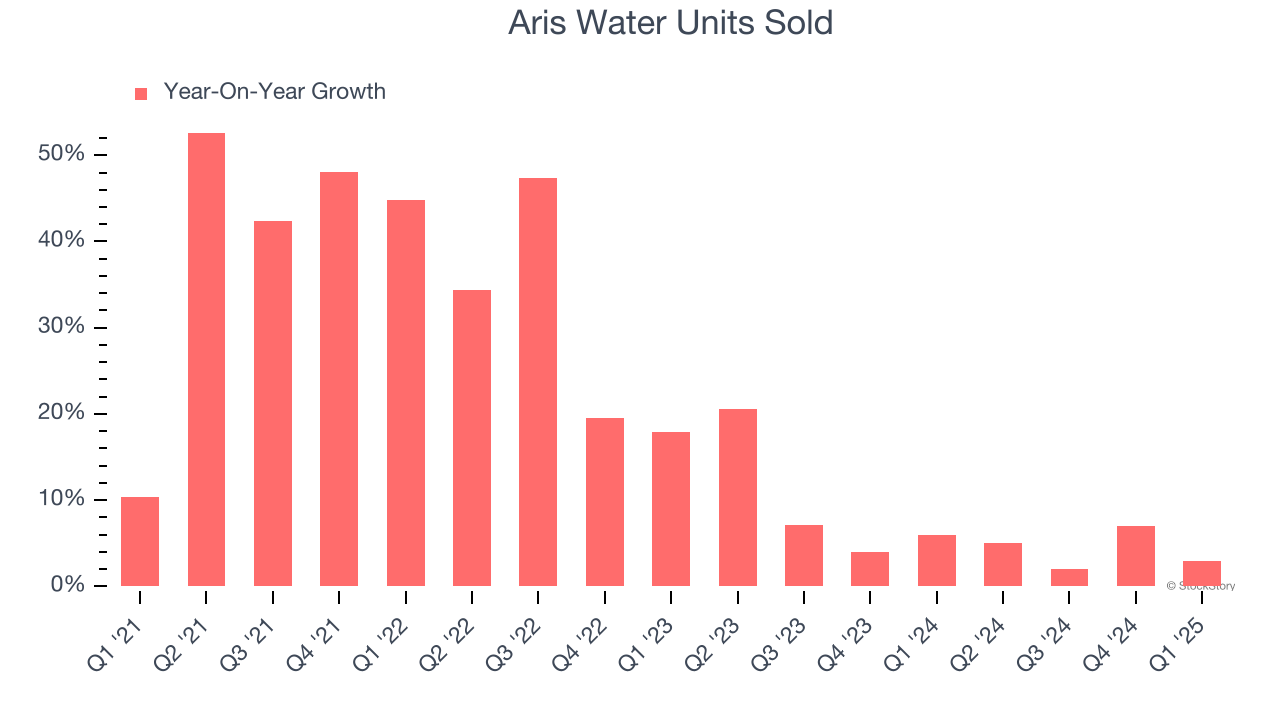

- Sales Volumes rose 3% year on year (6% in the same quarter last year)

- Market Capitalization: $832.6 million

“Aris continued its positive momentum with an excellent first quarter. We received record-breaking volumes from our long-term contracted customers in both Produced Water and Water Solutions and surpassed the top end of our Adjusted EBITDA guidance. We maintained strong margins, achieving an Adjusted Operating Margin of $0.44 per barrel in the quarter. Margin strength was driven by continued operational efficiency, as well as an approximately $2 million benefit from the timing of planned maintenance activity which will now be incurred in the second quarter,” said Amanda Brock, President and CEO of Aris.

Company Overview

Primarily serving the oil and gas industry, Aris Water (NYSE:ARIS) is a provider of water handling and recycling solutions.

Sales Growth

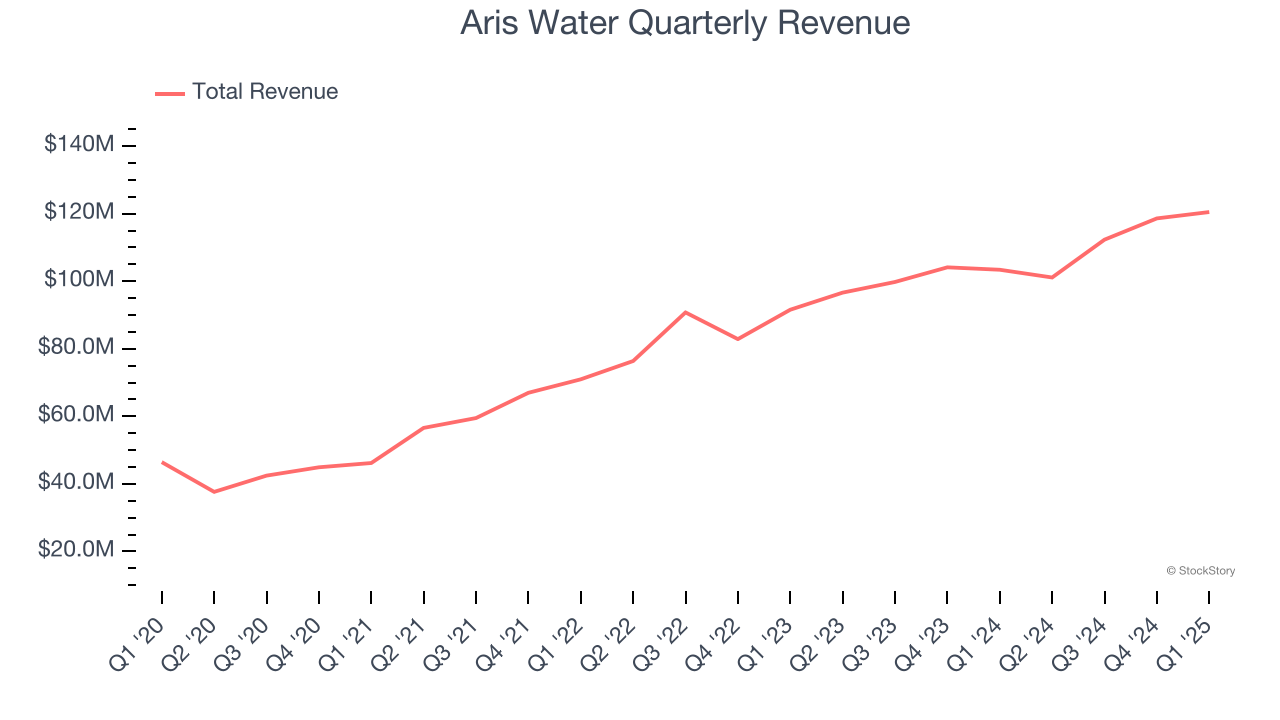

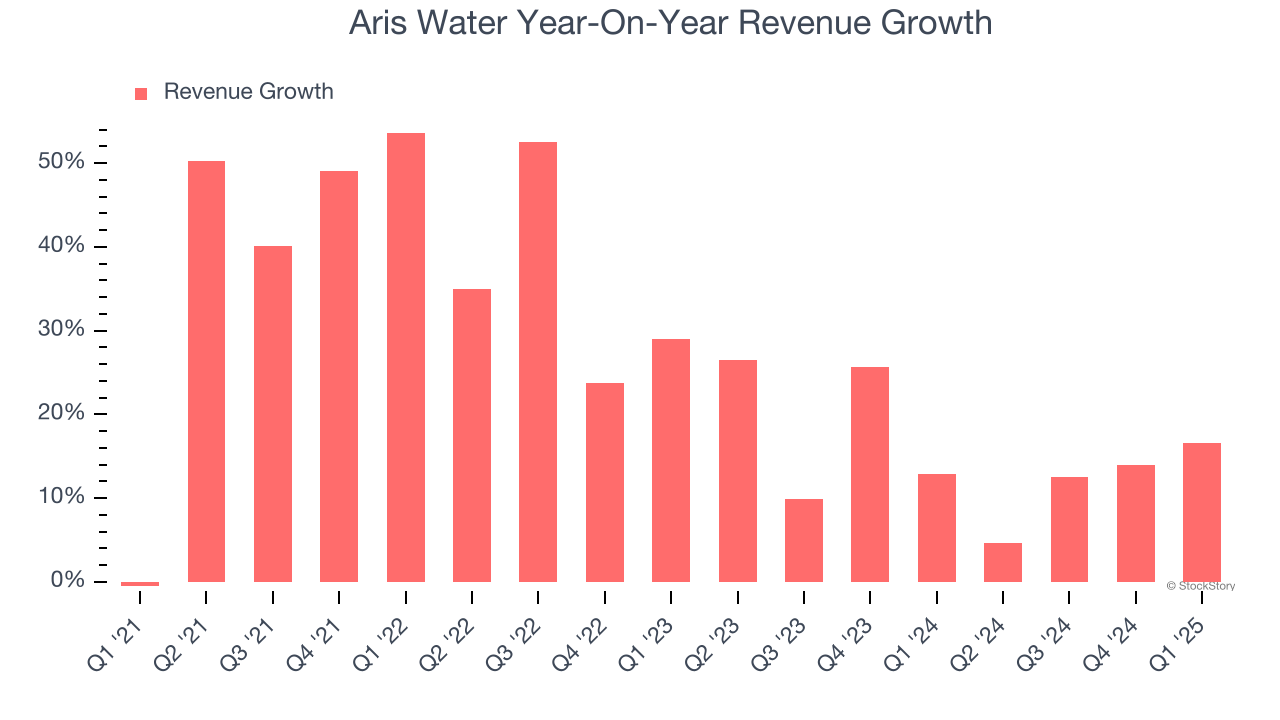

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last four years, Aris Water grew its sales at an incredible 27.5% compounded annual growth rate. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Aris Water’s annualized revenue growth of 15.1% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its number of units sold. Over the last two years, Aris Water’s units sold averaged 6.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Aris Water reported year-on-year revenue growth of 16.5%, and its $120.5 million of revenue exceeded Wall Street’s estimates by 6.5%.

Looking ahead, sell-side analysts expect revenue to grow 8.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and suggests the market is forecasting some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

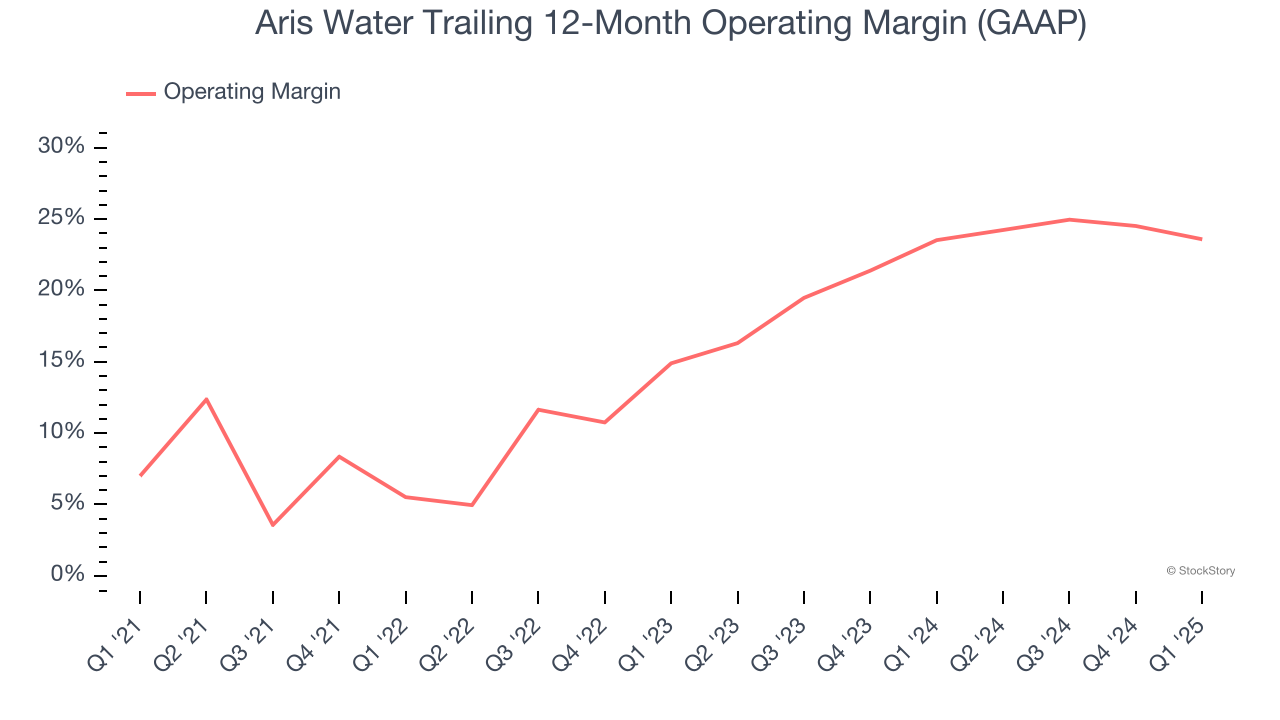

Aris Water has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Aris Water’s operating margin rose by 16.6 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q1, Aris Water generated an operating profit margin of 23.1%, down 3.8 percentage points year on year. Since Aris Water’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

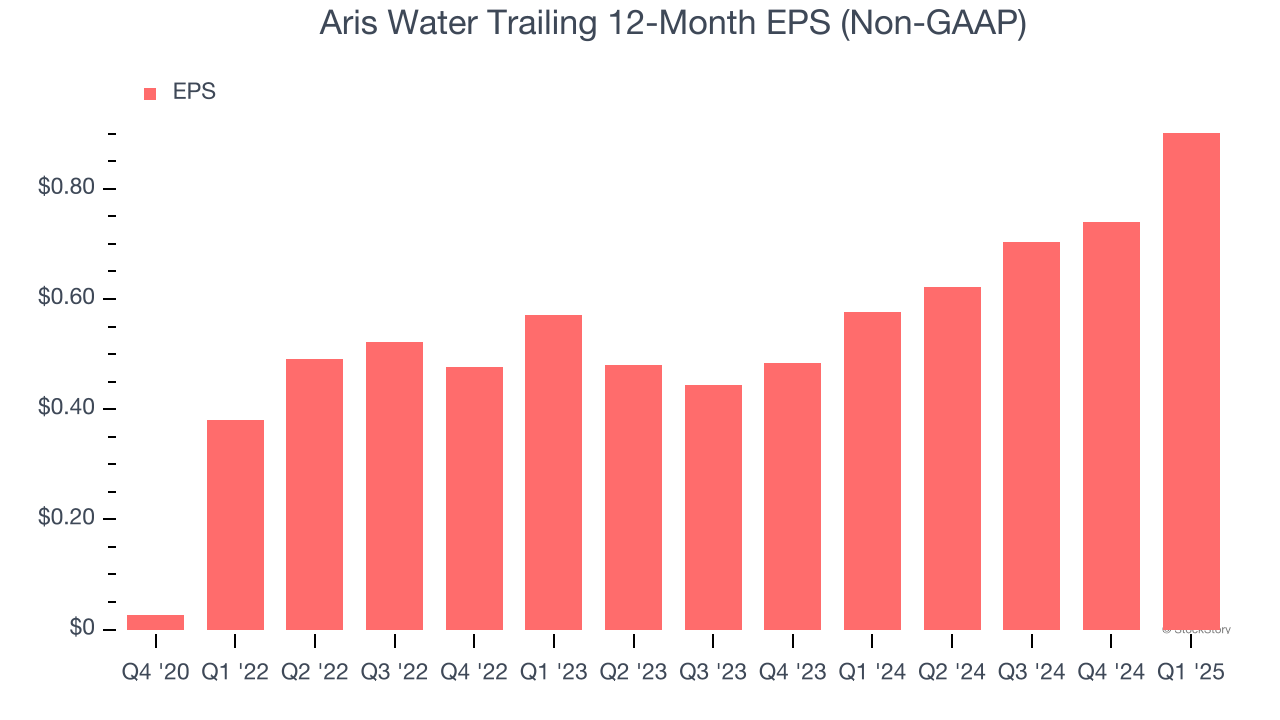

Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Aris Water’s EPS grew at an astounding 25.6% compounded annual growth rate over the last two years, higher than its 15.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Aris Water’s earnings to better understand the drivers of its performance. While we mentioned earlier that Aris Water’s operating margin declined this quarter, a two-year view shows its margin has expanded by 4.9 percentage points. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Aris Water reported EPS at $0.35, up from $0.19 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Aris Water’s full-year EPS of $0.90 to grow 63.8%.

Key Takeaways from Aris Water’s Q1 Results

We were impressed by how significantly Aris Water blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its EBITDA guidance for next quarter missed. Still, we think this was a solid print. The stock traded up 1.8% to $25.91 immediately following the results.

Aris Water put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.