In a sliding market, Walmart has defied the odds, trading up to $99.32 per share. Its 19% gain since November 2024 has outpaced the S&P 500’s 4.7% drop. This run-up might have investors contemplating their next move.

Is now the time to buy Walmart, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Walmart Not Exciting?

Despite the momentum, we don't have much confidence in Walmart. Here are three reasons why we avoid WMT and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Walmart grew its sales at a tepid 5.4% compounded annual growth rate. This was below our standard for the consumer retail sector.

2. Low Gross Margin Reveals Weak Structural Profitability

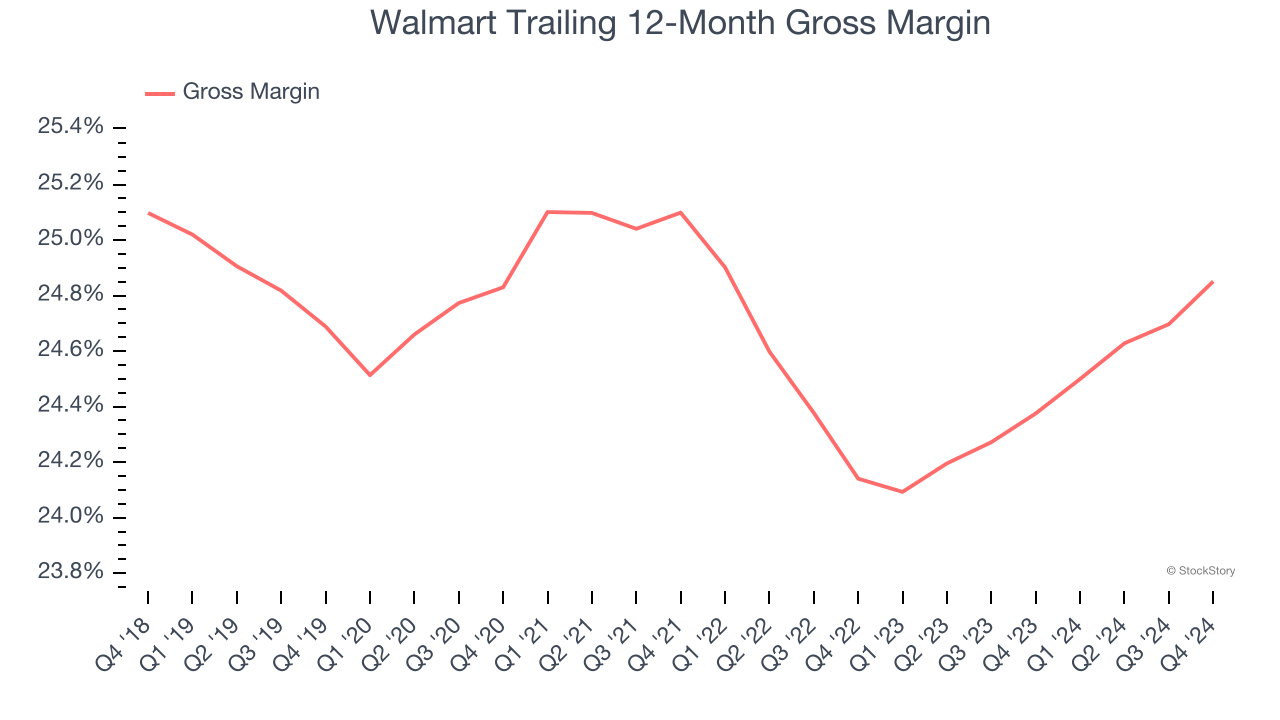

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

Walmart has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 24.6% gross margin over the last two years. That means Walmart paid its suppliers a lot of money ($75.38 for every $100 in revenue) to run its business.

3. Weak Operating Margin Could Cause Trouble

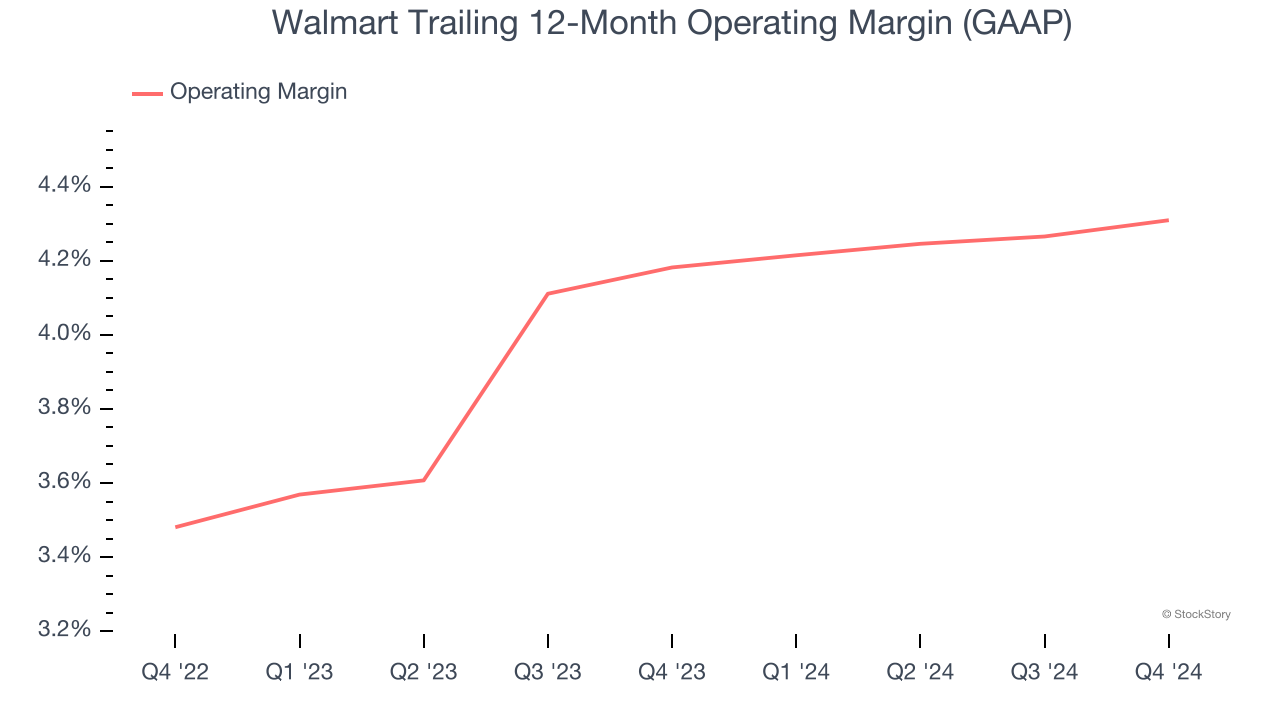

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Walmart was profitable over the last two years but held back by its large cost base. Its average operating margin of 4.2% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

Final Judgment

Walmart isn’t a terrible business, but it doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 36.1× forward P/E (or $99.32 per share). At this valuation, there’s a lot of good news priced in - we think there are better investment opportunities out there. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of Walmart

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.