While the broader market has struggled with the S&P 500 down 4.7% since November 2024, Snowflake has surged ahead as its stock price has climbed by 37.8% to $167.30 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy SNOW? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does SNOW Stock Spark Debate?

Founded in 2013 by three French engineers who spent decades working for Oracle, Snowflake (NYSE:SNOW) provides a data warehouse-as-a-service in the cloud that allows companies to store large amounts of data and analyze it in real time.

Two Things to Like:

1. Billings Surge, Boosting Cash On Hand

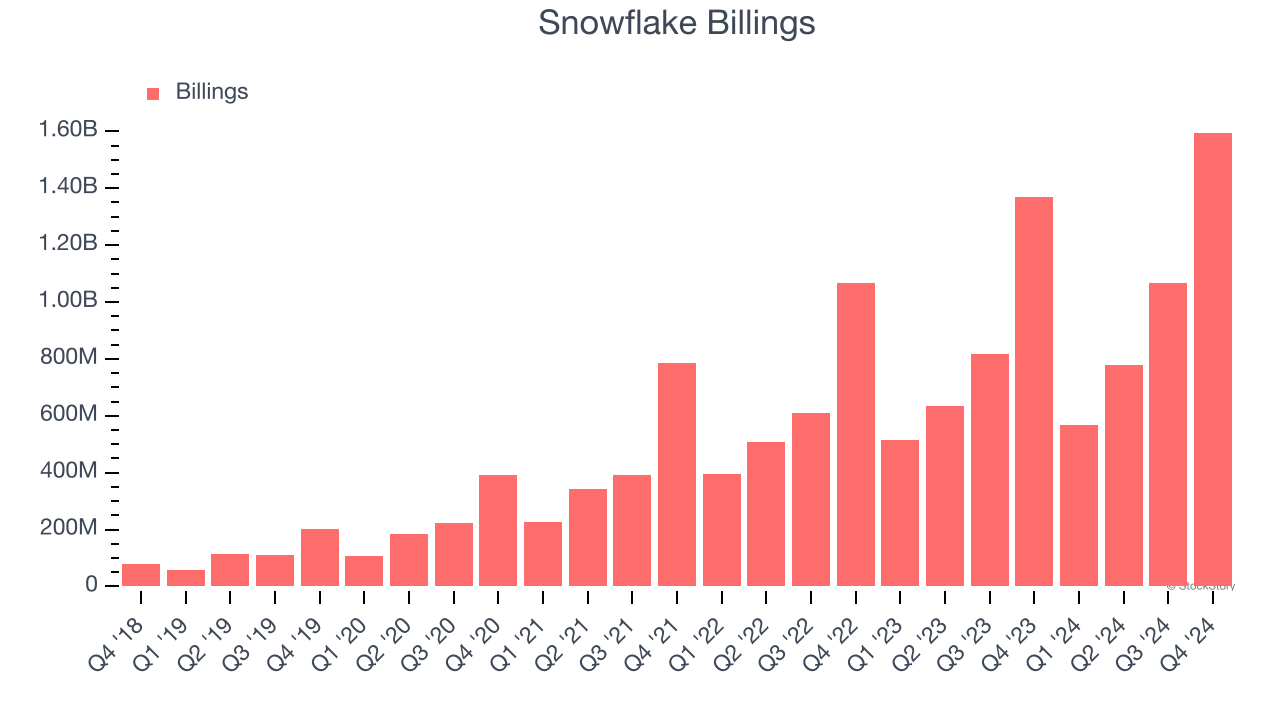

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Snowflake’s billings punched in at $1.60 billion in Q4, and over the last four quarters, its year-on-year growth averaged 20.1%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Outstanding Retention Sets the Stage for Huge Gains

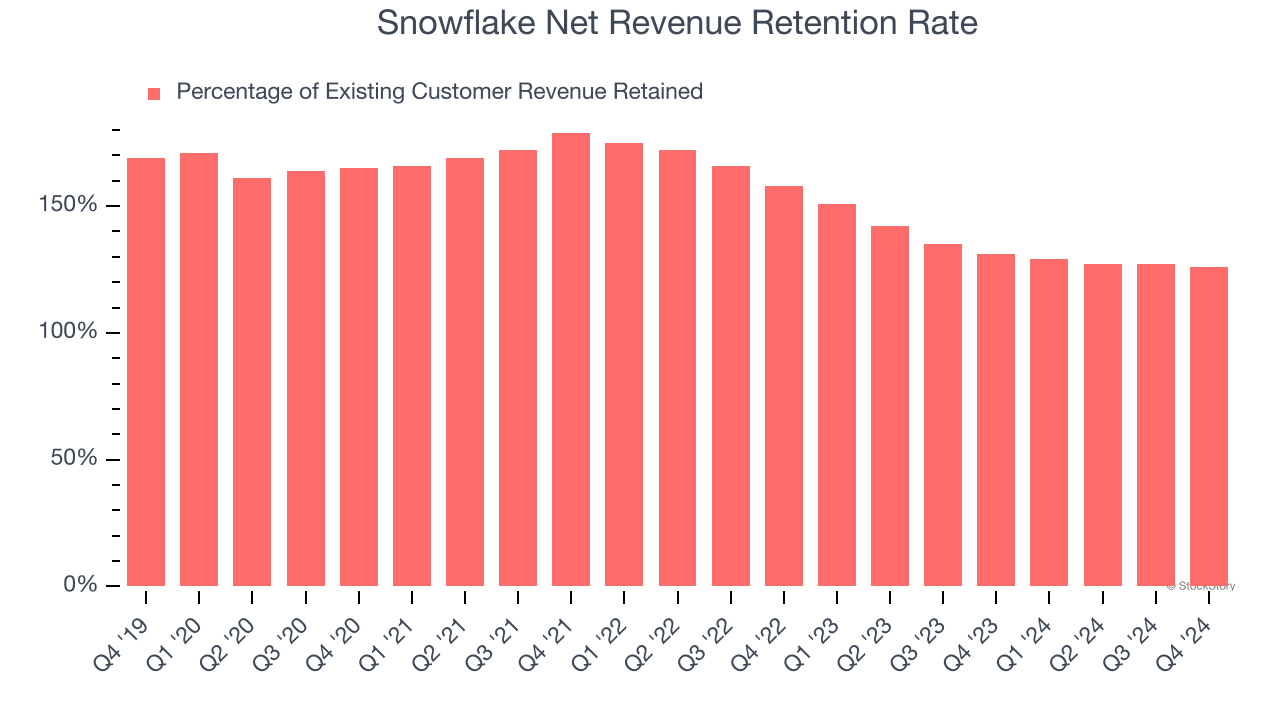

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Snowflake’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 127% in Q4. This means Snowflake would’ve grown its revenue by 27.2% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Snowflake still has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing usage over time.

One Reason to be Careful:

Operating Losses Sound the Alarms

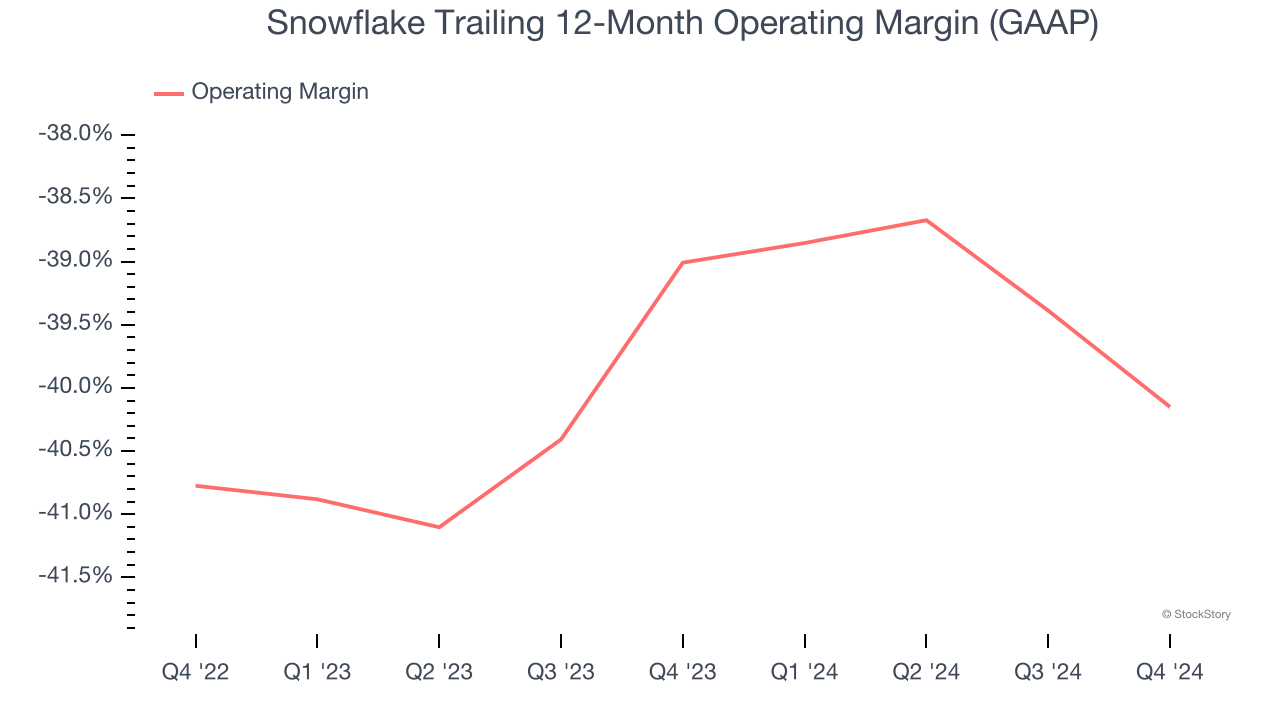

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Snowflake’s expensive cost structure has contributed to an average operating margin of negative 40.2% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Final Judgment

Snowflake’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 12.4× forward price-to-sales (or $167.30 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks That Overcame Trump’s 2018 Tariffs

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today.