Water infrastructure products manufacturer Mueller Water Products beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 3.1% year on year to $364.3 million. The company’s full-year revenue guidance of $1.40 billion at the midpoint came in 1% above analysts’ estimates. Its non-GAAP profit of $0.34 per share was 9.7% above analysts’ consensus estimates.

Is now the time to buy Mueller Water Products? Find out by accessing our full research report, it’s free.

Mueller Water Products (MWA) Q1 CY2025 Highlights:

- Revenue: $364.3 million vs analyst estimates of $354 million (3.1% year-on-year growth, 2.9% beat)

- Adjusted EPS: $0.34 vs analyst estimates of $0.31 (9.7% beat)

- Adjusted EBITDA: $62.2 million vs analyst estimates of $80.57 million (17.1% margin, 22.8% miss)

- The company lifted its revenue guidance for the full year to $1.40 billion at the midpoint from $1.38 billion, a 1.1% increase

- EBITDA guidance for the full year is $312.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 19.2%, up from 18% in the same quarter last year

- Free Cash Flow was $14.3 million, up from -$15.8 million in the same quarter last year

- Market Capitalization: $4.26 billion

“We delivered a solid performance in our second quarter. Our focused execution enabled us to benefit from healthy order levels during the quarter supported by continued resilient end-market demand. As a result, we achieved quarterly records for our consolidated net sales, adjusted EBITDA and adjusted net income per share. I am grateful for our teams’ dedication to delivering exceptional customer service, improving operational excellence and maintaining cost discipline which contributed to these results,” said Martie Edmunds Zakas, Chief Executive Officer of Mueller Water Products.

Company Overview

As one of the oldest companies in the water infrastructure industry, Mueller (NYSE:MWA) is a provider of water infrastructure products and flow control systems for various sectors.

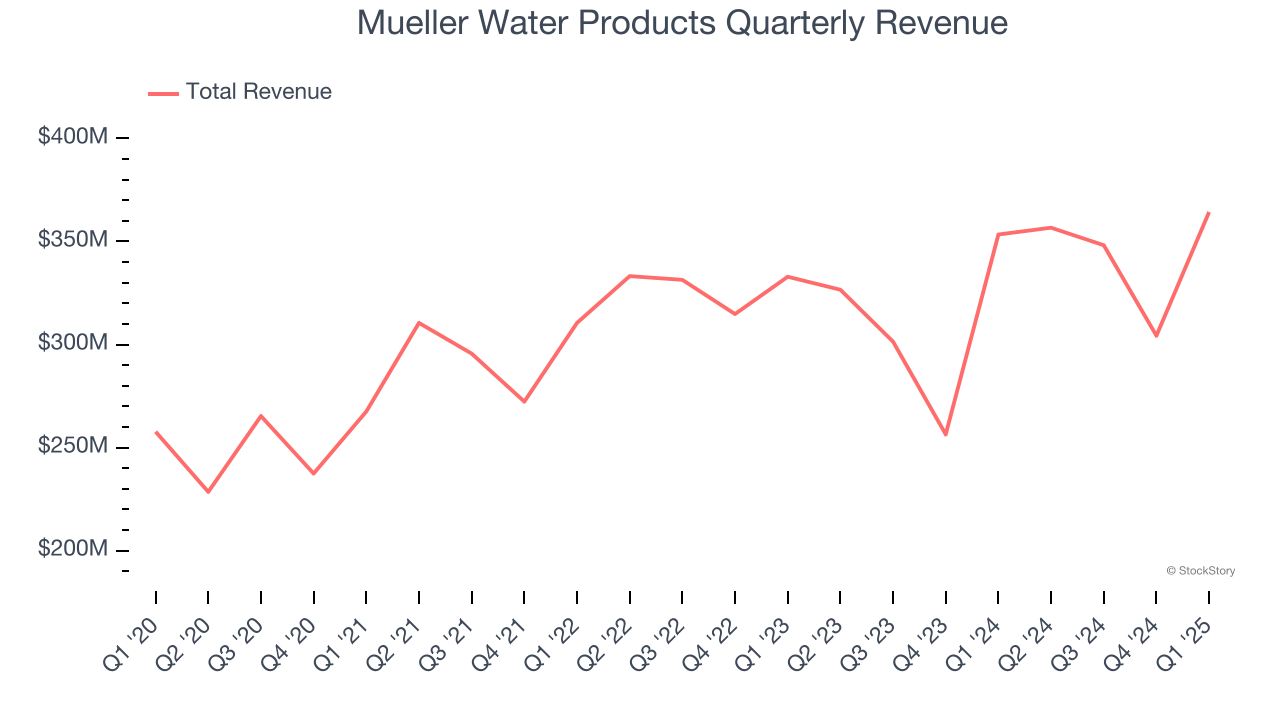

Sales Growth

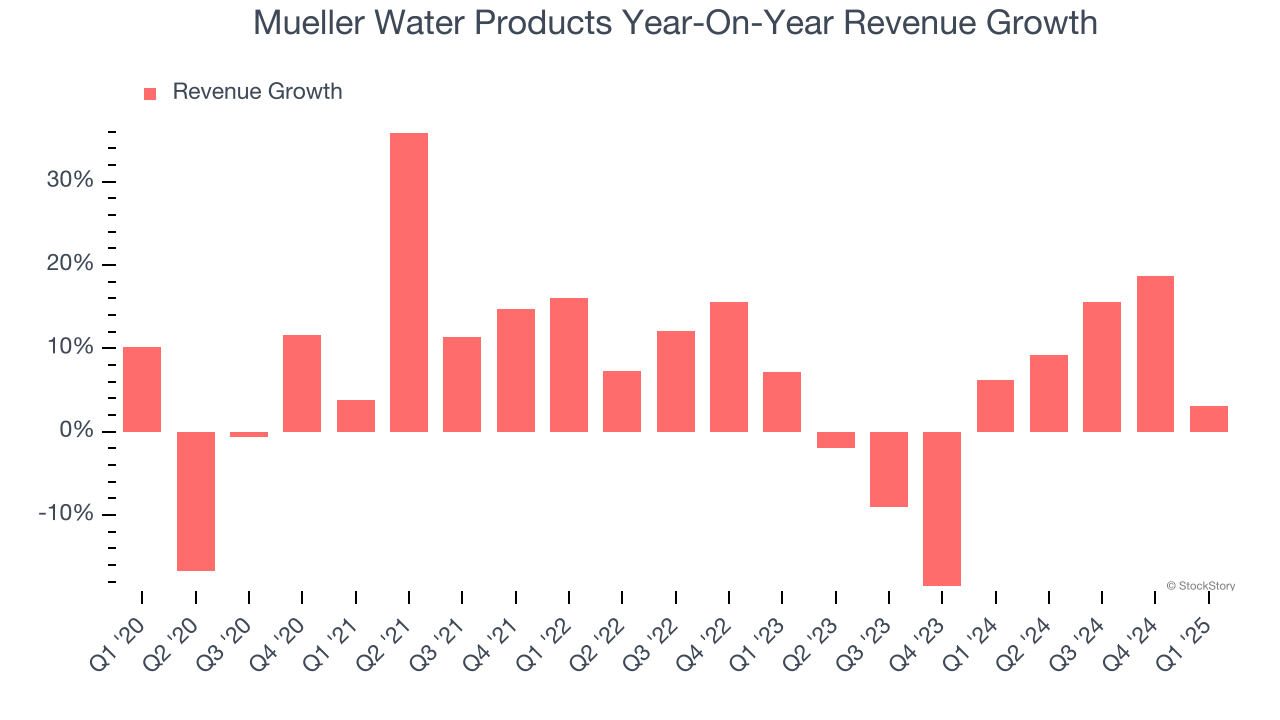

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Mueller Water Products’s 6.3% annualized revenue growth over the last five years was mediocre. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Mueller Water Products’s recent performance shows its demand has slowed as its annualized revenue growth of 2.3% over the last two years was below its five-year trend.

This quarter, Mueller Water Products reported modest year-on-year revenue growth of 3.1% but beat Wall Street’s estimates by 2.9%.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, similar to its two-year rate. While this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

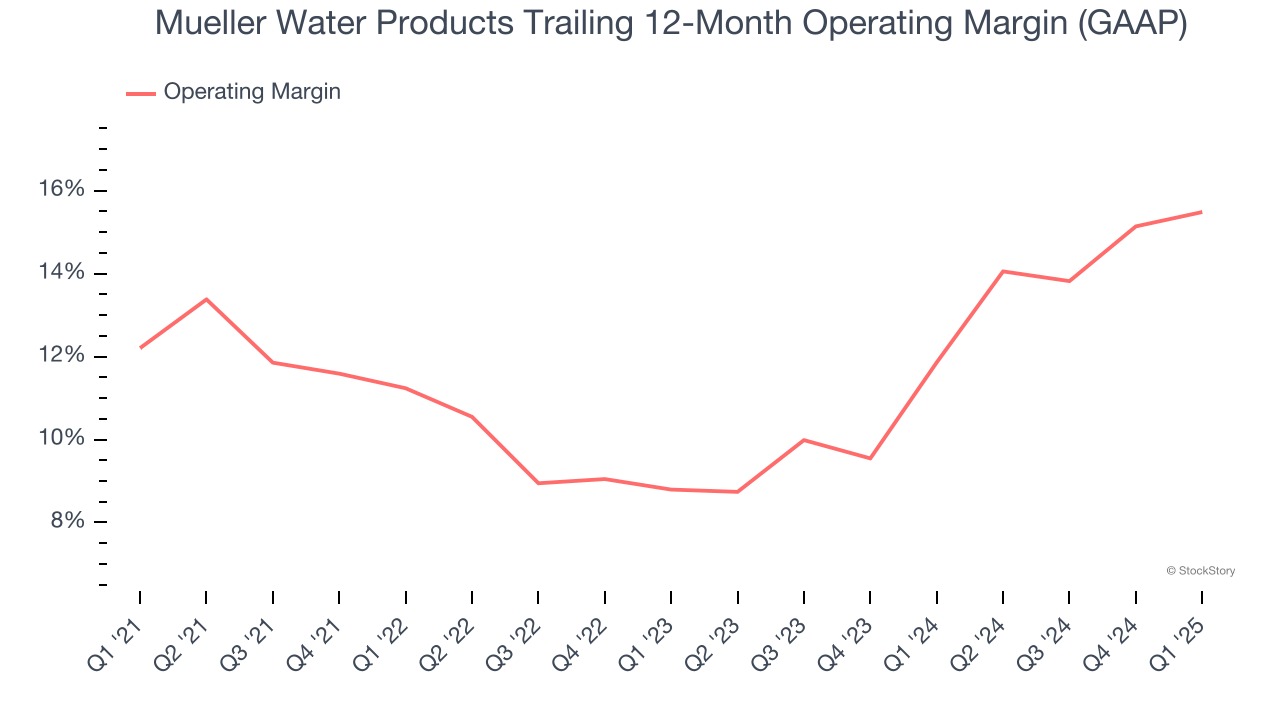

Operating Margin

Mueller Water Products has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12%.

Looking at the trend in its profitability, Mueller Water Products’s operating margin rose by 3.3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Mueller Water Products generated an operating profit margin of 19.2%, up 1.2 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

Earnings Per Share

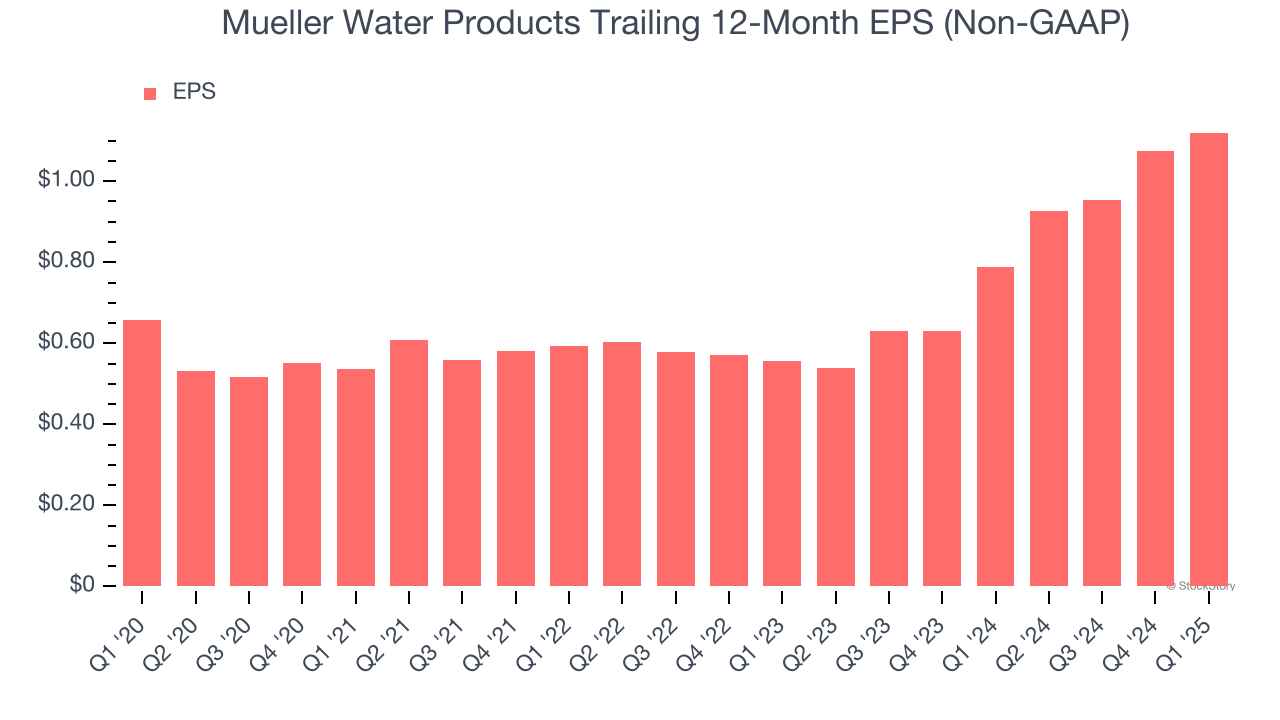

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Mueller Water Products’s EPS grew at a solid 11.3% compounded annual growth rate over the last five years, higher than its 6.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Mueller Water Products’s earnings can give us a better understanding of its performance. As we mentioned earlier, Mueller Water Products’s operating margin expanded by 3.3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Mueller Water Products, its two-year annual EPS growth of 41.8% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q1, Mueller Water Products reported EPS at $0.34, up from $0.30 in the same quarter last year. This print beat analysts’ estimates by 9.7%. Over the next 12 months, Wall Street expects Mueller Water Products’s full-year EPS of $1.12 to grow 13.1%.

Key Takeaways from Mueller Water Products’s Q1 Results

We enjoyed seeing Mueller Water Products beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed significantly. Overall, this print had some key positives. The areas below expectations seem to be driving the move, and the stock traded down 1.8% to $26.57 immediately following the results.

Big picture, is Mueller Water Products a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.