Online insurance comparison site EverQuote (NASDAQ:EVER) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 83% year on year to $166.6 million. On top of that, next quarter’s revenue guidance ($157.5 million at the midpoint) was surprisingly good and 5.4% above what analysts were expecting. Its GAAP profit of $0.21 per share was 36.4% below analysts’ consensus estimates.

Is now the time to buy EverQuote? Find out by accessing our full research report, it’s free.

EverQuote (EVER) Q1 CY2025 Highlights:

- Revenue: $166.6 million vs analyst estimates of $158.3 million (83% year-on-year growth, 5.2% beat)

- EPS (GAAP): $0.21 vs analyst expectations of $0.33 (36.4% miss)

- Adjusted EBITDA: $22.51 million vs analyst estimates of $19.97 million (13.5% margin, 12.7% beat)

- Revenue Guidance for Q2 CY2025 is $157.5 million at the midpoint, above analyst estimates of $149.5 million

- EBITDA guidance for Q2 CY2025 is $21 million at the midpoint, above analyst estimates of $18.61 million

- Operating Margin: 4.8%, up from 1.9% in the same quarter last year

- Free Cash Flow Margin: 13.3%, similar to the previous quarter

- Market Capitalization: $965.7 million

“2025 is off to a strong start, building on our momentum from last year, and we once again achieved record financial performance across our key financial metrics of revenue, Variable Marketing Dollars or VMD and Adjusted EBITDA,” said Jayme Mendal, CEO of EverQuote.

Company Overview

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

Sales Growth

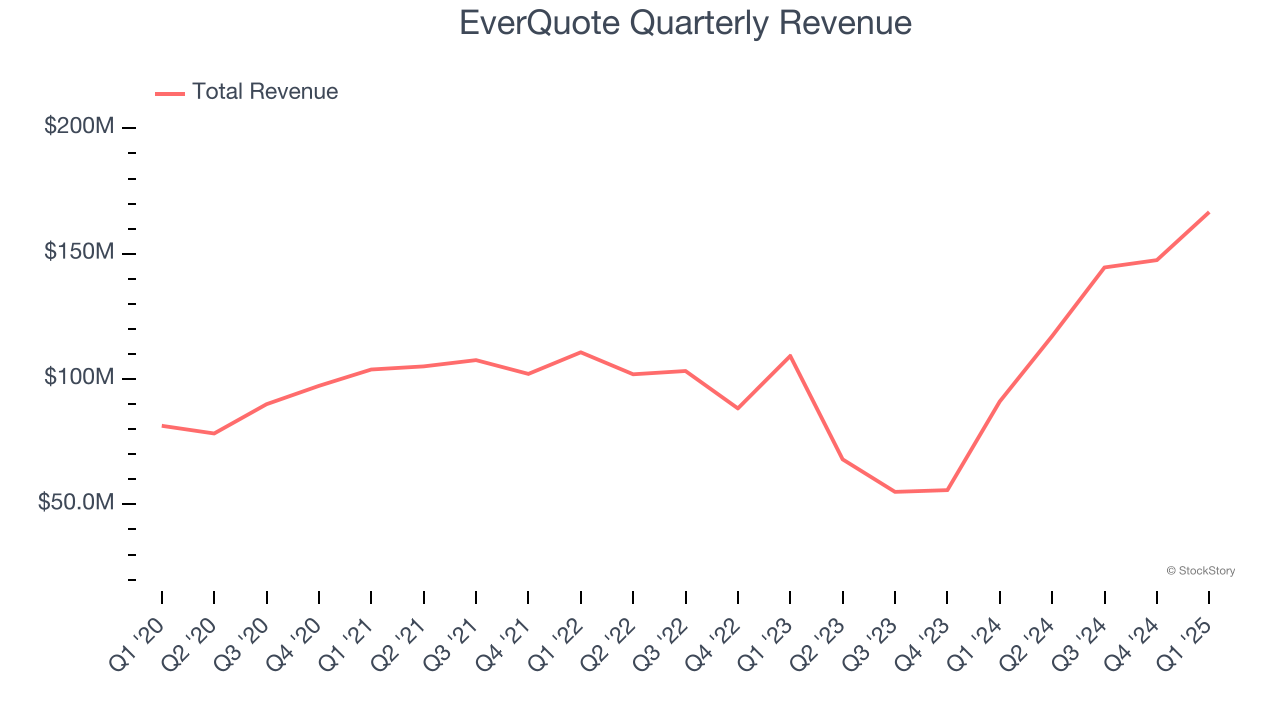

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, EverQuote’s 10.6% annualized revenue growth over the last three years was decent. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, EverQuote reported magnificent year-on-year revenue growth of 83%, and its $166.6 million of revenue beat Wall Street’s estimates by 5.2%. Company management is currently guiding for a 34.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.6% over the next 12 months, similar to its three-year rate. This projection is above the sector average and indicates its newer products and services will help sustain its historical top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

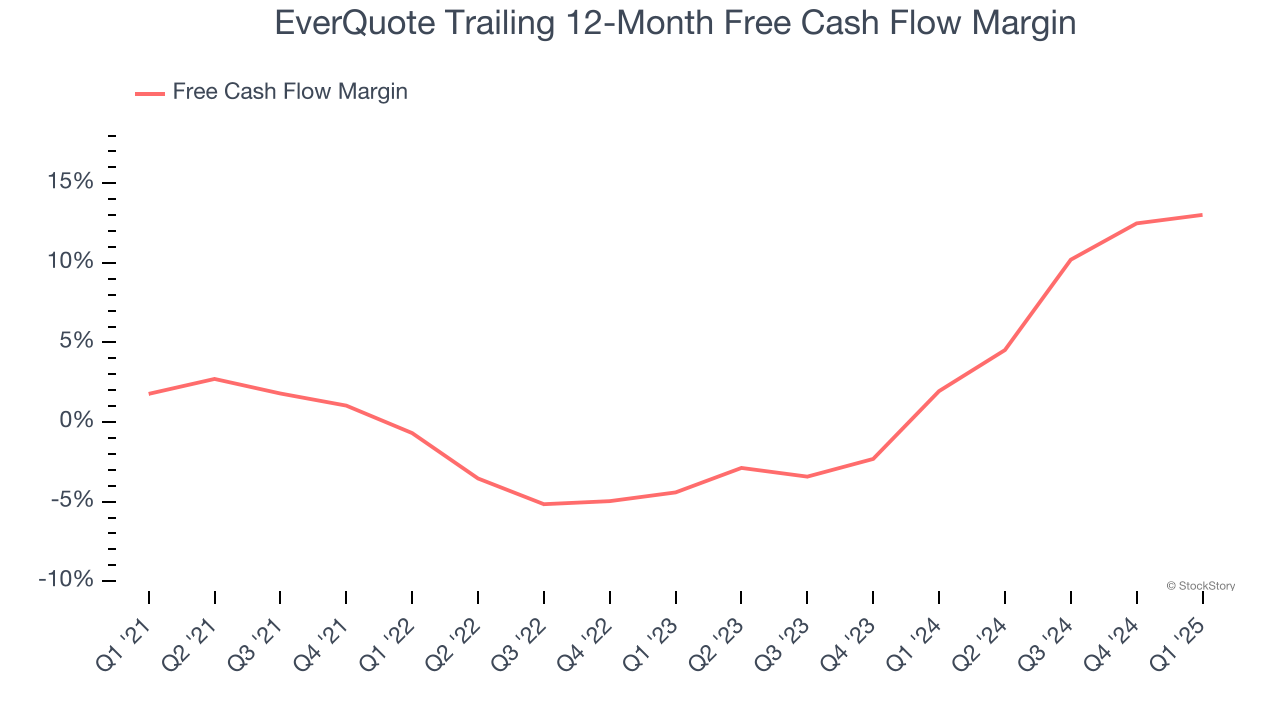

EverQuote has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.5% over the last two years, better than the broader consumer internet sector.

Taking a step back, we can see that EverQuote’s margin expanded by 13.7 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

EverQuote’s free cash flow clocked in at $22.17 million in Q1, equivalent to a 13.3% margin. This result was good as its margin was 2.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

Key Takeaways from EverQuote’s Q1 Results

We were impressed by EverQuote’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. However, expectations may have been elevated as shares traded down 1.3% to $26 immediately following the results.

Is EverQuote an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.