Medical device company Artivion (NYSE:AORT) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 1.6% year on year to $98.98 million. The company’s full-year revenue guidance of $429 million at the midpoint came in 1.2% above analysts’ estimates. Its non-GAAP profit of $0.06 per share was $0.02 above analysts’ consensus estimates.

Is now the time to buy Artivion? Find out by accessing our full research report, it’s free.

Artivion (AORT) Q1 CY2025 Highlights:

- Revenue: $98.98 million vs analyst estimates of $94.98 million (1.6% year-on-year growth, 4.2% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.05 ($0.02 beat)

- Adjusted EBITDA: $17.55 million vs analyst estimates of $16.47 million (17.7% margin, 6.6% beat)

- The company slightly lifted its revenue guidance for the full year to $429 million at the midpoint from $427.5 million

- Operating Margin: 2.2%, down from 26% in the same quarter last year

- Free Cash Flow was -$20.59 million compared to -$9.10 million in the same quarter last year

- Market Capitalization: $995.9 million

"I am pleased with our first quarter results as we returned to normal operations following our previously disclosed cybersecurity incident while making substantial progress on our strategic growth initiatives. As anticipated, our performance was driven by year-over-year growth in stent grafts of 14%, On-X of 10%, and BioGlue of 7%, all compared to the first quarter of 2024. On a constant currency basis, year-over-year stent grafts, On-X, and BioGlue grew 19%, 11% and 9%, respectively. Our strong product revenue growth of 14% on a constant currency basis was tempered by a 23% decrease in preservation services revenue due to the short-term backlog in tissue processing operations caused by the cybersecurity incident. We are pleased with our team's progress to date in returning to standard tissue processing times, as we outpaced our initial expectations enabling stronger than anticipated first quarter performance," said Pat Mackin, Chairman, President, and Chief Executive Officer.

Company Overview

Formerly known as CryoLife until its 2022 rebranding, Artivion (NYSE:AORT) develops and manufactures medical devices and preserves human tissues used in cardiac and vascular surgical procedures for patients with aortic disease.

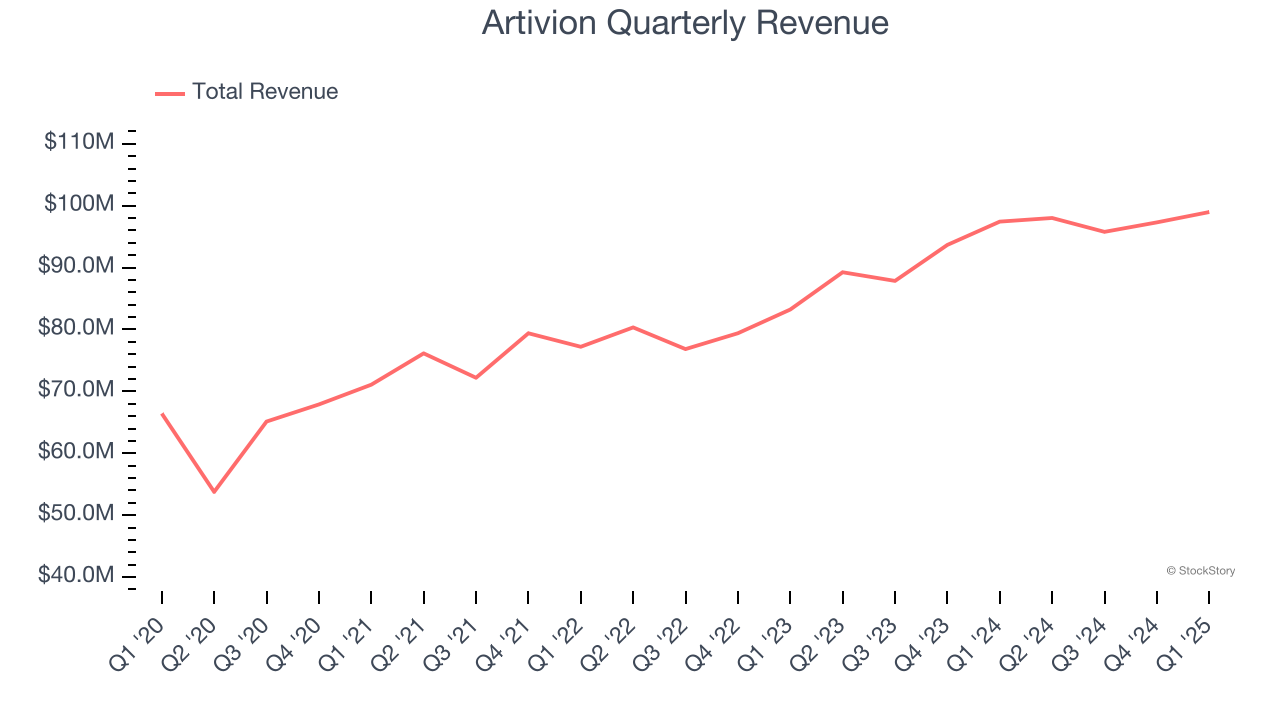

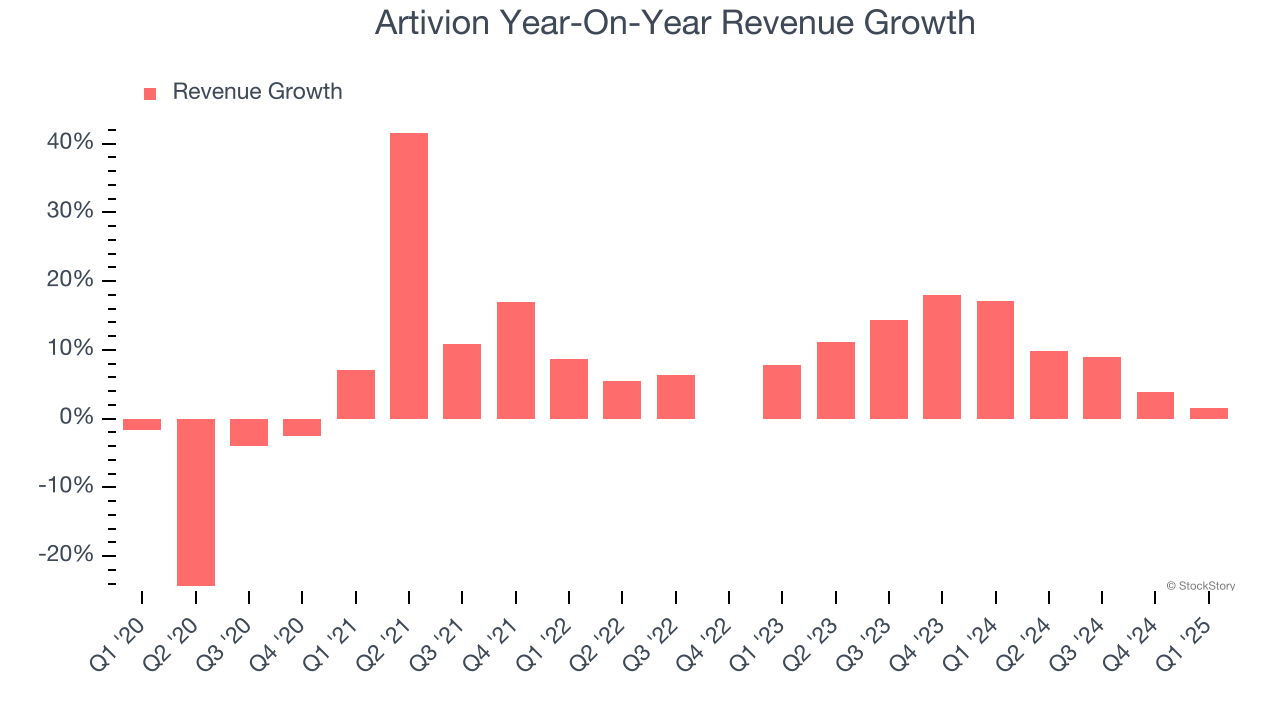

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Artivion’s 7.2% annualized revenue growth over the last five years was mediocre. This was below our standard for the healthcare sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Artivion’s annualized revenue growth of 10.4% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Artivion reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 4.2%.

Looking ahead, sell-side analysts expect revenue to grow 12.8% over the next 12 months, an improvement versus the last two years. This projection is commendable and implies its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

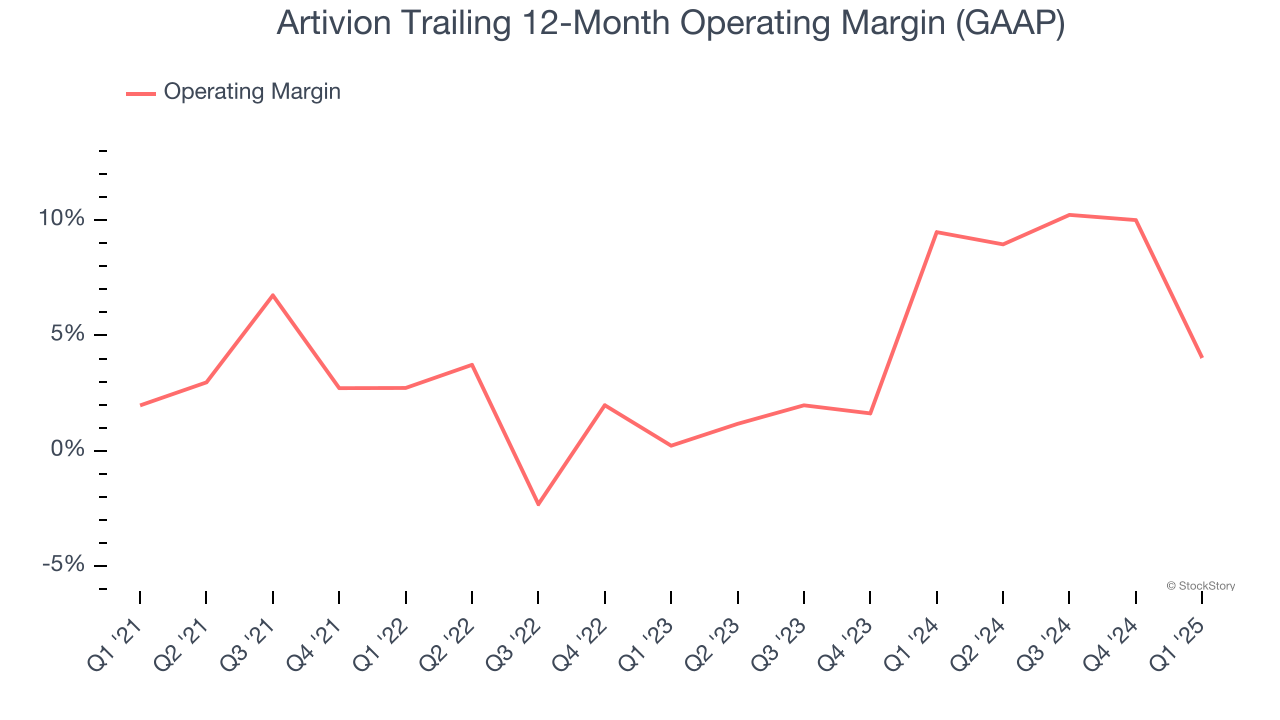

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Artivion was profitable over the last five years but held back by its large cost base. Its average operating margin of 3.9% was weak for a healthcare business.

On the plus side, Artivion’s operating margin rose by 2.1 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 3.8 percentage points on a two-year basis.

This quarter, Artivion generated an operating profit margin of 2.2%, down 23.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

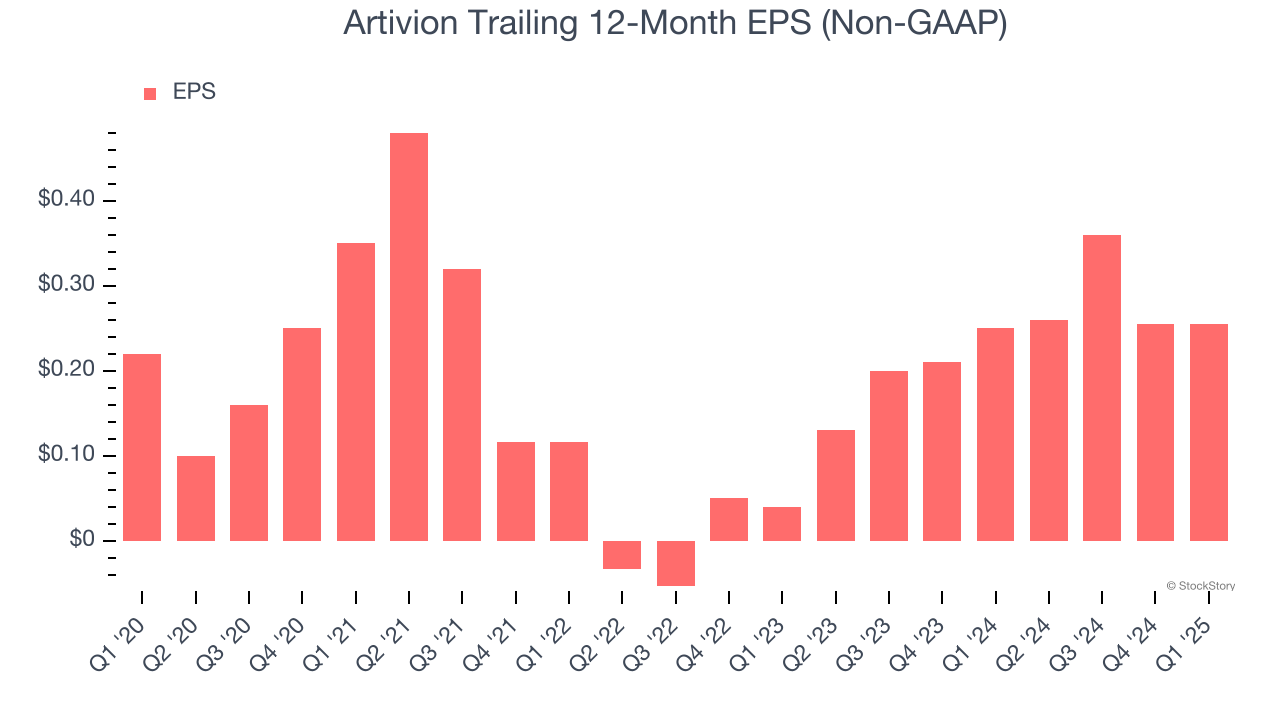

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Artivion’s EPS grew at an unimpressive 3% compounded annual growth rate over the last five years, lower than its 7.2% annualized revenue growth. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

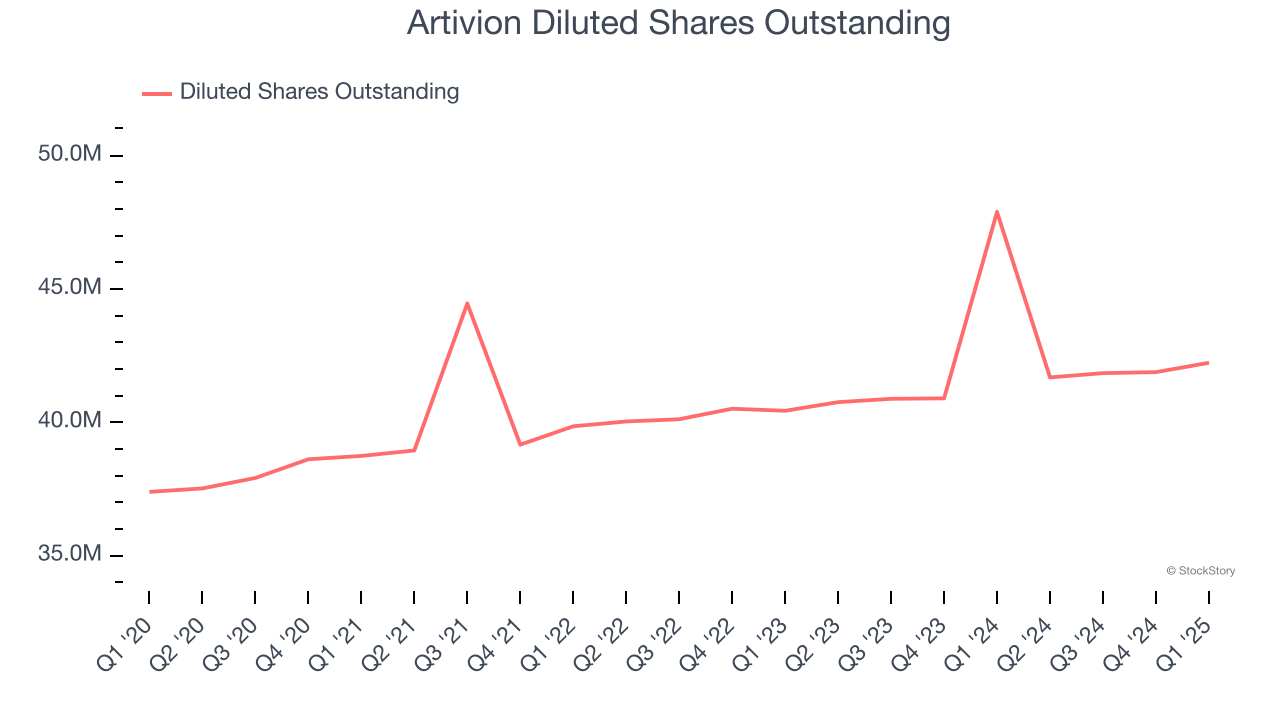

We can take a deeper look into Artivion’s earnings to better understand the drivers of its performance. A five-year view shows Artivion has diluted its shareholders, growing its share count by 12.9%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Artivion reported EPS at $0.06, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Artivion’s full-year EPS of $0.25 to grow 164%.

Key Takeaways from Artivion’s Q1 Results

We were impressed by how significantly Artivion blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 4.6% to $24.90 immediately following the results.

Artivion may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.